[The content of this article has been produced by our advertising partner.]

By Professor Veronique J.A. LAFON-VINAIS

Associate Professor of Business Education, Department of Finance

HKUST Business School

Family businesses include a wide range of businesses from small owner operations to large listed companies, which are significant contributors to the economies of Asia and the world. According to a report by Deloitte in Spring 2022, companies that are owned and controlled by families account for 2/3 of all businesses, 70- 90% of annual global GDP and 50-80% of jobs in most countries. These businesses often have a long-term perspective and a strong sense of responsibility towards their employees, customers, and communities.

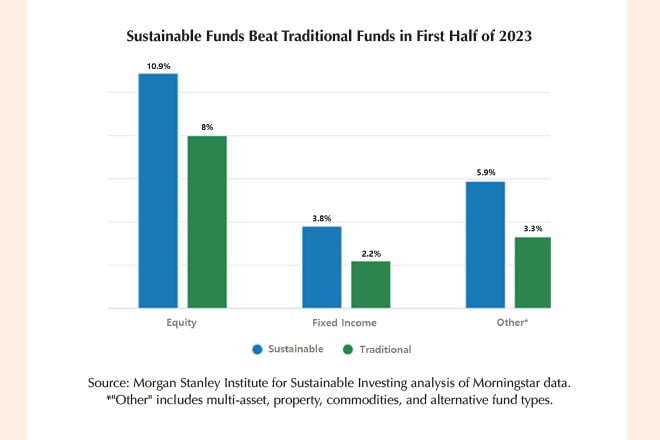

Family businesses in Asia are increasingly recognizing the importance of sustainable finance. According to a survey by UBS, 77% of family businesses in Asia believe that ESG factors are important to their investment decisions. This is in line with global trends, where sustainable finance is becoming an increasingly important consideration for investors. This article explores the intersection of family businesses and sustainable finance in Asia, and why family businesses can benefit from first mover advantage in sustainability.

Part I: Rise of Sustainable Finance

Sustainable finance refers to financial activities that take into account environmental, social, and governance (ESG) factors. On the investment side, this includes investments that promote sustainable development, such as renewable energy, green infrastructure, and sustainable agriculture. It also involves integrating ESG factors into investment decision-making processes and measuring the impact of investments on ESG outcomes. On the capital raising side, it also includes financing decisions related to ESG factors, for example issuing bonds which proceeds will be used exclusively to finance pre-defined environmental projects or borrowing loans where the pricing is a function of performance on ESG pre- defined KPIs.

The rise of sustainable and green finance is evidenced in the following developments (source: S&P Sustainability Focus 2023).

- On the issuance size, the sustainable debt and credit market has been estimated between US$1 and 3 trillion as of year end 2021, according to data compiled by Refinitiv and Bloomberg.

- Issuance of Green Social Sustainable and Sustainability-Linked Bonds (GSSSB) has increased globally and in Asia Pacific region (APAC), picks up after a dip in 2022 resulting from difficult market conditions overall in fixed income, and the GSSB share of the overall bond market continues to increase

- Focusing on APAC, the rise of sustainable finance has accelerated, with China the dominant player (sources: S&P and Moody’s)

- On the buy side, sustainable investing assets have been estimated at US$35 trillion globally as of 2021; the number of signatories of the Principles for Responsible Investment (PRI) Group continues to increase

- In a recent report Morgan Stanley estimated that sustainable funds have reached more than US$3.1 trillion or 8% of total global assets under management, with 89% in Europe, 10% in America and less than 2% in other regions. Asia still only accounts for 7% of the number of sustainable funds.

- According to Morningstar the number of sustainable open-end funds and ETFS continues to grow significantly, driven by Europe

- While significantly lower than other regions, the growth of sustainable funds in Asia ex-Japan continues, driven by China and Singapore

Despite the impressive growth of sustainable and green finance, it still only represents a modest fraction of the overall financial markets, and still only a small part of the climate financing needs, which have been estimated at US$50 trillion by the World Economic Forum. McKinsey estimates that the net zero transition will require approximately US$9.2 trillion per year, a total of US$275 trillion. (source: McKinsey 2022 Year in Review)

According to S&P, climate mitigation is a key focus for issuers in Asia Pacific, dominated by renewable energy, green buildings, energy efficiency and transportation.

Most importantly, many businesses are now realizing that climate change creates natural catastrophe risks to business continuity that may no longer be insurable.

Nevertheless climate adaptation and transition present many opportunities: McKinsey estimates US$12 trillion of yearly opportunities from Net Zero plans across various industries.

The rise of sustainable finance is the current manifestation of a deep evolution from shareholder capitalism to stakeholder capitalism that started in the 1980s with the “triple bottom line” coined by John Elkington, and which has accelerated under the twin impacts of climate change acceleration and the Covid-19 pandemic. The “triple bottom line” (profits, people, planet) was based on the notion of “creating shared value”. This principle of shared value is integrated in the concept of shareholder capitalism (Business Roundtable) and is familiar to family businesses as it is integral to their family values.

Part II: Family Business and Sustainability

1 – A matter of values

The very definition of sustainability ”meeting the needs of the present without compromising the ability of future generations to meet their own needs” aligns with the core intent of family businesses who are created and maintained with future generations in mind, balancing economic prosperity with legacy. Now a business imperative for businesses globally, sustainability is already embedded in family businesses values, positioning them to benefit from first mover advantage, according to a recent KPMG/STEP report. For many family businesses, sustainability is already a “road well-traveled” (source: KPMG/STEP). For example, in Hong Kong, companies like CLP, Swire and Esquel developed frameworks and targets decades before “sustainability” became a buzzword.

With the latest developments, sustainable finance provides a framework for family businesses large and small to align their financial activities with their values and contribute to sustainable development.

2 – APAC rises

Family businesses in Asia are increasingly recognizing the importance of sustainable finance. According to a survey by UBS, 77% of family businesses in Asia believe that ESG factors are important to their investment decisions. This is in line with global trends, where sustainable finance is becoming an increasingly important consideration for investors.

Examples abound of Asian family businesses riding the wave of sustainable and green finance. Ayala Corporation, a Philippine-based conglomerate, has a long history of environmental and social stewardship and has made sustainability a core part of its business strategy. In 2014, Ayala launched its first green bond, which raised US$225 million for renewable energy and energy efficiency projects. Ayala has also integrated ESG factors into its investment decision-making processes and has set ambitious sustainability targets for its business operations.

Another example is the Lee Kum Kee Group, a Hong Kong-based condiment manufacturer. Lee Kum Kee has a strong commitment to sustainability and has implemented a range of initiatives to reduce its environmental impact. In 2018, Lee Kum Kee issued its first green bond, which raised US$150 million for sustainable agriculture and food safety projects. The bond was oversubscribed, indicating strong investor demand for sustainable finance in Asia.

Part of the attraction of sustainable and ESG financing is the pricing advantage. According to Global Capital, the greenium available in APAC was up to 10 bps in 2022, lower than Europe’s 25 bps but growing. In addition, issuers benefit from better execution. According to Global Capital, “in dollars globally, the average oversubscription was 3.8 times for green bonds and 2.7 times for vanilla deals, according to JP Morgan. Spread compression averaged 29.3 bp for green bonds and 22.5 bp for vanilla bonds. ESG deals attracted high- quality orderbooks and showed more resilience in the secondary market”.

A study by CBI (Climate Bond Initiative) in October 2022, also found that green bonds offer pricing benefits and better liquidity.

Despite the growing interest in sustainable finance among family businesses in Asia, there are still significant challenges to overcome. One challenge is the lack of standardized ESG reporting and disclosure requirements in the region. This makes it difficult for investors to compare the sustainability performance of different companies and assess the impact of their investments on ESG outcomes. To address this challenge, there have been efforts to develop regional ESG reporting and disclosure standards. The ASEAN Corporate Governance Scorecard, for example, includes ESG factors in its assessment of corporate governance practices. The Sustainable Stock Exchanges initiative, which includes stock exchanges in Asia, has also developed guidance on ESG reporting and disclosure.

3 – Generational Impact

As businesses are transitioning from first generation to second or third generation, the role of the “NextGen” in pushing through a sustainability agenda cannot be underestimated. In PwC’s Global NextGen Survey 2022 of more than 1,036 NextGens, 59% said they believed their own family business was moving too slowly on sustainability, and 72% said they expected to be involved in increasing their family business’ focus on investments for sustainability in the future. But only 28% are involved right now. Top of focus is business growth.

Despite a cross-generational focus on growth, younger generations are focusing on sustainability. Many of these ambitions are deployed through their family offices.

According to PwC Survey 2022, 42% of NextGens said their families had a family office, and 43% of those with a family office have a sustainability strategy, compared with 37% of those with no family office. They are also more likely to have a written constitution and a succession plan in place.

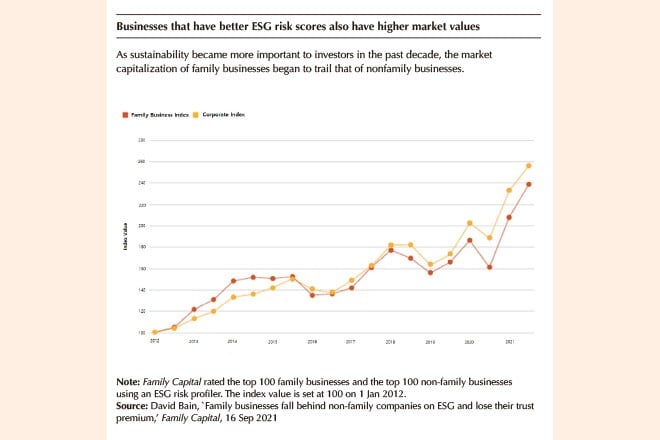

Furthermore, recent research is showing that a focus on sustainable and green finance can combine profitability and growth objectives with sustainability values, making sustainable funds an increasingly attractive option for family offices. Morgan Stanley Institute’s recent research shows a marked outperformance of sustainable funds over traditional funds.

Conclusion: The Importance of Education

Another challenge to the widespread adoption of sustainability in Asian family businesses may be the lack of awareness and education about sustainable finance in Asia. Many family businesses might not be aware of the benefits of sustainable finance or how to integrate ESG factors into their investment decision-making processes.

To address this challenge, there have been efforts to raise awareness and provide education about sustainable finance in Asia. In Hong Kong, the government is encouraging collaboration between all stakeholders to increase sustainability initiatives and firmly position Hong Kong as a leading Sustainable Finance Center.

At HKUST, sustainability is a core strategy across disciplines, from research with our Theme Based Research project on Green Finance, to undergraduate education with our BSc in Sustainable and Green Finance, executive education with our HKUST X HKGFA Certificate in Sustainable and Green Finance and to on-campus initiatives such as the Life Cycle Assessment Lab and Sustainable and Green Campus as a Living Lab through our Sustainable and Net Zero Office.

Family businesses in Asia are increasingly recognizing the importance of sustainable finance. Sustainable finance provides a framework for family businesses to align their financial activities with their values and contribute to sustainable development. While there are still significant challenges to overcome, there are also opportunities for family businesses to lead the way in sustainable finance in Asia. By integrating ESG factors into their investment decision-making processes and measuring the impact of their investments on ESG outcomes, family businesses can contribute to a more sustainable and prosperous future for the region.