Properties identified as being high risk could face stricter insurance and building requirements.

Roughly 2,500 properties in Santa Rosa have been identified as facing higher risk of flooding, according to newly released government maps, meaning property owners could face stricter insurance and other requirements.

The Federal Emergency Management Agency, in collaboration with Santa Rosa, Sonoma County and Sonoma Water, has been studying flood hazards in the Santa Rosa Creek watershed since 2023.

The maps are used to determine the flood risk and insurance requirements of residential, commercial and undeveloped properties and the maps must be adopted by local jurisdictions to participate in the National Flood Insurance Program.

FEMA’s release of the preliminary maps kicks off a public process where property owners can appeal the designation. More information about the appeal process is expected to be available later this year.

The federal agency mapped about 2,500 properties in Santa Rosa as being in a high-risk flood zone.

The included properties have a 1-in-4 chance of flooding over a 30-year period, according to the city.

It wasn’t immediately clear how many of the impacted properties saw their designation change with the latest mapping effort.

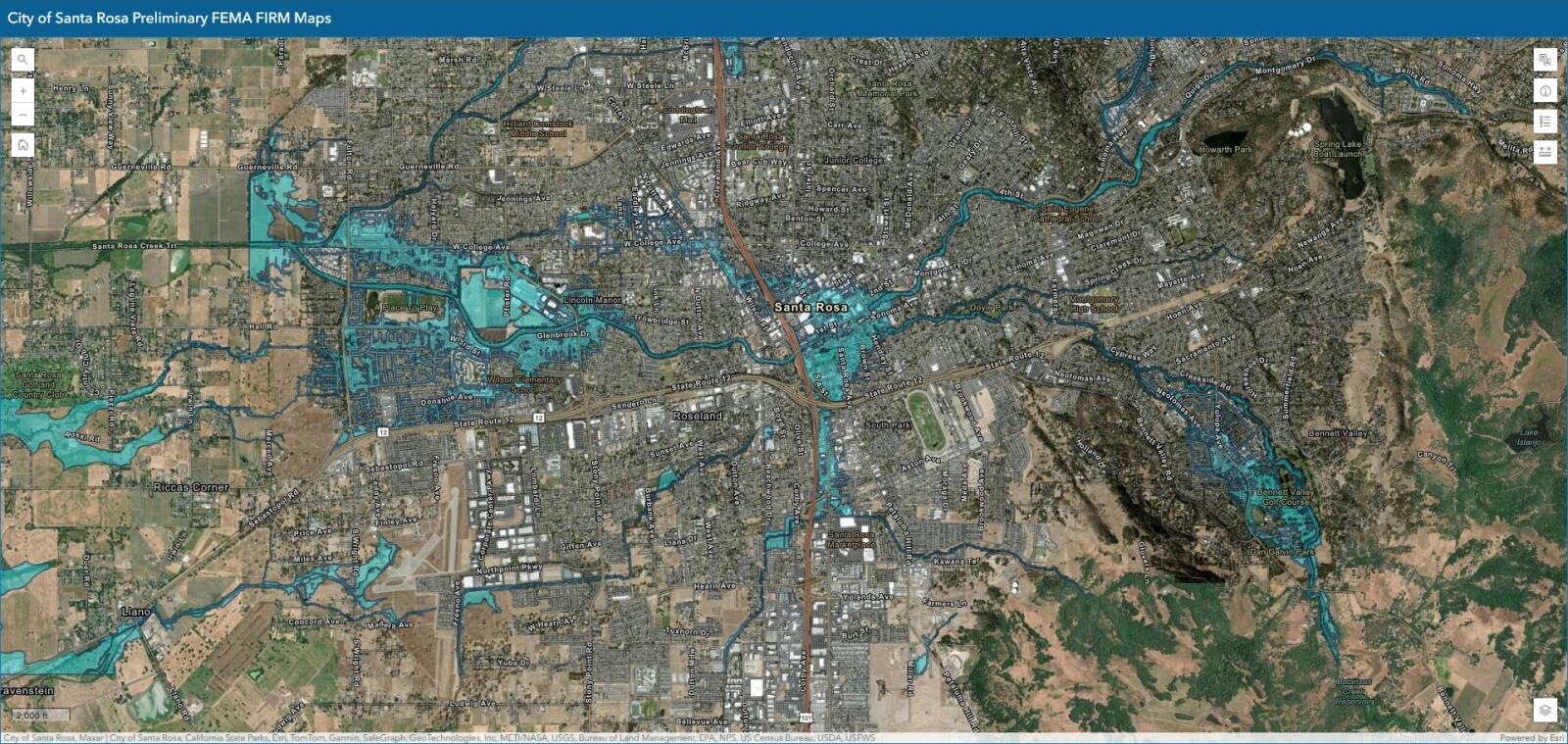

Hazardous areas spanned downtown Santa Rosa, including City Hall, and the neighborhoods surrounding Juilliard Park and a large swath of west Santa Rosa, west of Stony Point Road between Piner Creek and Highway 12.

The commercial area between Highway 101 and Santa Rosa Avenue between Highway 12 and Colgan Creek also was at increased risk of flooding as was the city-owned Bennett Valley Golf Course and the residential and commercial area straddling Yulupa Avenue near the course.

Check if your property is in a high-risk flood zone by searching your address on the city’s hazard map.

Flannery Banks, a supervising engineer with the planning department’s engineering division, said such assessment can help planning officials develop strategies to improve community resiliency during natural disasters and help residents and businesses better protect their properties.

Properties within the flood risk zone, particularly those with a federally backed mortgage, may be required to obtain flood insurance.

Most standard homeowners and renters’ insurance policies don’t cover flood damage, but insurance is available through the National Flood Insurance Program and private insurers, according to the city.

Stricter building regulations, such as anchoring buildings to reduce the chance of them being swept away in heavy rains and other measures to reduce flood damage, also are required for new development and substantial improvements within the high-risk zone.

FEMA is anticipated to open a 90-day public appeal and comment period in the winter where property owners can formally challenge the flood zone designation but they must provide scientific or technical data to back up their request.

After the appeal period has closed, the federal agency will review comments to determine if changes are needed before adopting the final maps.

The new maps — and insurance and other requirements for impacted properties — are expected to take effect in spring 2027.

FEMA and the National Flood Insurance Program are hosting a joint virtual community meeting with Santa Rosa and Sonoma County officials 6 p.m. Sept. 10 to go over the new flood maps and answer questions prior to the public comment period kicking off.

You can reach Staff Writer Paulina Pineda at 707-521-5268 or paulina.pineda@pressdemocrat.com. On X (Twitter) @paulinapineda22.