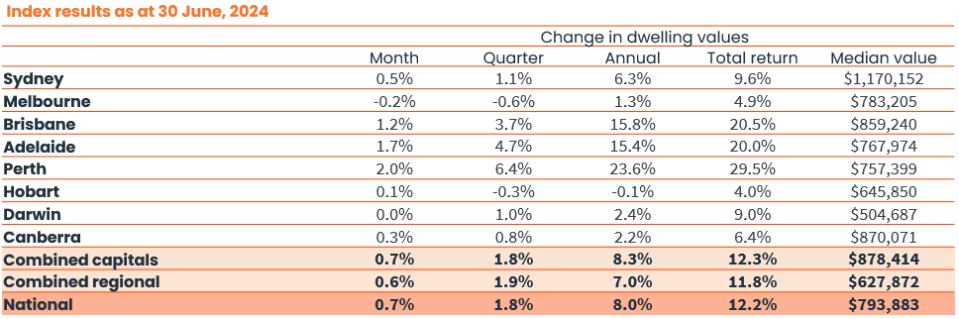

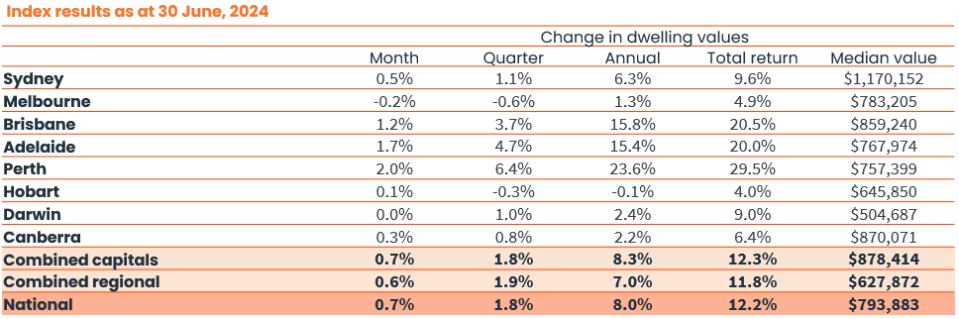

Property prices soared by 8 per cent nationwide last financial year, new data has revealed. This delivered a whopping $59,000 windfall to the average Aussie property owner.

CoreLogic’s latest Home Value Index (HVI) showed values increased 0.7 per cent in June, taking the average cost of a home to a record high of $794,000. Most regions are trending higher in value, with only Melbourne and regional Victoria dipping during the month, falling 0.2 and 0.3 per cent respectively.

Sydney home prices have hit a record high with values increasing 6.3 per cent annually to reach $1,170,152. Brisbane prices have increased a whopping 15.8 per cent annually to hit $859,240, while Melbourne prices have increased a more modest 1.3 per cent during the financial year to reach $783,205.

RELATED

CoreLogic research director Tim Lawless said prices had been rising between 0.5 to 0.8 per cent month on month since February.

“The persistent growth comes despite an array of downside risks including high rates, cost of living pressures, affordability challenges and tight credit policy,” Lawless said.

“The housing market resilience comes back to tight supply levels which are keeping upwards pressure on values.”

Do you have a story to share? Contact tamika.seeto@yahooinc.com

AMP chief economist Shane Oliver said higher for longer interest rates continued to be a key constraint on the property market and a source of downside risk.

“The big negative influence on the property market remains poor and still worsening affordability and high mortgage stress on the back of high prices, high debt levels and high mortgage rates,” Elliot said.

“Thanks to the surge in interest rates and average home prices there is now a wide divergence between buyers’ capacity to pay for a property and current home prices.”

Where are prices rising the most?

Mid-sized capitals have been recording the biggest price gains, with Perth leading the way with an increase of 23.6 per cent over the year, making home owners $144,768 wealthier.

Brisbane values were up 15.8 per cent annually, adding $117,061 to values. Adelaide property values increased by 15.4 per cent, adding $102,719 to median values.

These cities have also been experiencing chronic shortages in the number of homes available for sale, CoreLogic found. Perth listings were 47 per cent lower than the five-year average and 23 per cent lower than the same time last year, while Adelaide recorded a 43 per cent drop and Brisbane a 34 per cent fall.

In comparison, Melbourne listings have increased to 14 per cent above the five-year average.

Top 10 suburbs in Australia

The top 10 regions across the capital cities that recorded the biggest price increases last year were all located in Greater Perth. They were:

-

Kwinana – $618,925, up 33.2 per cent

-

Armadale – $678,832, up 32.3 per cent

-

Gosnells – $677,844, up 30.4 per cent

-

Rockingham – $698,767, 28.4 per cent

-

Mandurah – $671,834, 27.8 per cent

-

Canning – $847,807, 27.8 per cent

-

Cockburn – $814,853, 27.6 per cent

-

Swan – $684,616 – 27.2 per cent

-

Wanneroo – $719,832, 27.0 per cent

-

Serpentine – Jarrahdale – $700,548 – 26 per cent

Get the latest Yahoo Finance news – follow us on Facebook, LinkedIn and Instagram.