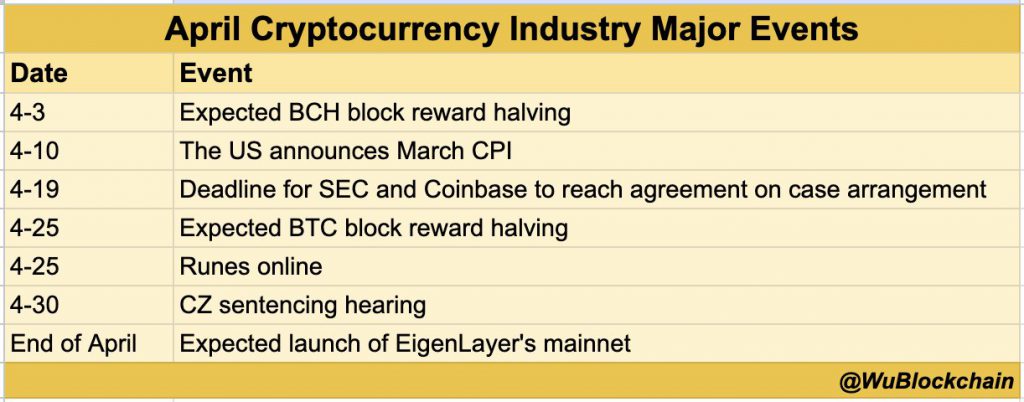

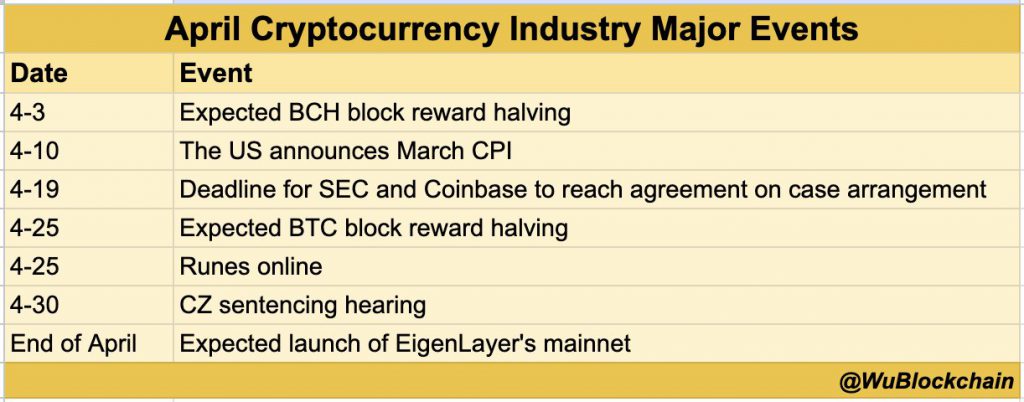

April 2024 looms as a crucial juncture for the cryptocurrency market, set to witness a convergence of significant occurrences that could potentially alter the dynamics of digital assets.

From pivotal protocol advancements to legal confrontations involving industry heavyweights, the month is brimming with events that may dictate the trajectory of the market for the foreseeable future.

Bitcoin Halving

We have now entered the highly anticipated month of April 2024, with the Bitcoin halving event just around the corner, a mere 20 days away. As the countdown to the halving event continues, Bitcoin (BTC) has exhibited notable strength in its price recently.

At the time of writing, Bitcoin is trading at $66,000 levels, boasting a market capitalization of $1.31 trillion. The upcoming fourth Bitcoin halving stands out as the most eagerly awaited event of April, historically characterized by increased market volatility and speculative activity.

Respected analysts suggest that this halving could trigger a surge in altcoin prices, potentially indicating a shift in Bitcoin’s dominance. This speculation gains momentum as Bitcoin demonstrates remarkable volatility, surpassing even Ether in the lead-up to the halving event.

SEC and Coinbase Lawsuit

The Securities and Exchange Commission (SEC) remains steadfast in its pursuit of legal action against Coinbase. This further prolongs the cryptocurrency exchange’s legal challenges. The Court’s rejection of Coinbase’s motion to dismiss the lawsuit indicates an ongoing and protracted legal dispute.

It underscores the regulatory ambiguities faced by major players in the crypto industry. Both parties are required to submit a case management plan by April 19. It further outlines the key issues in the case and the strategies for trial proceedings.

Also Read: Bitcoin vs Gold: Why Economist Peter Schiff Believes Gold Trumps BTC

US March CPI Release

All attention will be focused on April 10 when the Consumer Price Index (CPI) data for March is released. It will offer crucial insights into inflation patterns. Analysts will meticulously scrutinize this data, anticipating its implications for Federal Open Market Committee (FOMC) decisions.

This is regarding interest rates and monetary policy. Despite prevailing expectations, Forbes indicates that adjustments to interest rates are improbable in April. This is in preparation for their upcoming meeting on May 1.

While no alterations to interest rates are foreseen at the meeting, relatively mild inflation data could lay the groundwork for a potential interest rate cut in the summer, aligning with the anticipated outlook of most FOMC officials and fixed-income markets.

CZ’s Hearing

The sentencing of Changpeng Zhao (CZ), the founder and former CEO of Binance, has been delayed until April 30, as stated in a notice filed in Seattle federal court on Monday.

CZ’s legal struggles have garnered significant attention, particularly his efforts to obtain permission to travel to the UAE for medical reasons. Indeed, these have been consistently denied by the US Federal Court due to the lack of an extradition treaty.

Honourable Mentions

April also witnesses the Bitcoin Cash (BCH) halving. This comes with the launch of EigenLayer’s mainnet, marking significant milestones within their respective ecosystems. These developments carry implications for investors and users, underscoring the continuous evolution and maturation of the cryptocurrency market.

As April unfolds, the cryptocurrency community awaits the outcomes of these pivotal events, mindful of their potential to reshape the trajectory of Bitcoin and the broader crypto market in the months ahead. With regulatory ambiguities, legal entanglements, and protocol upgrades dominating the discourse, April 2024 emerges as a defining moment in the ongoing narrative of cryptocurrencies.

Also Read: Shiba Inu Gets Nod from Early Bitcoin Investor: Is It Time to Buy?