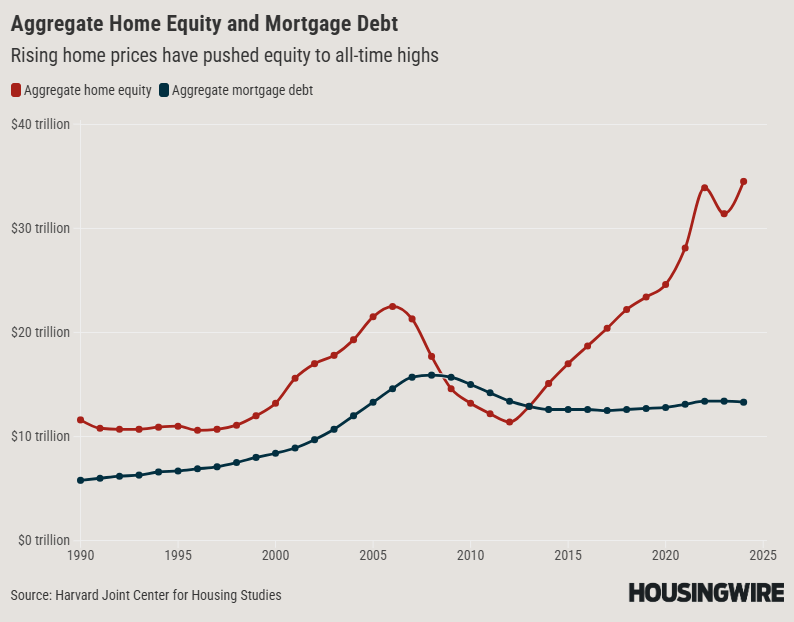

Mortgage delinquencies are rising as homeownership costs pile up

Cotality data from 2025 shows that while serious mortgage delinquencies, defined as homeowners who are 90 days or more past due on a payment, fell steadily for more than three years, the trend reversed in mid-2024. The top three states with the highest year-over-year changes in their serious delinquency rates are Florida, South Carolina and