(Kitco News) – Monday saw the return of bull market momentum for cryptos as Bitcoin (BTC) climbed back above $70,000 while several dozen altcoins recorded double-digit gains, exciting crypto traders and reigniting FOMO for underexposed investors.

It was the opposite story for stocks, which fell under pressure at the market open to start the final week of Q1 following a quarter that saw new record highs for the major indices against a backdrop of sticky inflation.

At the closing bell, the S&P, Dow, and Nasdaq were all in the red, down 0.31%, 0.41%, and 0.27%, respectively.

Data provided by TradingView shows that after rallying from $64,000 to $67,000 on Sunday, Bitcoin bulls picked up where they left off on Monday, pushing the top crypto from $67,000 to a high above $71,000 in the afternoon.

BTC/USD Chart by TradingView

Bulls are now aiming at Bitcoin’s all-time high of $73,865 and look to push King Crypto back into uncharted territory.

Rising volatility

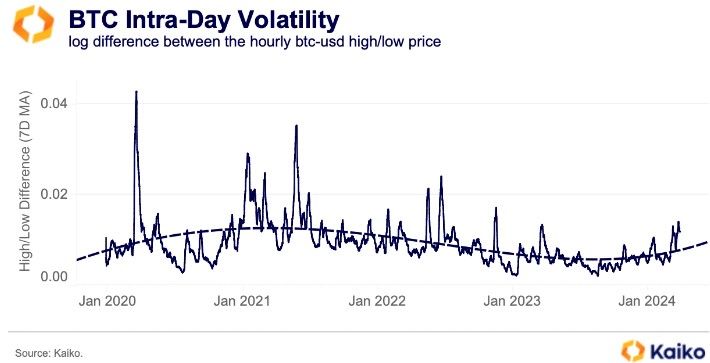

“Bitcoin flash crashes – defined as a sudden and extreme price drop – have occurred on at least two occasions over the past few weeks,” said Kaiko Research in a report released Monday. “The low liquidity and fragmentation of the cryptocurrency market, as well as potential manipulation attempts, are contributing factors to these flash crashes, which are unlike anything seen in traditional markets.”

Volatility is highest during U.S. trading hours (14 to 21h UTC), Kaiko noted. “However, BTC’s intra-day volatility, as measured by the log difference between the hourly high and low price, is still well below its peak hit during the COVID-induced market crash or the 2021 bull market.”

“It is also worth noting that the current spike in volatility follows an unusually low volume and volatility period, making the recent fluctuations feel more pronounced,” Kaiko said.

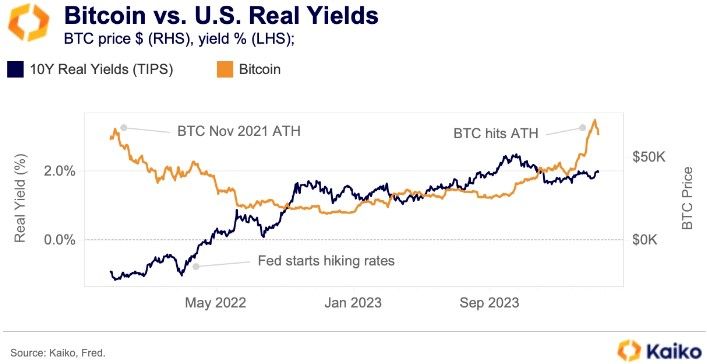

Bitcoin is also showing resilience despite the rise of real yields in the U.S., they added.

“U.S. real yields, as indicated by the 10-year inflation-protected securities (TIPS), hit a yearly high of 2% last week before slightly retreating,” the report said. “Historically, rising yields have put downward pressure on Bitcoin prices, making risk assets less attractive compared to risk-free treasuries.”

“However, this year, BTC has shown resilience to the gradual increase in yields, gaining 50% YTD,” they said. “Despite the recent pullback from its all-time high, BTC’s strong performance suggests that other factors, such as inflows from spot ETFs, may be providing support to its price.”

“Interestingly, gold, which also tends to lose value as yields rise, has experienced a similar upwards trend, suggesting that rising debt levels and geopolitical turmoil may have contributed to offset the impact of higher yields on both assets,” Kaiko added.

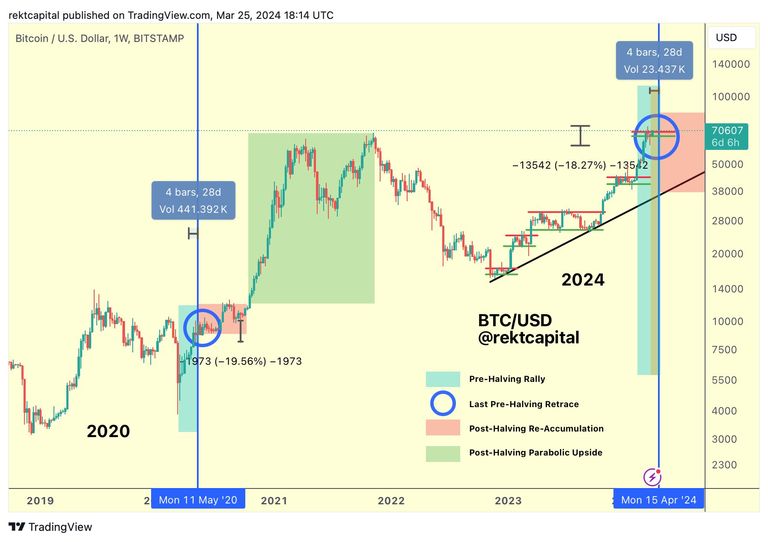

According to market analyst Rekt Capital, “This current cycle has been a story of Re-Accumulation Ranges (green-red).”

“And one interesting possibility for price going into the Halving is further consolidation at highs (i.e. Re-Accumulation). This turn of technical events would be historically accurate,” he said. “It would satisfy the fact that a Pre-Halving Retrace occurs 28-14 days before the Halving, and it would satisfy the fact that Pre-Halving Retraces transition into Post-Halving Re-Accumulation.”

“If Bitcoin manages to turn the old All-Time High of ~$69,000 into new support then this ‘Re-Accumulation Range’ idea would be invalidated because price would be ready for price expansion into Price Discovery,” he added. “If, however, Bitcoin isn’t able to turn ~$69,000 into support before the Halving… This Re-Accumulation Range could become a reality and would be in line with historical price tendencies around the Halving.”

Sea of green in the altcoin market

The altcoin market was a sea of green on Monday as only two tokens in the top 200 recorded losses.

Daily cryptocurrency market performance. Source: Coin360

Polymesh (POLYX) was the biggest gainer, recording an increase of 56.4% to trade at $0.61, followed by an increase of 44% for Reserve Rights (RSR), and a gain of 38.5% for Yield Guild Games (YGG). Conflux (CFX) was the biggest loser, falling 2.5%, while WEMIX (WEMIX) lost 0.4%.

The overall cryptocurrency market cap now stands at $2.68 trillion, and Bitcoin’s dominance rate is 52.2%.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.