The Emily Dickinson apartments at 1015 Sherman St. in Cap Hill represent the properties that Cornerstone Apartments manages – older, smaller and urban. (Courtesy Cornerstone Apartments)

Some 10,000 people live in buildings managed by Charlie Hogan’s company, but sometimes he feels like the units don’t exist at all.

In the data, at least.

“There’s a story that isn’t being told on a true average rent in the city of Denver,” said Hogan, who is CEO of property management firm Cornerstone Apartments.

That’s because the roughly 300 buildings his company oversees average just 25 units apiece. The Apartment Association of Metro Denver’s much-cited quarterly survey that calculates the metro’s average rent and vacancy rate doesn’t include buildings with fewer than 50 units.

The apartment association reports the city’s average monthly rent in the first quarter was $1,843. The buildings that Hogan manages, meanwhile, have an average rent of $1,458, he said. Some rent in the $900s.

While Hogan concedes that his smaller buildings probably wouldn’t skew the city-wide average rent too much, he said the issue is that the apartment association survey is widely read by legislators at the state and local level — who in turn make decisions based on it.

“You just really have a tale of two stories in the rental market,” Hogan said.

Charlie Hogan

On the one hand, you have new apartments built in the past 15 years that come with swanky amenities and high rents.

On the other hand, you have buildings that Hogan manages, largely confined to the area between Interstate 70, Sheridan Boulevard, Quebec Street and Dartmouth Avenue, with many in dense neighborhoods like Cap Hill. In addition to being small, his buildings are typically older and lack amenities.

Hogan showed BusinessDen an email in which a city staffer told him that 20% of Denver’s apartments are in buildings with fewer than 50 units — some 32,000 units in total.

“It’s almost like having 32,000 affordable units in the market not being presented,” he said.

Drew Hamrick, general counsel for the apartment association, acknowledged that Hogan’s buildings aren’t surveyed due to their size. But he said including figures from all the smaller buildings don’t change the overall numbers enough to justify the effort.

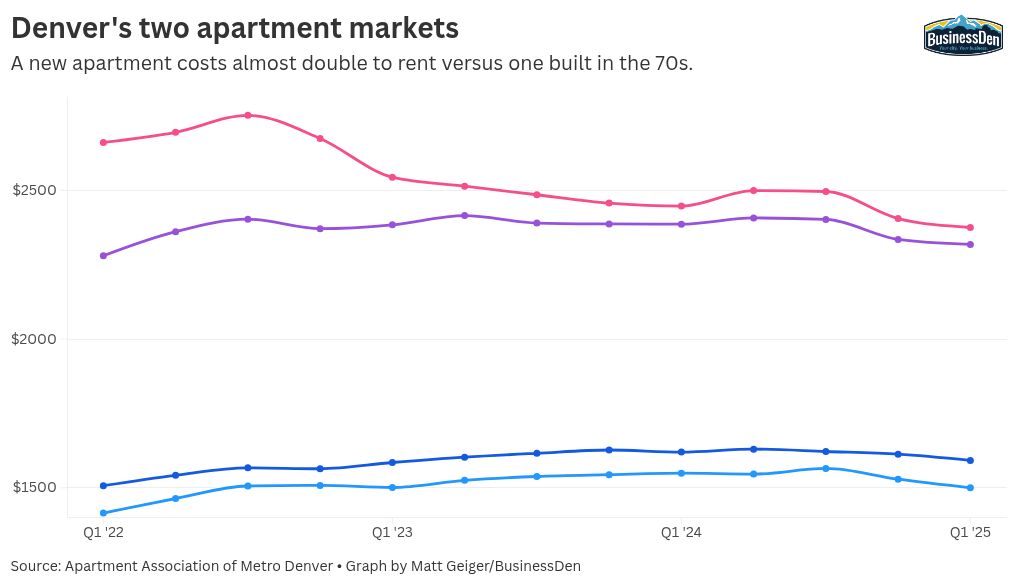

Hamrick noted that the association has begun breaking down rents in its quarterly report by the decade that buildings were constructed. While those figures still only represent buildings with 50 or more units, that breakdown illustrates how older buildings tend to be cheaper.

“He may not track totally what say, the pre-1970s market’s doing, but I guarantee after he looked through two years worth of quarterly reports … the trend would match,” Hamrick said of Hogan’s buildings.

Discussion of the survey’s methodology comes at a bit of an inflection point. In the first quarter, the apartment association found a decline in rents and an increase in vacancy.

In Denver specifically, total vacancy sits at 7.7%, up from a decade-low of 4.6% in the third quarter of 2021. Rents are the lowest since the first quarter of 2022. For properties built before 1970, rents are lower than they’ve been in about two years, with vacancies higher than they’ve been all decade.

One reason for this is the surge of new apartments being completed. The city added 10,544 units last year, more than double the amount built in 2023, per the report.

“There have been a massive number of brand new units dropped on the market. I mean, historic numbers,” Hamrick said. “Certainly last year was an all-time high, but it only narrowly beat out the year before, which was an all-time high up to then, and narrowly beat out the year before, which is an all-time high before then. So, just a tremendous number of new units that’s caused an increase in the vacancy rate, which, of course, then leads to a decrease in the rent rate.”

Hogan said he has just 4% vacancy across his units.

He does see some warning signs on the horizon, though.

The average age of his renters is 29, when it used to be 25. Just 17% of his tenants are coming from out-of-state, an all-time low. Both of those point to a cooling job market, which both Hamrick and Hogan said are important drivers of the multifamily sector.

And with concerns of safety in Denver’s urban core, where much of his product sits, Hogan is stressing that the market may sour further.

“It’s kind of the perfect storm,” he said.