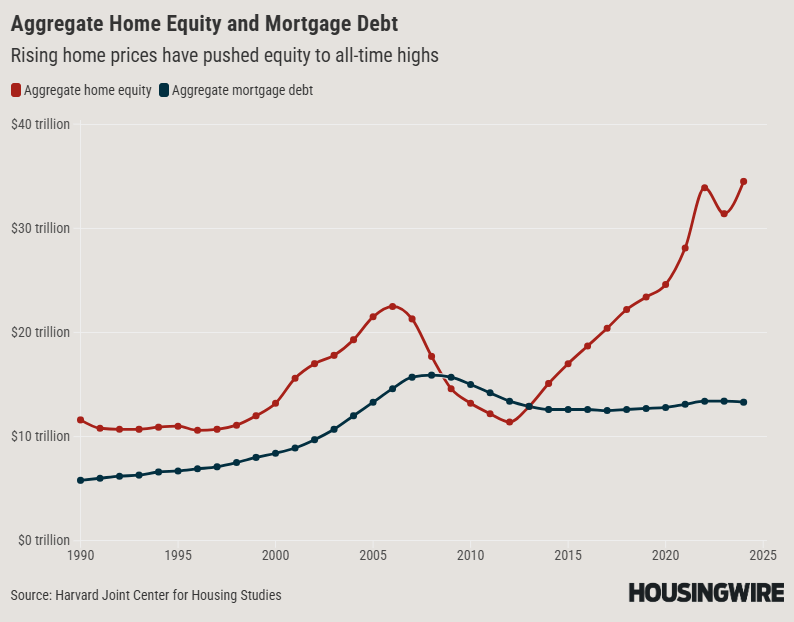

Record-high home equity is an opportunity for reverse mortgages

Along with the rise in equity, total mortgage debt has actually fallen by a marginal amount — from $13.4 trillion in 2012 to $13.3 trillion in 2024. This figure has been relatively flat in the post-pandemic period after rock-bottom mortgage rates helped to keep debt down. This is good news for seniors looking to remodel