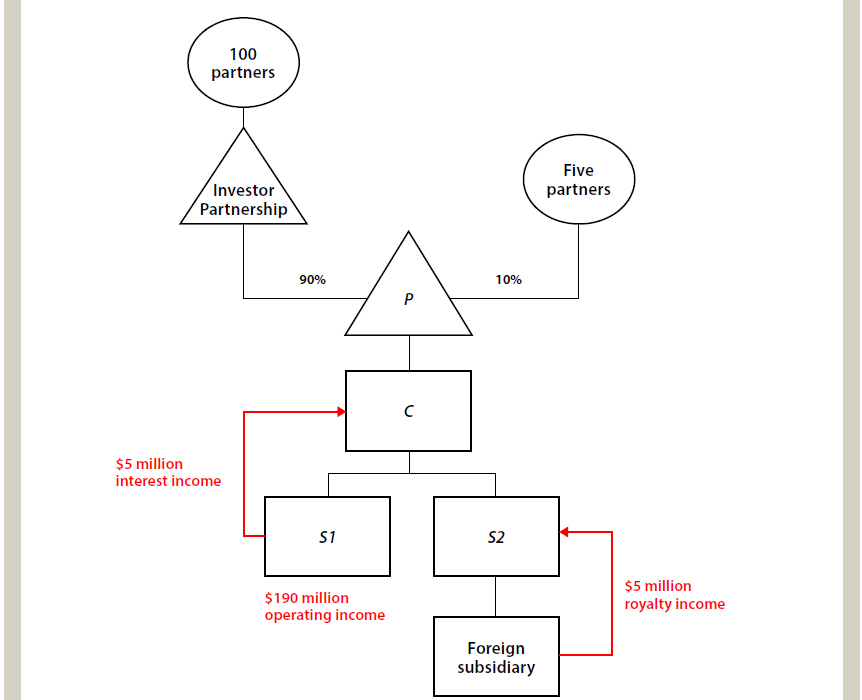

A trap for the unwary investment partnership

Editor: Jeffrey N. Bilsky, CPA Sec. 541 imposes a 20% tax on the undistributed personal holding company income of a personal holding company. Initially enacted in 1934, the tax was intended to discourage individuals from using closely held corporations as tax shelters for investment income. However, given that current long–term capital gains rates are less