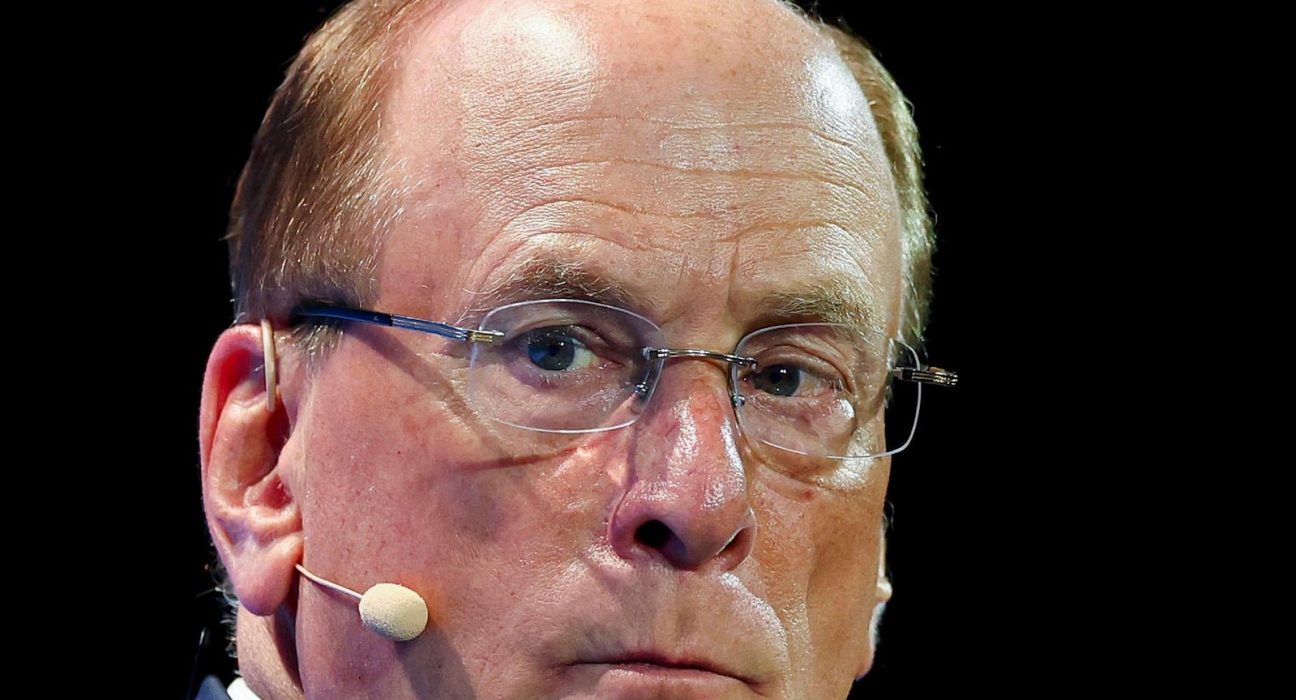

‘Huge’ BlackRock Crypto Bombshell Suddenly Hurtling Toward Bitcoin At Key Price ‘Turning Point’

Bitcoin has bounced back in recent weeks, surging as serious U.S. dollar collapse fears drive billionaire interest in bitcoin. Front-run Donald Trump, the White House and Wall Street by subscribing now to Forbes’ CryptoAsset & Blockchain Advisor where you can “uncover blockchain blockbusters poised for 1,000% plus gains!” The bitcoin price has soared toward its