‘Mortgage fraud’ or ‘abuse’ of confidential data?

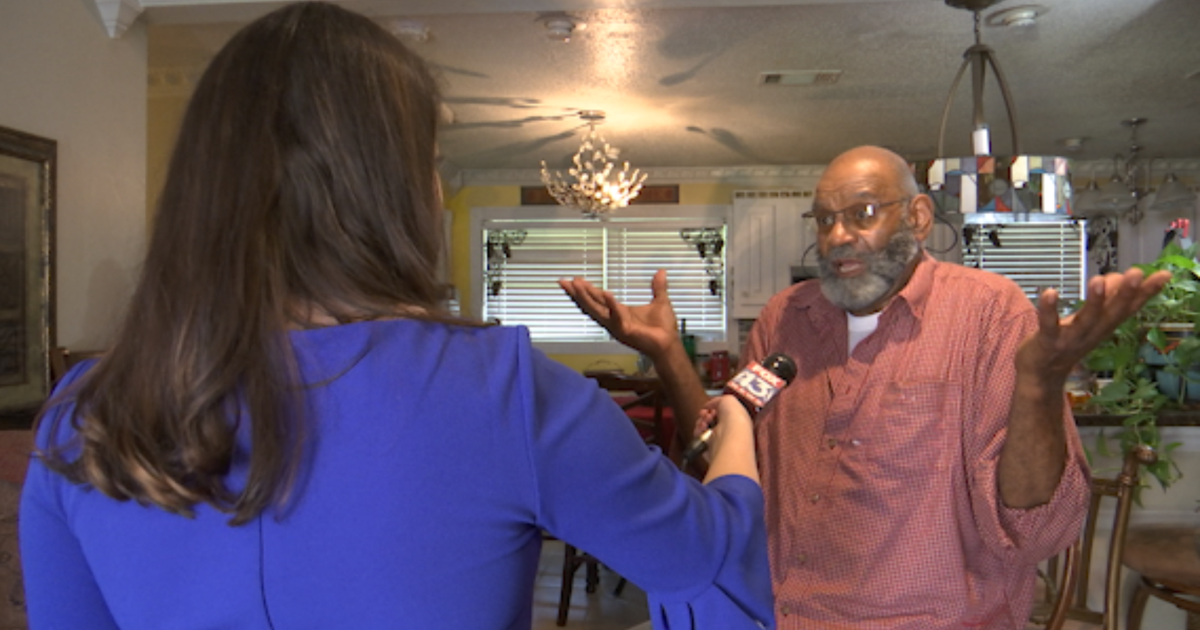

Who is Federal Reserve Governor Lisa Cook? Federal Reserve Governor Lisa Cook, reappointed through 2038, rejects Trump’s claim he fired her. The announcement from President Donald Trump on Aug. 25 that he was firing Federal Reserve governor Lisa Cook amounts to an extraordinary weaponization of the housing finance system that depends on private, deeply personal data from