-

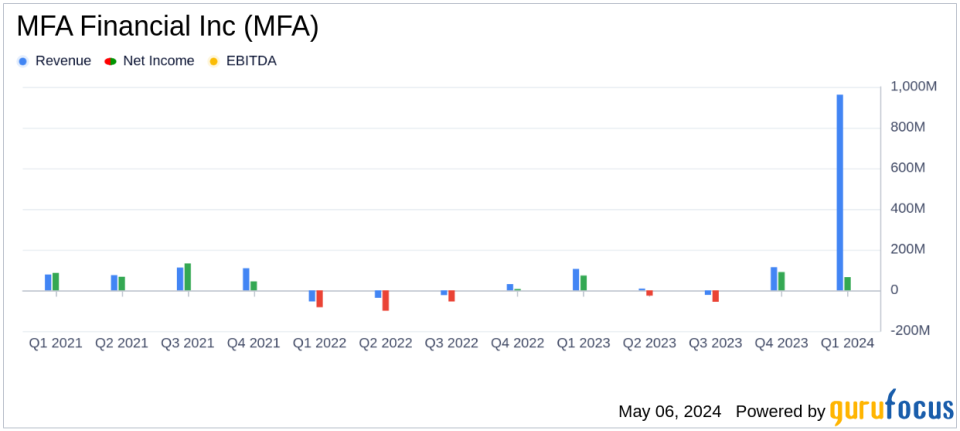

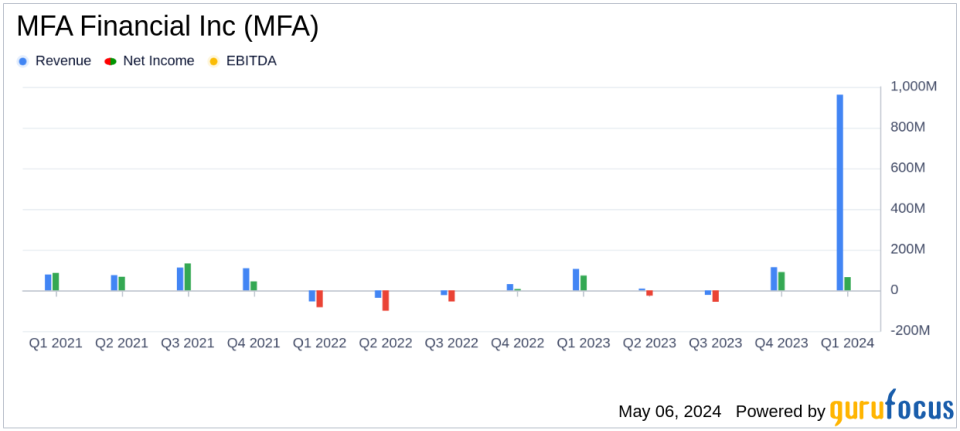

Reported earnings per share (EPS) of $0.40 for Q1 2024, aligning with analyst estimates.

-

Net income reached $41.54 million in Q1 2024, meeting the expectations set by analysts.

-

Generated revenue of $54.56 million during the quarter, exactly as analysts predicted.

-

Acquired or originated $652 million of residential mortgage loans, demonstrating robust portfolio growth.

-

Completed a securitization and benefited from a $3.2 billion interest rate swap position, yielding a net positive carry of $29 million.

-

Net interest margin and net interest spread reported were 2.88% and 2.06% respectively, indicating strong interest income performance relative to interest expenses.

-

Issued $115 million of 8.875% senior unsecured notes and an additional $75 million of 9.00% senior unsecured notes, enhancing financial flexibility.

MFA Financial Inc. (NYSE:MFA) disclosed its financial outcomes for the first quarter ended March 31, 2024, through its recent 8-K filing. The company, a notable player in the residential mortgage and real estate investment sectors, navigated the complexities of a volatile interest rate environment to post robust distributable earnings, aligning closely with analyst expectations for the period.

MFA Financial Inc. is an internally managed real estate investment trust (REIT) that primarily invests in residential mortgage loans, securities, and other real estate assets. The company’s strategic operations through its subsidiary, Lima One Capital, have been pivotal in originating and servicing business purpose loans, contributing significantly to its revenue streams.

Financial Performance Overview

For the first quarter of 2024, MFA Financial reported earnings that were consistent with analyst projections. The company achieved a net interest spread of 2.06% and a net interest margin of 2.88%, underscoring effective risk management and a disciplined investment approach. The acquisition and origination of residential mortgage loans amounted to $652 million, with significant contributions from business purpose loans exceeding $400 million.

The company’s CEO, Craig Knutson, remarked on the resilience shown in maintaining a healthy portfolio despite rate hikes. He noted the strategic repurchase of $40 million in convertible senior notes and the issuance of new senior unsecured notes totaling $190 million, aimed at bolstering the company’s financial structure against future interest rate and credit spread volatilities.

Asset Allocation and Portfolio Activity

As of March 31, 2024, MFA Financial’s asset allocation was strategically diversified to mitigate risks and capitalize on market opportunities. The total fair value of purchased performing loans stood at approximately $8.025 billion, with a significant portion in non-QM and transitional loans. The company’s adept handling of financing agreements and securitized debt underlines its robust asset management capabilities.

The investment portfolio saw a net increase, with residential whole loans and real estate owned (REO) assets rising to $9,225 million from $9,151 million at the end of the previous quarter. This growth reflects MFA Financial’s active portfolio management and its ability to adapt to market dynamics.

Strategic Initiatives and Market Positioning

MFA Financial continues to strengthen its market position through strategic initiatives that enhance its portfolio’s resilience and growth potential. The company’s substantial cash position and proactive capital management strategies are designed to safeguard its balance sheet while providing flexibility to seize emerging market opportunities.

The company’s commitment to delivering shareholder value is evident from its consistent dividend distributions, totaling $4.7 billion since its IPO in 1998. MFA Financial’s strategic focus on high-yield investments and effective cost management has enabled it to maintain stable distributable earnings, reinforcing its appeal to investors seeking reliable income streams from real estate investments.

Conclusion

In conclusion, MFA Financial Inc.’s first-quarter performance for 2024 demonstrates a well-executed strategy in a challenging economic environment. The company’s focus on high-quality mortgage assets, combined with prudent financial maneuvers, positions it well to navigate future uncertainties in the real estate and financial markets. Investors and stakeholders can anticipate continued robust management and strategic growth initiatives from MFA Financial as it capitalizes on its strong market position and comprehensive asset portfolio.

Explore the complete 8-K earnings release (here) from MFA Financial Inc for further details.

This article first appeared on GuruFocus.