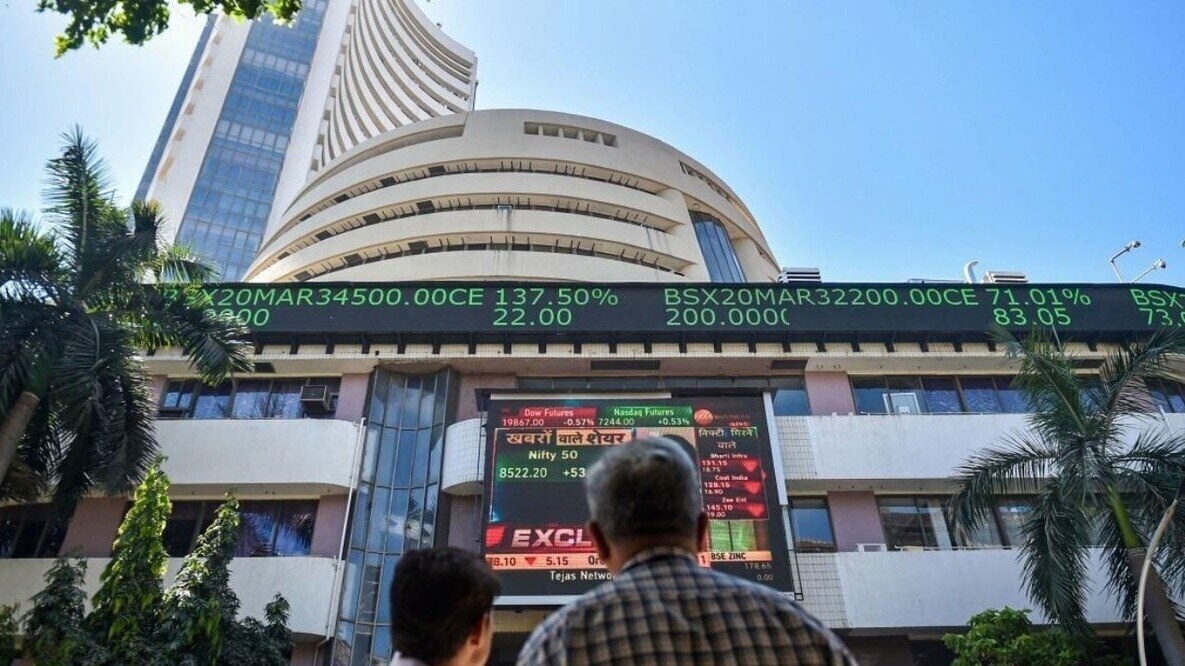

PNB Housing Finance Shares Plunge 18% on CEO Resignation: Rediff Moneynews

PNB Housing Finance shares fell sharply after MD & CEO Girish Kousgi’s resignation announcement. The company is initiating a search for a new leader. New Delhi, Aug 1 (PTI) Shares of PNB Housing Finance tumbled 18 per cent on Friday after its Managing Director and Chief Executive Officer Girish Kousgi announced his resignation and said