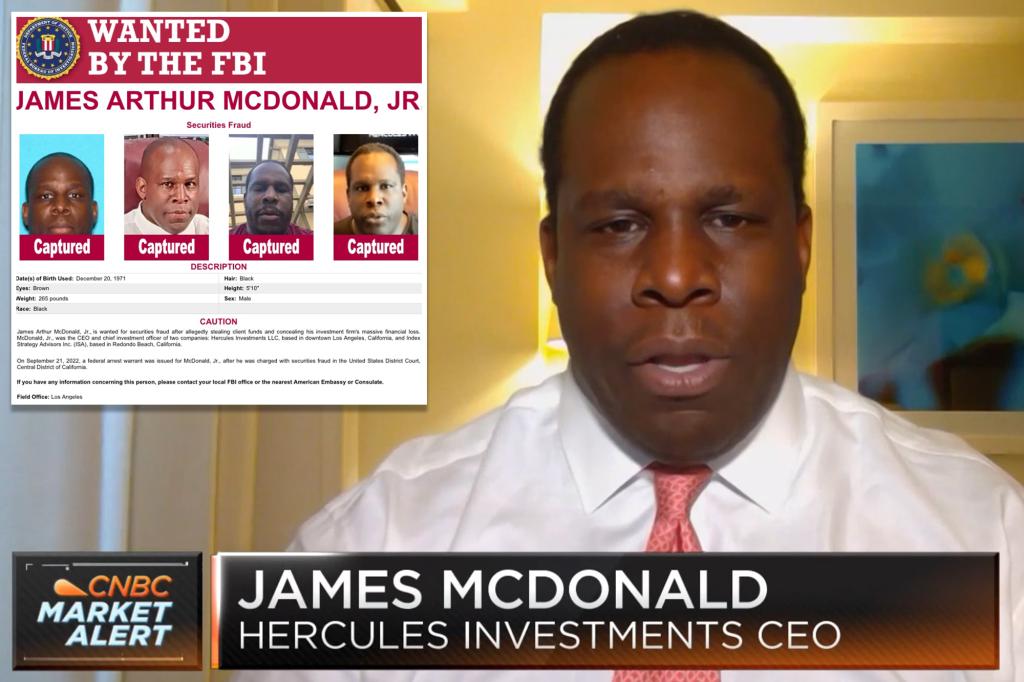

Former CNBC analyst James Arthur McDonald Jr., who betrayed investors, sentenced in multimillion-dollar fraud scheme

A former television financial analyst accused of defrauding investors out of millions of dollars and spending years on the run was sentenced to five years in prison, the Justice Department said Monday. James Arthur McDonald Jr., 53, is also expected to be ordered to pay restitution to his victims following his April 7 guilty plea for securities