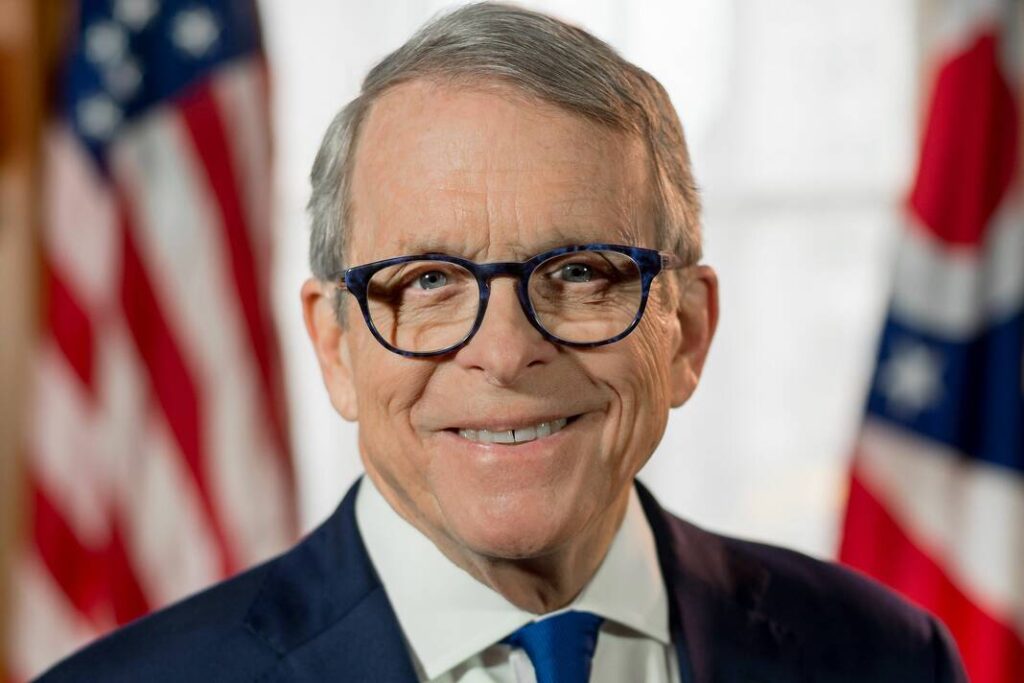

DeWine

By Anna Staver

cleveland.com (TNS)

COLUMBUS — Gov. Mike DeWine’s new property tax reform group hasn’t held its first meeting, but it’s already drawing criticism from conservative groups and some Republican lawmakers who say it’s missing key perspectives.

“What it’s lacking is policy think tanks who work on this stuff,” said Donovan O’Neil, Ohio state director for Americans for Prosperity. “Where are the Ohio Realtors who have been on the front lines of rising home prices? Where is the [Ohio Chamber of Commerce]? Where is the voice of the taxpayer on this? Where is a group or a set of citizens who can weigh in on behalf of the taxpayer?”

The 11-member panel includes former lawmakers, county auditors, and local officials — but no one currently serving in the General Assembly. It includes Allen County Treasurer Krista Bohn.

“I would have loved to be on it,” said Sen. Bill Blessing, a Hamilton County Republican who’s pushed for property tax reform. “Obviously, that ship has sailed.”

There are no representatives from Ohio’s largest cities or urban school districts either. The governor’s office hasn’t explained the reasoning, but funding data may offer a clue.

Urban districts generally rely less on property taxes than their suburban and rural counterparts. According to data from the Ohio Department of Education and Workforce, Cleveland Municipal Schools receives 31% of its funding from local property taxes.

Dublin City Schools — whose superintendent is on the work group — gets about 75% of its budget from local dollars. The rest comes from the state and federal government.

The same pattern plays out in city government. Large cities often depend on municipal income taxes to fund services, while townships — unable to levy income taxes at all — lean heavily on property taxes to pay for roads, and safety services.

Lake County Auditor Chris Galloway, one of the Property Tax Reform Working Group members, acknowledged the political and policy hurdles ahead.

Asked whether the group can succeed where others have failed, he replied: “I think you can tell from my stammering that’s the challenge.”

Galloway said the governor needs to be clear about what’s on or off the table: What would DeWine veto? What would Ohio’s GOP supermajority never take up?

In 2024, lawmakers formed their own property tax study committee, co-chaired by Summit County Republican Rep. Bill Roemer. That group held eight hearings and produced 21 recommendations, many of which have since been introduced as bills in the legislature.

Roemer said he wasn’t asked to join the governor’s work group.

“The one thing I noticed also is there are no taxpayers,” Roemer said. “It’s great to have a very broad spectrum of people represented, but no one who is a direct taxpayer is represented.”

House Speaker Matt Huffman, a Lima Republican, questioned what exactly the group is meant to accomplish.

He said he was told by co-chair Pat Tiberi that the goal is to come up with a plan that local governments would accept. But Huffman warned that if the solution involves less money for them, “they’re not going to be satisfied with that.”

“If the question is, ‘find the best plan that local governments will comply with,’ well, we have that now,” Huffman said, referencing the budget provisions DeWine vetoed. “We’ll see what they say.”