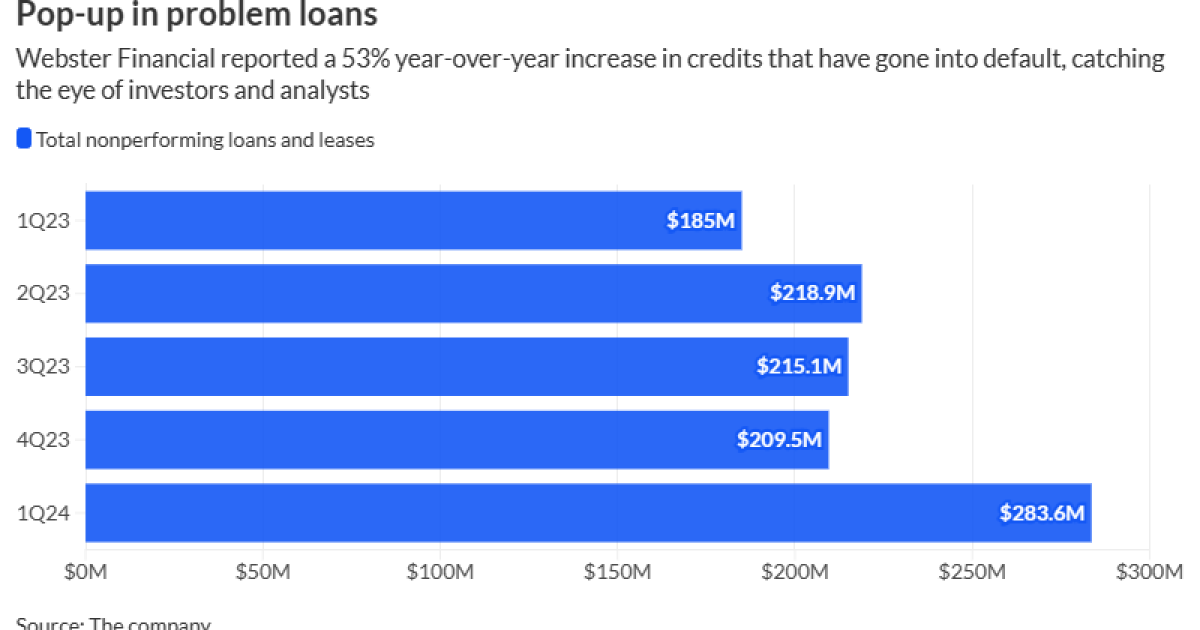

‘Credit darling’ Webster Financial reports uptick in defaulted loans

Webster Financial on Tuesday reported a steep rise in nonperforming loans and leases, but executives said the double-digit increase does not signal widespread credit problems ahead. Instead, the first-quarter surge in default loans and leases — which are up 53% year-over-year — involves just five credits, four in the commercial-and-industrial loan book and one in