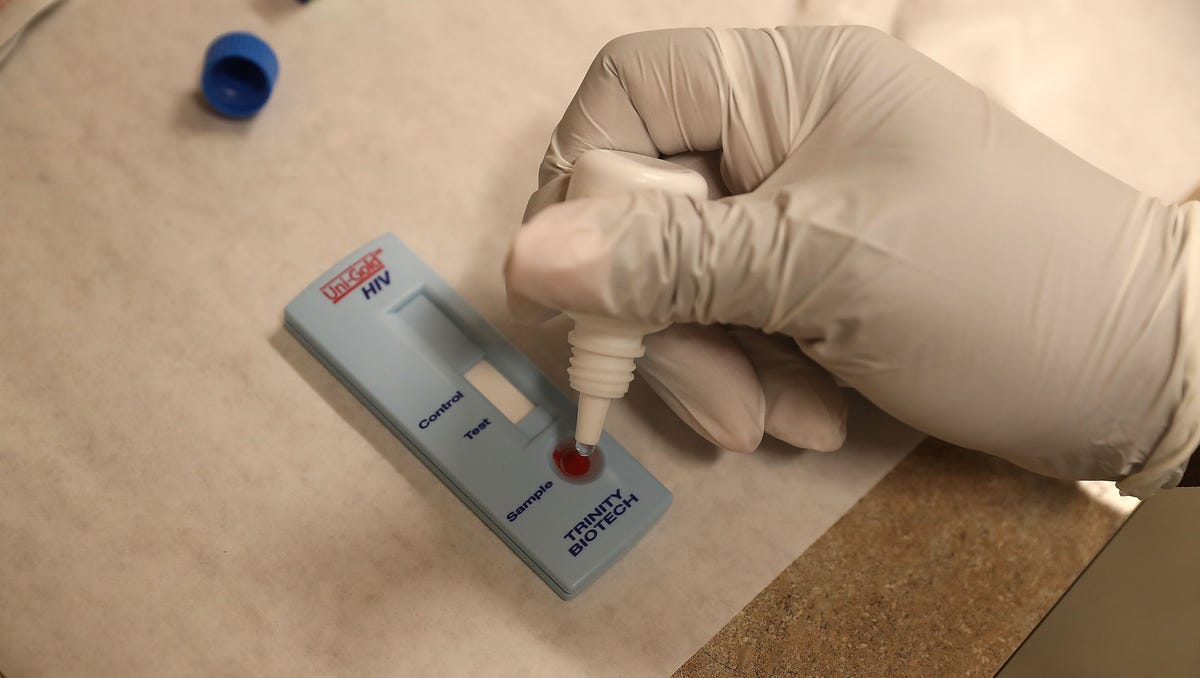

DOGE cuts millions in funds for HIV research at Florida universities

Those working to end the HIV epidemic say this cut in funding will have a ‘devastating impact.’ Protesters against planned National Institutes of Health funding cuts The Trump administration’s push to slash funding at the National Institutes of Health has been temporarily blocked by a federal judge. About $42 million of the terminated grants were