US stocks moved higher on Tuesday as markets looked to continue a record-setting run that has become the story on Wall Street during the first quarter of the year.

The S&P 500 (^GSPC) rose about 0.3%, while the Dow Jones Industrial Average (^DJI) edged higher by roughly 0.1%. The tech-heavy Nasdaq Composite (^IXIC) led the way, rising nearly 0.5%.

Wall Street took a break from its rally on Monday, with all three major indexes dipping slightly. But a bullish mood is prevailing, with the latest signal coming from Oppenheimer Asset Management strategist John Stoltzfus, who raised his 2024 S&P 500 price target to a Street high of 5,500.

On Tuesday, the focus turned to economic data. Durable goods orders rebounded during the month of February, rising 1.4% last month amid increases in transportation equipment and machinery orders, according to the Commerce Department’s Census Bureau.

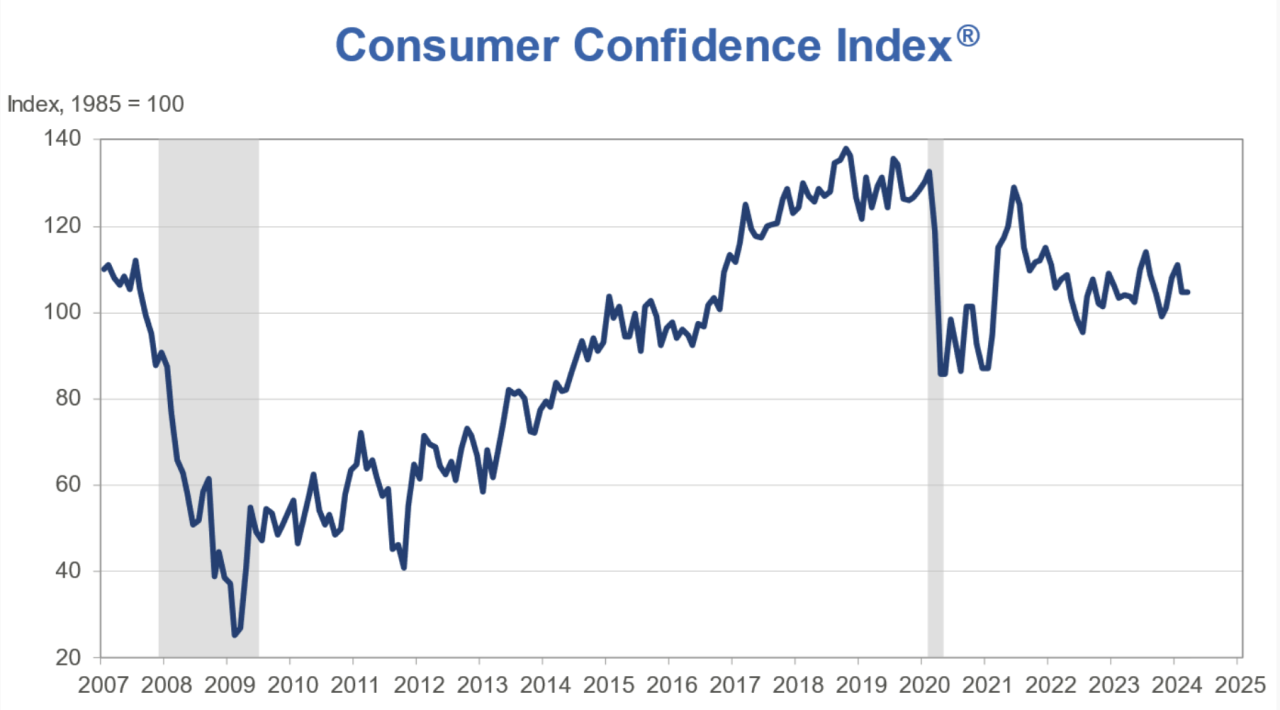

Meanwhile, a fresh reading on US consumer confidence showed consumers are feeling less confident about the future state of the US economy.

According to new data released Tuesday morning, The Conference Board’s Consumer Confidence Index for March came in at a reading of 104.7, little changed from a revised 104.8 in February.

However, the “Expectations Index,” which tracks consumers’ short-term outlook for income, business, and labor market conditions, fell to 73.8 in March from 76.3 last month. Historically, a reading below 80 in that category signals a recession in the coming year.

All of the data this week serve as appetizers for the main event on Friday, when the government will release the Personal Consumption Expenditures Price Index, otherwise known as PCE. That contains the Federal Reserve’s preferred look at the pace of inflation, in the form of “core” PCE growth.

In company news, former President Donald Trump’s social media company was set for its Wall Street debut after merging with Digital World Acquisition Corp. Shares of Trump Media & Technology Group Corp. (DJT) rose more than 40% in early trading.

Live6 updates