Okay property owners, get your dukes up. The deadline to fight your property tax appraisal is next week, May 15.

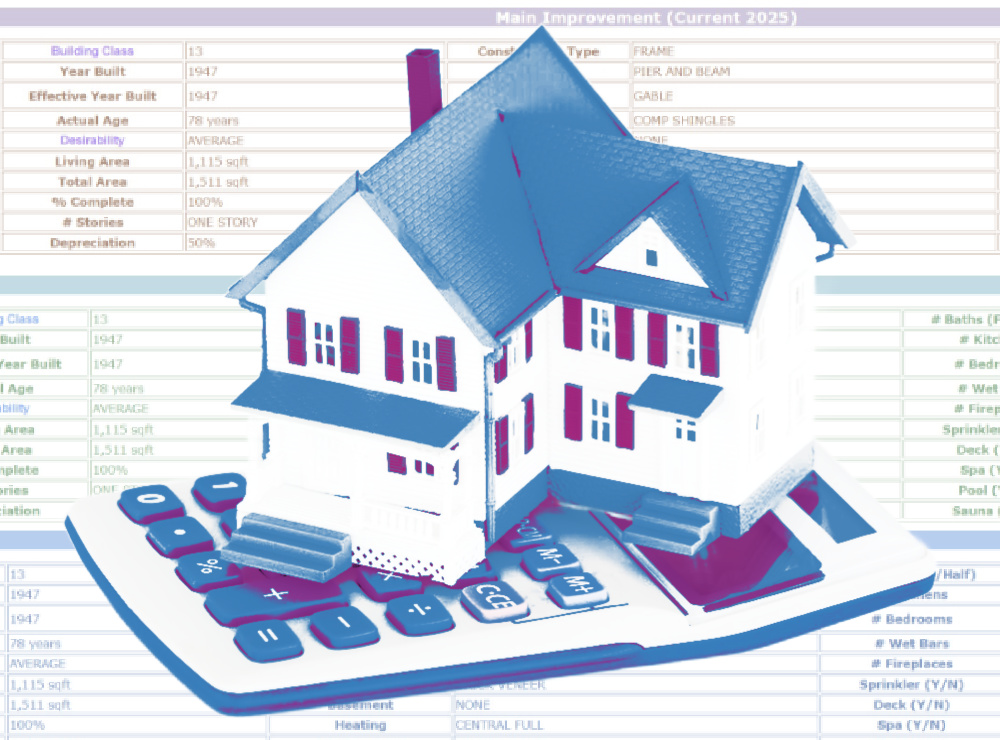

Fighting your property tax technically means filing an intent to protest the value your county appraisal district has assessed. That is how much the appraisal district proposes you would receive for your home if you sold it on Jan. 1, 2025. In this CandysDirt.com series so far, we have shown how to check your appraisal to ensure you have your homestead exemption and any other exemption for which you are eligible. Having all the exemptions that you qualify for will save you thousands of dollars.

Last week, we discussed options for fighting your appraisal — with some public information, you can represent yourself in an appraisal district hearing, or you can hire a property tax agent or firm to represent you in your appeal if you do not have enough time to handle the protest yourself.

Now you are ready to get into the nitty gritty of appealing what the county appraisal district proposes your home’s market value would be.

The Devil Is in the Details

To help discuss some of the best angles of appealing your appraisal, we spoke with Glenn Goodrich, owner of propertytax.io, a property value software and protest service. The best opportunity to successfully reduce your market value is “protesting with a purpose,” Goodrich said.

If your market value increased, Goodrich said property owners should look at what increased the overall market value. The market value consists of the value given to your land and the value given to your home. Those two figures are your market value. While it may be tempting to fight your land value since it will typically be higher, it is not a strategy that works well.

“Appraisal districts look at the total neighborhood land value,” Goodrich said. That means to fight the land appraisal you would have to fight that total neighborhood land value.

“I usually see them increase the land,” he said. “This area is more attractive because prices are driven by the location.” So that leaves your improvement as the best avenue to try to lower your market value and, in turn, lower what you may pay in property taxes.

“If the improvement value goes up, did they change the condition from let’s say Average to Good?” Goodrich said.

To find the condition of your home based on what the appraisal district has estimated, look for the “Desirability” rating on your tax appraisal. There are eight Desirability ratings ranging from Excellent to Average to Undesirable. The higher the rating the more your value will be increased.

“People can disagree with the Desirability rating,” he said. “They can argue that it’s not ‘Good’ because they have a dated kitchen. If they can decrease the condition, that’s a way to get your improvement value down.”

Build Your Case with Photos and Comparisons to Other Homes in Your Neighborhood

You will want to take photos of issues to show the appraiser why the value of your home should be lowered. Getting estimates for repairs along with photos proves to the appraiser that your improvement should be lowered as well as your Desirability rating. Are you having foundation issues? Get an estimate and submit it as part of your case.

Another area in which you can appeal to your appraiser is using the equal and uniform argument, Goodrich said. That argument says your home is being compared to homes that are not the same as yours. Again, you want to look at what the district has under your “Main Improvement” category and compare that with other similar homes.

For instance, if you and your neighbor have the same square footage but they have an extra half bath or a swimming pool or a wood fence as opposed to your chain link fence then those are differences you can point out to the appraiser as to why the improvement value should be lowered.

Goodrich also said property owners should look for homes that are for sale in their neighborhood that are similar to theirs and have not sold.

“The market is not hot” right now, he said. “You want to use listings especially if it’s been on the market for 30 days.” The reasoning is that if the home listed has not sold and the asking price is the same or less than your market value, then you can show how the district has overvalued your property.

Thankfully, the information you need to handle your own protest is right at your fingertips and is a couple of clicks away. You can log on to your respective appraisal district website and see the values of other properties in your neighborhood and compare them with yours. You can also just walk around your home and take photos of issues your home may have.

Reducing your market value may seem nitty gritty and downright daunting, but doing so means you could pay less in property taxes, not only this year but for future appraisals to come.