U.S. property taxes increased twice as fast in 2023 compared to prior year

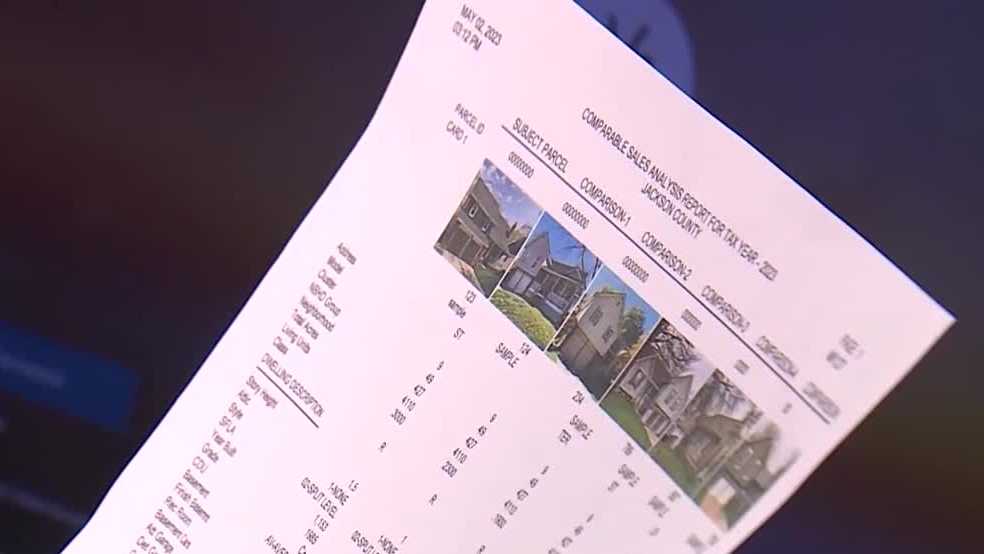

U.S. property taxes on single-family homes rose twice as fast in 2023 as they did in 2022, with a total of $363.3 billion levied compared to $339.8 billion one year earlier. This is according to an analysis conducted by Attom, based on property tax data collected from county tax assessor offices nationwide at the state,