Investors warm to Treasury bonds after Trump-induced tumult

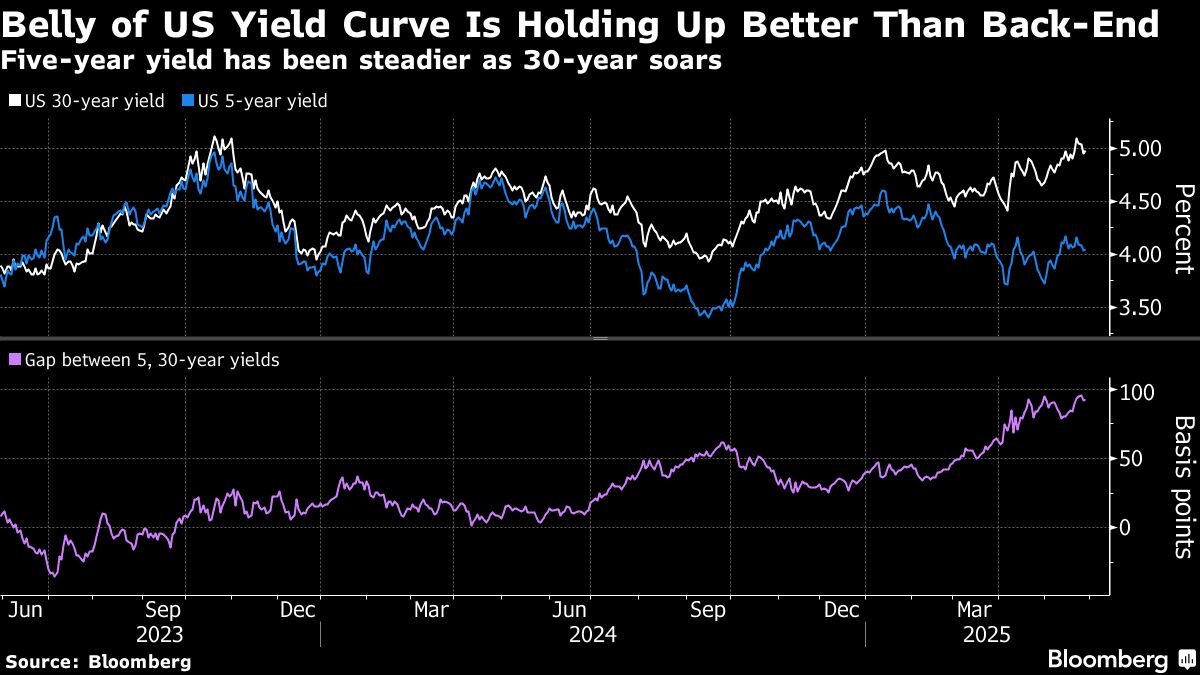

In the coming days, the U.S. Treasury Department will hold auctions for 2-year, 5-year, and 7-year Treasury notes, along with a few weekly ones. The government holds these auctions to raise money, which helps it finance all of its obligations. These auctions have been especially noteworthy this year because bond investors have had some concerns about