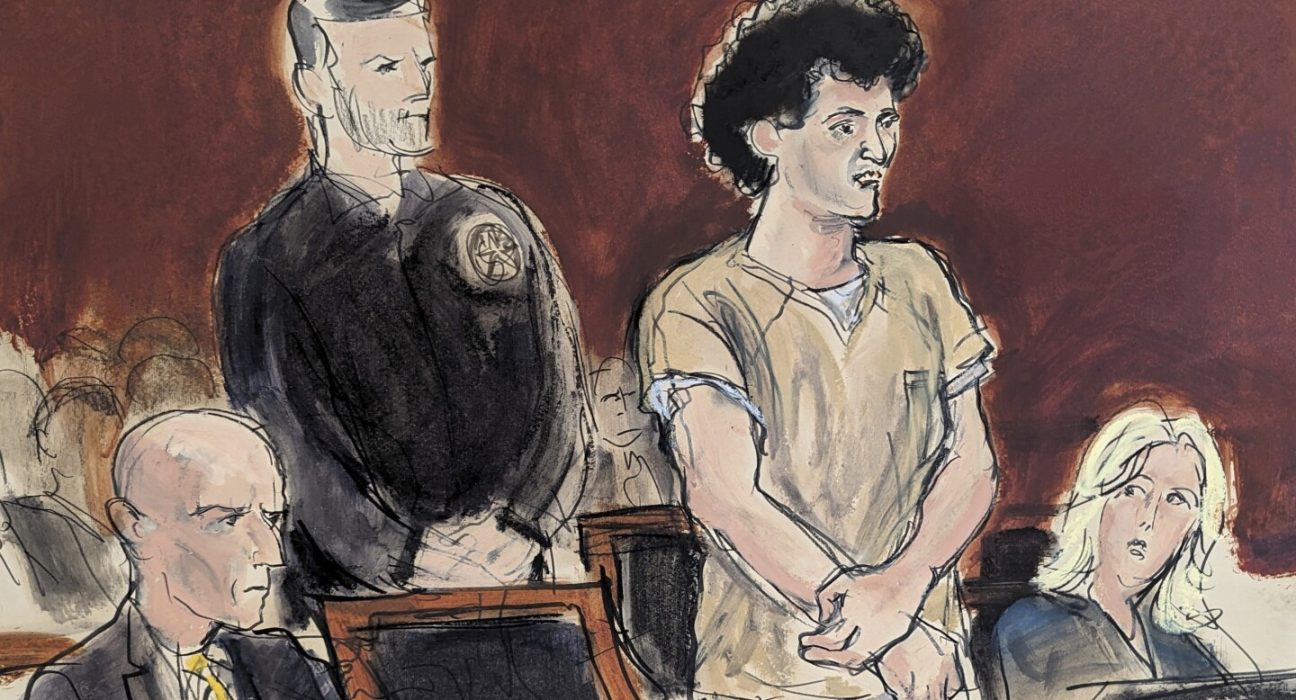

Bankman-Fried Agrees to Help Sue Celebrity Crypto Promoters

A group of FTX investors has agreed to drop legal claims against Sam Bankman-Fried. In exchange, the disgraced former crypto exchange CEO will cooperate in the investors’ suits against other defendants stemming from FTX’s collapse, including various celebrities paid to promote the exchange, according to court documents filed Friday (April 19). The settlement, first reported by Bloomberg News, comes weeks