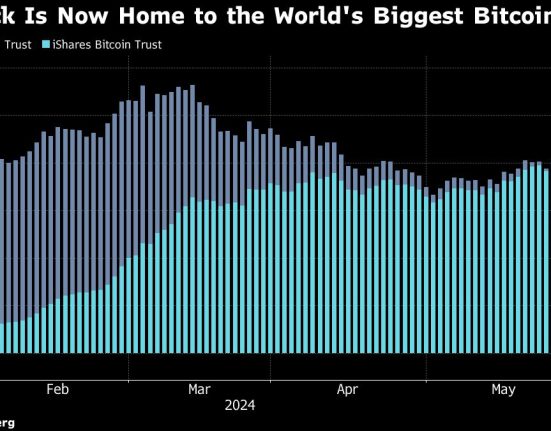

(MENAFN) BlackRock’s Acher’s Bitcoin Trust has achieved the milestone of becoming the largest cryptocurrency fund globally, accumulating approximately USD20 billion in assets since its listing in the United States earlier this year. According to a report by Bloomberg on Wednesday, data compiled by the financial news agency revealed that the exchange-traded fund (ETF) reached a total asset size of USD19.68 billion as of Tuesday, surpassing the assets held by the Grayscale Bitcoin Trust, which stands at around USD19.65 billion.

This significant achievement marks a shift in the landscape of cryptocurrency investment vehicles, with BlackRock’s Bitcoin Trust overtaking the long-standing dominance of Grayscale’s offering. The Securities and Exchange Commission (SEC), led by crypto-skeptic Gary Gensler, had previously rejected Bitcoin-focused ETFs for more than a decade due to concerns regarding market manipulation. However, in January, the SEC approved such ETFs after Grayscale Investments secured a favorable court ruling the previous year.

The approval of Bitcoin-focused ETFs by the SEC signals a growing acceptance of cryptocurrencies within traditional financial markets. BlackRock’s success with its Bitcoin Trust underscores the increasing demand for crypto investment products among institutional and retail investors alike. This milestone also reflects the maturation of the cryptocurrency market and its integration into mainstream investment strategies. As the cryptocurrency landscape continues to evolve, the emergence of BlackRock’s Bitcoin Trust as the largest cryptocurrency fund signifies a significant development in the broader financial ecosystem.

MENAFN23062024000045015682ID1108361634

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.