Rina Foley would like to see some of her peers boost their personal finance prowess.

“I honestly don’t think this generation has a good knowledge of how to handle their finances,” said Foley, 21, of Leechburg, who is a senior at Seton Hill University.

That’s bad for young adults and society in general, according to numerous studies of the issue.

A 2014 National Institutes of Health report that looked at multiple peer-reviewed studies on debt among adolescents showed that debt rate correlates with juvenile crime rates.

The overview of studies found about half of adolescents reported having debt, with 25% reporting “financial problems.” The study also found that serious and/or habitual juvenile offenders were more likely to report money problems than those without debt.

A Forbes Advisors survey last year found alarming links between debt and mental health issues.

Among the Forbes findings of those reporting financial problems:60% of respondents reported their problems caused conflicts in their relationships with others

54% reported they often or always felt stress

66% reported they were considering filing for bankruptcy

48% reported sleep problems

38% reported experiencing a diminished social life

34% reported depression

But learning how to manage debt, budget and invest to avoid financial problems is a subject often not required in high schools.

That’s set to change in a few years.

In December, Pennsylvania became the 25th state to pass legislation, Senate Bill 843, making it mandatory for the 2026-27 school year for high school students to complete a semesterlong course in financial literacy.

Currently, Pennsylvania does not have any personal finance course or standards requirements for high school graduation.

Pennsylvania Auditor General Timothy L. DeFoor toured multiple high schools statwide in 2023, including Ligonier Valley High School, to see firsthand how they’re teaching financial literacy to students.

“We have a generation of students who need to understand debt, know how to sustain wealth and learn how to be money smart,” DeFoor said in a press release. “Having access to financial literacy curriculum in high school levels the playing fields for all Pennsylvanians.”

While at Leechburg Area High School, Foley selected personal finance as an elective, choosing from three finance-related courses: Principals of Democracy, Personal Finance and Consumer Math.

“I felt it was important to have some knowledge of how finances work. I was going to college, and it was important to know how to save and how to have a budget for certain things,” she said.

Leader in financial literacy

Hempfield Area High School pioneered the finance path in Westmoreland County, offering student financial literacy in 2017, requiring students to complete a half-credit finance course.

“We were the first in the area and one of only a handful of high schools in the state to make it a graduation requirement,” said John Howell, Hempfield teacher and business department chair.

Howell described the research numbers surrounding financial literacy, or the lack thereof, in America as “astounding.”

He noted 76% of Americans live paycheck to paycheck; 50% of working Americans have less than $2,000 saved for retirement; and more than 50% of Americans didn’t save any money in 2023.

“Those numbers were shocking, and equally shocking is no one was teaching financial literacy to young people at any level of education,” Howell said.

In his interactions with his students, Howell said many students have little knowledge about credit scores, credit history, how to build a credit score and what can hurt a credit score.

“This is one of the biggest deficiencies for students, as well as ways to invest money,” Howell said.

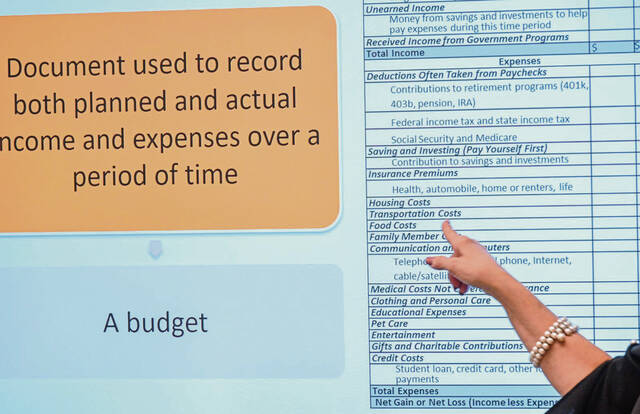

Topics covered in high school financial literacy courses include buying a car, renting, insurance, buying a house, diversification, investing for retirement, online banking, getting a credit card, fixing your credit, paying taxes, choosing and balancing a checking account, budgeting and savings and risk versus return.

Hempfield officials initially offered the financial course to freshmen but found students at that age were not quite ready to understand or appreciate the importance of the course.

“We moved it to 11th-grade level, and it was a game changer,” Howell said. “At that age, a student has a much greater interest and appreciation for what we’re teaching them since many of them are starting to think about buying a car, renting their own apartment, going to college or technical school or entering the workforce, where they will be individually responsible for the financial choices they make.”

Howell teaches several financially-based sections, including a 16-week stock market project.

The students are exposed to various features of the stock market, learn how to read stock reports and how to create a diversified stock portfolio.

Investment simulations include showing students the difference between investing from the age of 25 compared to starting at 40, based on a retirement age of 65.

“It’s literally jaw-dropping for them. We stress heavily that time is your best friend when it comes to investing and why they need to start earlier rather than later,” Howell said.

At Riverview Junior-Senior High School in Oakmont, senior Gwyneth Fichte is learning how to help herself be more financially responsible.

“I struggle financially, personally, because I don’t have a lot of guidance from my parents,” Fichte said. “I am very reckless with my money, and I’m trying to learn money management skills.”

Fichte said the course she’s taking at Riverview kicked off with a wants, needs and values lesson, taught by teacher Patsy Kvortek.

Kvortek advocated for personal finance being mandatory at Riverview, and the high school began requiring the yearlong course in 2015.

“I think that was the biggest thing we learned. It’s good to really ask yourself is this a want or is this a need?” Fichte said.

Nationally, 87% of teenagers own an iPhone and expect an iPhone to be their next phone, and 72% of teens have Airpods.

About 39% of teens work part time, according to the Bureau of Labor Statistics.

Certified financial adviser Gene Natali, CEO and co-founder of Troutwood, a financial planning and education company, and author of the award-winning teen/college finance book “The Missing Semester” said the new mandate for public high schools is “giant.”

“The passing of personal finance (requirements) will immediately benefit the student. The second beneficiary will be their parents and, then, a giant community impact will happen as students apply what they learn to better their financial lives,” Natali said.

Natali of McCandless has given more than 1,000 presentations across the U.S. on personal finance for high school and college students.

“Budgeting and the stock market is the greatest interest for high school students, and one of the reasons is that technology investments have made it possible to invest with smaller amounts,” Natali said.

The pensions of the past are just that, Natali said, noting that of today’s teens, only about 1% will have access to a pension.

“We had pension funds and cash purchases, and now we have apps and influencers,” Natali said.

What we see or observe as kids does influence us in terms of financial literacy, he said.

Natali has taught a one-credit elective personal finance course at the University of Pittsburgh since 2015.

“Students have got to do what a pension once did for them,” Natali said. “The single biggest challenge of personal finance is replacing what the pension did. Otherwise, these kids are gonna be working until they’re 100.”

Natali works to provide educators with information and materials to help high school students grasp a better understanding of their finances and see its importance.

“He’s been a huge advocate in Pennsylvania for making financial literacy a graduation requirement,” Howell said.

Student spending sparks interest

Riverview senior Cohen Hoolahan of Oakmont said it’s a good thing Riverview students are required to study personal finance before graduating.

“I actually was interested in finance before taking the class, and it’s better as a senior to take it because you can remember a lot of the stuff more. It’s learning about adult life. For me, I don’t really spend that much. I don’t need that much stuff,” Hoolahan said. “The course isn’t boring because it’s helping you for the future.”

Fichte opened a bank account and works part time tutoring flute lessons.

“A lot of people are ‘ugh’ about taking it, but I think it’s a very helpful course and something people should be taking,” Fichte said.

In the region, personal finance courses are offered sporadically among districts.

Fox Chapel Area School District offers an online-only personal finance elective course.

Highlands High School in Harrison offers an optional semester course in personal finance, required for the incoming class of 2025.

At Kiski Area High School, freshmen are required to take a personal finance course.

Senior Owen Nuttall of Leechburg took a personal finance course taught by Leechburg Area teacher Jill Shipman when he was a sophomore.

Nuttall said learning about budgets is the foundation of personal finance.

“I learned how important it is to create a budget, manage your money, writing a check, going to a bank, and I handle my own personal banking,” Nuttall said. “I think it’s about 50-50 with teens on who knows about handling their own finances.”

Nuttall said he is feeling more financially confident as he nears graduation.

“It’s great and you learn more about finances coming out of high school,” said Nuttall, who has his own savings and checking accounts.

“I think teaching kids early on will help them learn the importance of saving and knowing their true financial situation. I think it should be mandatory — like math class,” Foley said.

“It’s really important. This course sets you up for your real future — and other classes are important and set you on a path to an occupation — but this class helps you with everything you’ll be doing in your adult life,” Hoolahan said.

Leechburg senior Giavonna Spagnola of West Leechburg is enrolled in her second personal finance elective course.

She took Consumer Math as a junior and is taking Principles of Democracy.

“I learned about insurance, calculating health and car insurance and interest rates,” Spagnola said. “We had to analyze interest rates for purchasing a car, a home, and I wanted to take it because it’s a math credit and it taught me real-world stuff that I think I need.”

Howell said sometimes parents approach Hempfield Area staff and offer thanks for teaching the course.

“They say they’ve seen a more conservative spending approach by their child. The statistics prove there is a real lack of understanding and importance for the current generation as to how they spend money, and something needed to be done,” Howell said of the newly passed legislation. “This is a huge step in the right direction to help our young people learn the importance of their finance choices, now and in the future. Financial literacy is truly a lifelong skill, and we’re very proud to have been ahead of the curve in seeing this need for our students.”

Joyce Hanz is a TribLive reporter covering the Alle-Kiski Valley. A native of Charleston, S.C., she graduated from the University of South Carolina. She can be reached at jhanz@triblive.com