Chocolate Finance raises US$15 million; CEO says it may still offer instant withdrawals in future

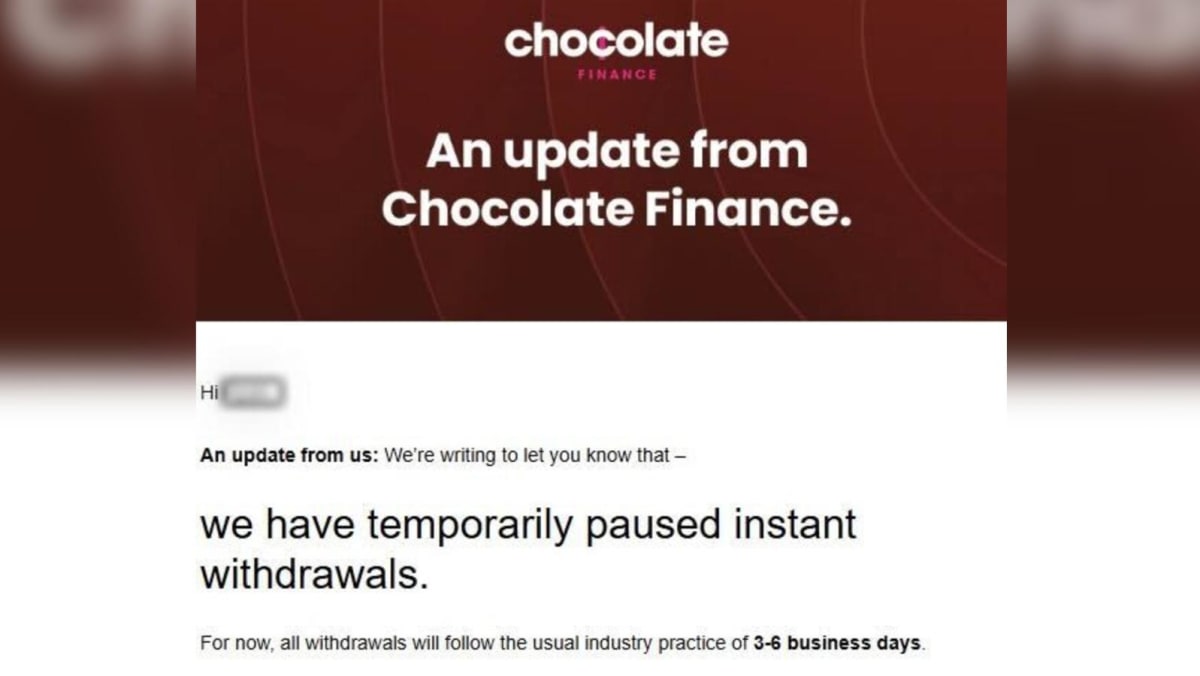

SINGAPORE: Four months after suspending instant withdrawals due to surging demand, Chocolate Finance announced on Thursday (Jul 24) that it has secured US$15 million in fresh funding. The funds were raised from Nikko Asset Management, returning investors Peak XV (previously known as Sequoia Capital India and Southeast Asia), Prosus, Saison Capital and Chocolate Finance’s founder