-

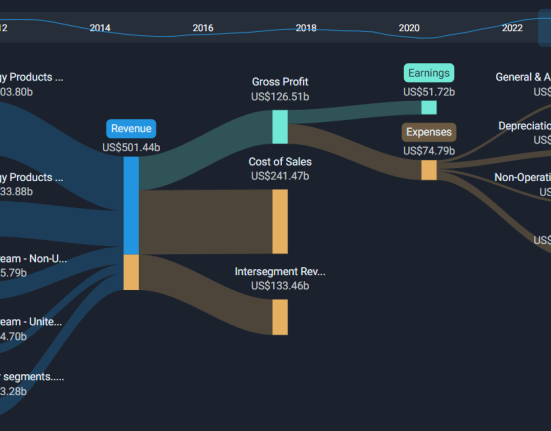

Intuitive Surgical Inc (NASDAQ:ISRG) showcases robust revenue growth with a 11.5% increase in total revenue year-over-year.

-

Net income attributable to Intuitive Surgical Inc surges by 53.3% from the previous year, indicating strong profitability.

-

Research and development expenses rise by 16.2%, reflecting the company’s commitment to innovation.

-

Intuitive Surgical Inc maintains a dominant market position with over 8,600 da Vinci systems installed worldwide.

Intuitive Surgical Inc (NASDAQ:ISRG), a pioneer in the field of robotic-assisted minimally invasive surgery, has released its 10-Q filing on April 19, 2024, providing a detailed financial snapshot of the company’s performance in the first quarter of the year. The company has continued to demonstrate financial strength with a significant increase in revenue, reporting a total revenue of $1,890.6 million, up from $1,696.2 million in the previous year. This growth is driven by a rise in both product and service revenues, indicating a growing demand for the company’s offerings. Net income attributable to Intuitive Surgical Inc has seen a remarkable rise to $544.9 million, a 53.3% increase from the previous year’s $355.3 million, showcasing the company’s ability to translate revenue growth into bottom-line profitability. The company’s commitment to innovation is evident from the increased investment in research and development, which has grown to $284.5 million, up 16.2% from the prior year. With a strong market presence and a focus on technological advancement, Intuitive Surgical Inc is well-positioned to maintain its leadership in the industry.

Strengths

Market Leadership and Brand Reputation: Intuitive Surgical Inc’s da Vinci systems have become synonymous with robotic-assisted surgery, establishing the company as a market leader. With over 8,600 systems installed globally, the brand has garnered trust within the medical community. This leadership is reflected in the company’s financials, with product revenue constituting 83% of total revenue, maintaining consistency year-over-year. The brand’s reputation for quality and innovation attracts a loyal customer base, which is crucial in a market where reliability and precision are paramount.

Financial Performance and Profitability: The company’s financial health is a testament to its operational efficiency and strategic pricing. The impressive 53.3% increase in net income attributable to Intuitive Surgical Inc, coupled with a solid gross profit margin of 66%, underscores the company’s ability to manage costs effectively while maximizing profit. This financial stability provides the company with the flexibility to invest in research and development, which has seen a significant increase, ensuring the continuous improvement of its product offerings.

Weaknesses

Dependence on Core Product Line: Intuitive Surgical Inc’s reliance on its da Vinci surgical systems as the primary revenue generator could be a potential weakness. With product sales accounting for a substantial portion of total revenue, any market shifts or technological disruptions could disproportionately affect the company’s financial stability. Diversification into other product lines or medical technologies could mitigate this risk and ensure long-term sustainability.

Increased Operating Expenses: The company’s operating expenses have risen, with selling, general, and administrative expenses reaching $491.5 million, a 2.3% increase from the previous year. While this indicates an investment in growth, it also suggests a need for careful cost management to prevent erosion of the company’s profit margins. Balancing the expansion of market reach with cost efficiency will be crucial for maintaining profitability.

Opportunities

Expansion into Emerging Markets: Intuitive Surgical Inc has the opportunity to further penetrate emerging markets, where the adoption of robotic-assisted surgery is still in its infancy. The company’s established presence in the US, with over 5,000 installations, provides a strong foundation to leverage its expertise and brand reputation to capture market share in regions with growing healthcare infrastructure and increased healthcare spending.

Advancements in Surgical Technology: The company’s robust investment in research and development opens doors to pioneering new surgical technologies and enhancements to the da Vinci systems. Innovations such as artificial intelligence, machine learning, and advanced imaging could further differentiate the company’s offerings, improve surgical outcomes, and solidify its market position.

Threats

Competitive Pressure and Technological Disruption: The medical device industry is highly competitive, with rapid technological advancements. Competitors may introduce new or improved products that could challenge the da Vinci systems’ market dominance. Intuitive Surgical Inc must continuously innovate to stay ahead of the curve and defend its market share against disruptive technologies.

Macroeconomic and Geopolitical Uncertainties: External factors such as economic downturns, supply chain disruptions, and geopolitical tensions can impact the company’s operations and financial performance. The ongoing conflicts and potential trade barriers could lead to increased costs or hinder market access, necessitating strategic planning to navigate these challenges effectively.

In conclusion, Intuitive Surgical Inc (NASDAQ:ISRG) presents a strong financial and strategic position as of the first quarter of 2024. The company’s market leadership, brand reputation, and solid financial performance are key strengths that underpin its competitive advantage. However, reliance on its core product line and increased operating expenses pose potential weaknesses that require strategic management. Opportunities for growth lie in expanding into emerging markets and advancing surgical technology, while threats from competitive pressure and macroeconomic uncertainties must be carefully monitored. Overall, Intuitive Surgical Inc is well-equipped to continue its trajectory of success, provided it remains agile and responsive to the dynamic healthcare landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.