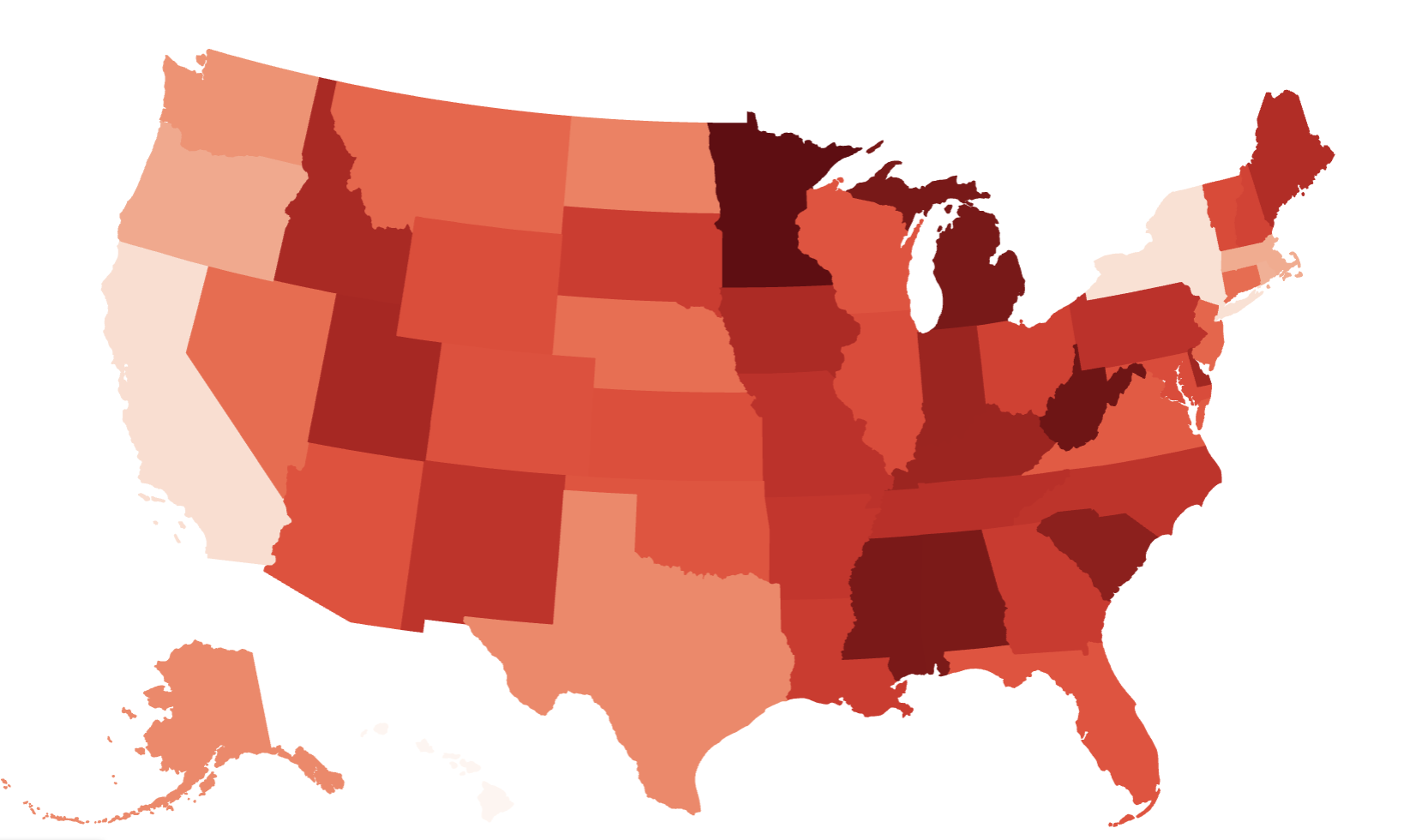

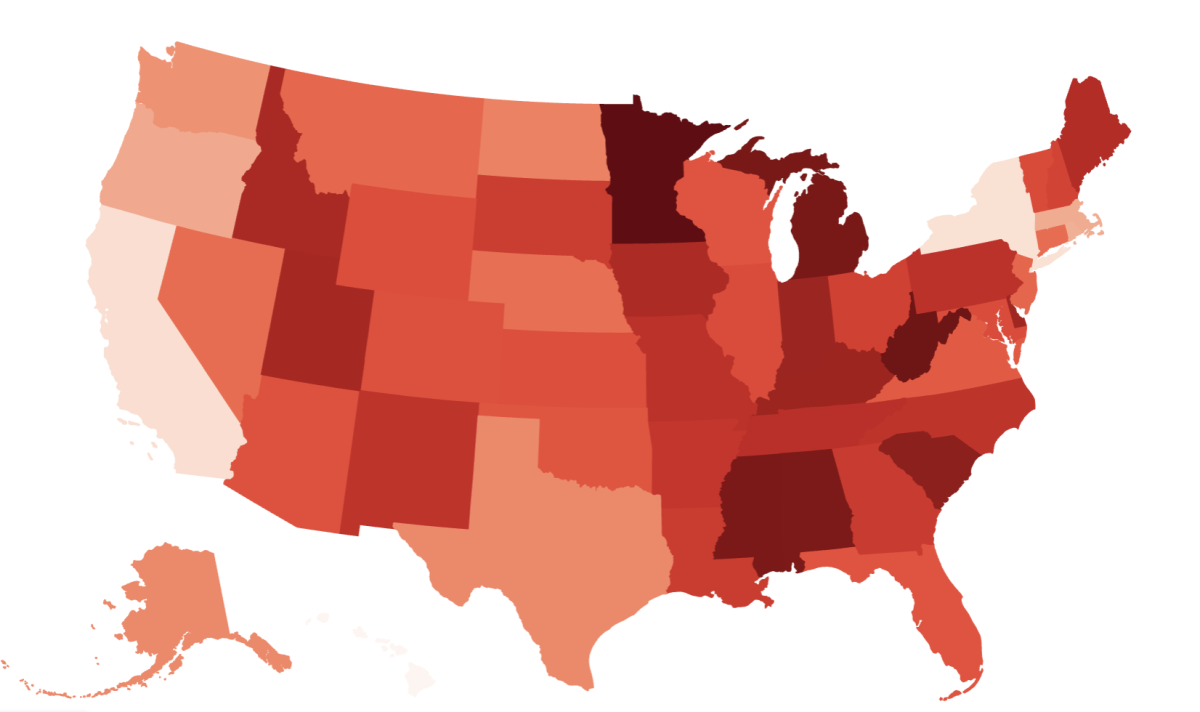

Minnesota has the highest rate of young homeowners in the entire nation, according to a new study by property management company Evernest, with 50.8 of adults under the age of 35 in the state owning a property.

It is currently the only state in the country where homeownership among young millennials and Gen Zers reaches over the 50 percent mark, thanks to its relatively low home prices and high salaries for young people.

Why It Matters

Low inventory and skyrocketing home prices during the pandemic homebuying frenzy have pushed many aspiring homebuyers in the U.S. to the sidelines of the market. First-time homebuyers in particular, a majority of which are normally young people, have struggled to get on the property ladder due to rising costs and historically high mortgage rates.

But even in the midst of a nationwide housing affordability crisis, some states have fared and are faring better than others. Evernest’s study shows that some of the states that escaped the pandemic boom have remained more affordable, especially for young buyers, though the dream of homeownership cannot be achieved without the support of a decent salary.

What To Know

Minnesota was also ranked by Evernest as the number one state where young Americans would want to buy property based on average young adult income (25-44), home prices, and the number of homes with a mortgage. The state got a ranking of 92.7 percent out of 100, boosted by an average salary for young people of $94.8k.

These are the best 10 states for young homeowners according to Evernest’s ranking:

- Minnesota (homeownership rate: 50.8 percent; average young adult income: $94.8k; final score: 92.7)

- Michigan (homeownership rate: 49.1 percent; average young adult income: $65.6k; final score: 83.6)

- Alabama (homeownership rate: 50.8 percent; average young adult income: $94.8k; final score: 79.8)

- Indiana (homeownership rate: 47 percent; average young adult income: $76.7k; final score: 79.7)

- Utah (homeownership rate: 46.1 percent; average young adult income: $95.2k; final score: 78.9)

- West Virginia (homeownership rate: 49.9 percent; average young adult income: $64.7k; final score: 78.8)

- Delaware (homeownership rate: 46.5 percent; average young adult income: $90.1k; final score: 78.6)

- South Carolina (homeownership rate: 48 percent; average young adult income: $72k; final score: 77.6)

- Mississippi (homeownership rate: 49.2 percent; average young adult income: $58.6k; final score: 76.7)

- Kentucky (homeownership rate: 46.9 percent; average young adult income: $69k; final score: 75.7)

What People Are Saying

Spencer Sutton, VP of Marketing at Evernest, said in a press release: “The emergence of non-coastal states like Minnesota as homeownership hubs for millennials and Gen Z signals a significant demographic shift. With over half of Minnesotans under 35 achieving homeownership—nearly double the rate in high-cost coastal markets—we’re witnessing young Americans prioritize financial stability and space over traditional urban amenities.”

He added: “This trend correlates strongly with remote work adoption, which has freed younger buyers to seek both affordability and quality of life factors like education and healthcare access.”

Hannah Jones, senior economic research analyst at Realtor.com, said in a recent report commenting on the study: “Minnesota homes tend to be priced lower than the national norm, making the market more approachable for young homebuyers. The Twin Cities [Minneapolis and St. Paul] area attracts young homebuyers who are looking for relative affordability without sacrificing job opportunities.”

She added: “Affordable, abundant housing options are important to attract and retain young homebuyers. As the housing market has gotten vastly less affordable over the last five-plus years, locales that offer an affordable cost of living relative to local incomes, as well as ample housing inventory, are able to attract and retain investment from young homebuyers.”

What Happens Next

While mortgage rates would need to come down to really improve affordability in the U.S. housing market (and are not expected to do through either 2025 or 2026), other factors are making it more favorable to buyers.

Inventory is rising across the country, though the shortage remains acute in the Northeast, giving prospective buyers more options and more negotiating powers. In parts of the country where it has grown the most—in Florida and Texas, for example—home prices are already falling in many cities.

Evernest