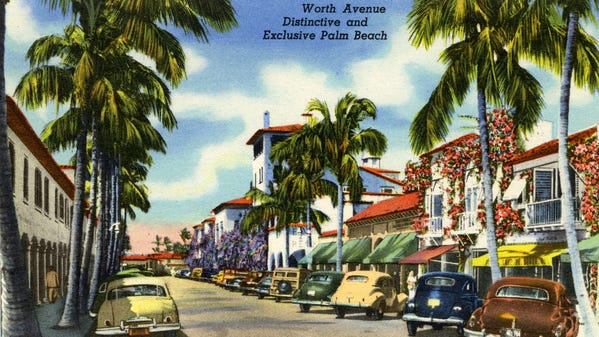

Video: Colorful postcards show Palm Beach in its early years

Postcards from the State Archives of Florida show the island, its people and landmarks, including The Breakers, Mar-a-Lago and Whitehall.

- The council opted against a millage rate reduction due to anticipated capital improvement expenses.

- If the tax rate is approved in September, owners of homesteaded properties would pay the town $79 more per $1 million of taxable value.

- The town’s proposed budget for the next fiscal year includes $7.9 million in major spending increases.

The Palm Beach Town Council opted to maintain the town’s current property tax rate during a budget workshop July 10 at Town Hall.

Citing concerns over funding for future capital improvement projects and unpredictable events such as hurricanes, council members voted to maintain the current millage rate instead of reducing it for the next fiscal year starting Oct. 1.

This year’s property tax rate is $2.61 per $1,000 of taxable value. Under that rate, property tax revenue would increase by $6.1 million to $85.8 million, driven by a 7.5% percent average increase in taxable property values on the island, according to a preliminary estimate from Palm Beach County Property Appraiser Dorothy Jacks’ office.

A proposal presented by Town Manager Kirk Blouin at the workshop would have lowered the rate to $2.53 as part of a proposed $124.7 million budget.

Council members considered the proposal before following Mayor Danielle Moore’s lead and voting unanimously to maintain the current tax rate for the 2025-26 fiscal year. Formal adoption of the millage rate is scheduled for September.

Moore voiced concerns about the cost of expensive capital improvement projects that need to be completed in coming years, especially the planned replacement of the aging seawall at Midtown Municipal Beach. That project, which is expected to be included in the 2026-27 fiscal year budget, carries an estimated $24 million price tag, said Bob Miracle, the town’s deputy town manager for finance and administration.

Moore warned the cost could go much higher, citing the recently completed North Fire Station as an example. Though the original estimate was $5.5 million, the project’s total cost ballooned to $17 million.

“That seawall could go from 24 million dollars to 30 million dollars in a heartbeat,” Moore said. “Then all of a sudden we have to take the millage rate and spike it in order to cover that. My feeling is that I’d rather be consistent. I think the taxpayers prefer consistency rather than all of a sudden getting a tax bill next year and having it go up four or five thousand dollars, and having them be stunned.”

If council members opt to keep the current rate in place when they vote in September, the owners of homesteaded properties would pay the town $79 more per $1 million of taxable value, Miracle said. Non-homesteaded property owners would pay $206 more per $1 million based on the 10% cap, as defined by state law.

Roughly 17 cents of every property tax dollar paid by property owners on the island goes to the town, according to town documents, with the rest distributed to Palm Beach County, the Palm Beach County School District, and other taxing districts. Maintaining the current property tax rate rather than lowering it would generate an additional $2.6 million for the town, Miracle said.

Council Member Julie Araskog said the extra money could be used as a buffer in the event of emergencies such as extreme weather.

Earlier in the workshop, Miracle noted that starting next year, the Federal Emergency Management Agency will no longer provide direct support to state and local governments during storm season.

“I think we do need a cushion,” Araskog said. “I think there are a lot of unknowns right now. We obviously always have an unknown with hurricane season.”

With the additional money generated by maintaining the millage rate, the proposed budget for the next fiscal year would rise slightly to $127.3 million. That figure represents a 6.88% increase from the current fiscal year’s $119.1 million budget.

It includes $7.9 million in major spending increases, with $1.4 million of that earmarked for employee pay increases and for 13 additional employee positions.

The new positions include four police officers and two police service aides to address safety and traffic concerns; a fitness supervisor in the Recreation Department; a deputy town engineer and a maintenance coordinator in the Public Works Department; and a project engineer in the Planning, Zoning and Building Department.

Additional new roles include two park attendants, a crew foreman, a police officer, and a part-time parking enforcement officer, all of whom would be assigned to Phipps Ocean Park once renovations are finished around November 2026.

“I believe the Phipps Park project is going to be a great success, and for good or bad it’s going to attract a lot of new visitors,” Town Manager Kirk Blouin told council members. “With new visitors, there will be an increase in parking revenues that I believe will offset any of these new positions that we’re adding to the budget.”

The employee pay increases include merit and step increases, market adjustments for police and firefighters, and a 2.6% cost-of-living adjustment for inflation in the regional market, the town said.

Additional spending increases include $1.6 million for an increase in obligations to the retirement program; $2.4 million for employee benefits; $1.9 million for contractual costs; and $600,000 in additional transfer costs to the coastal fund.

The proposed budget and tax rate will be finalized at two state-required public hearings, which are tentatively set for Sept. 8 and Sept. 18.

Jodie Wagner is a journalist at the Palm Beach Daily News, part of the USA TODAY Florida Network. You can reach her at jwagner@pbdailynews.com.