Cook County is saddled with a “broken system” of property tax appeals that gives breaks to business owners and wealthy white homeowners — while shifting nearly $2 billion of tax burden to the lowest income homeowners, according to a report released Monday by Cook County Treasurer Maria Pappas.

Businesses landed $25.5 billion in property valuation reductions through appeals, leading to $3.26 billion less on their tax bills, according to the report. Homeowners saw just $2.8 billion in assessment reductions, but had an additional $1.9 billion added to their tax bills.

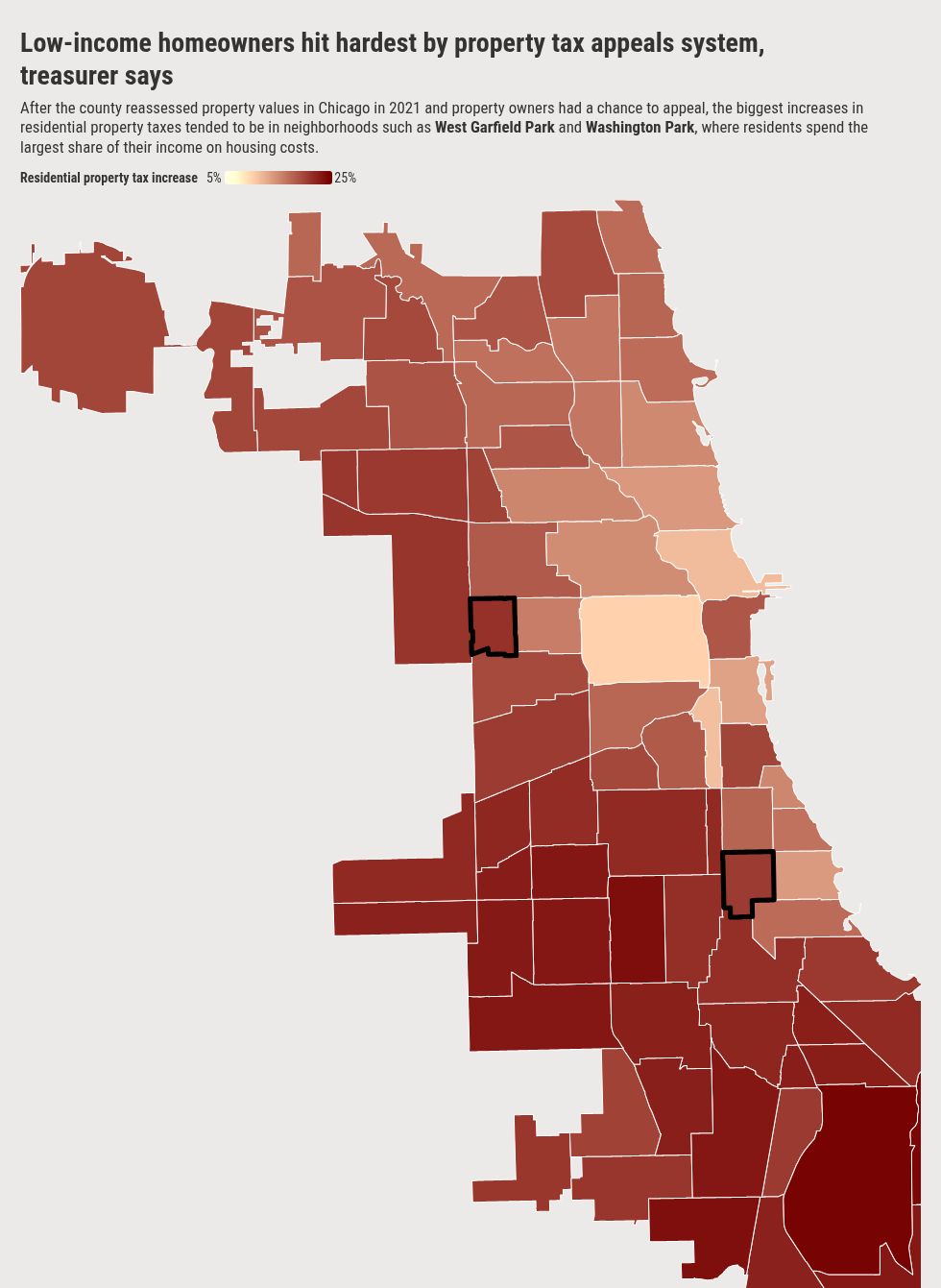

Chicago had some of the worst disparities in Cook County. Businesses’ tax bills dropped nearly 20% while residential bills increased by more than 16% during the 2021 to 2023 reassessment cycle. More than 250,000 households saw tax bills jump 25% or more in the same period, according to recently published data from the Cook County assessor’s office.

“[The county’s assessment appeal system] financially rewards business owners, while, in many cases, punishing lower-income, Black and Latino homeowners,” the report states. “And at the same time favors wealthier white homeowners.”

Overall, county households making less than $50,000 a year saw their tax bills jump an average of nearly 10%, compared to half that for those making more than $150,000 annually between 2021 and 2023.

South Deering, the East Side and West Englewood saw some of the biggest increases — between 20 and 25% — after the appeals process. West Garfield Park and Washington Park, neighborhoods where residents spend the largest share of their income on housing citywide, saw similar increases.

Meanwhile the Near West Side and Near North Side saw some of the lowest property tax increases in the same period, all around 10%, despite having median household incomes four times higher than those seeing their bills jump up twice as much.

Overall, Latino homeowners were hit hardest, though minority homeowners across the board saw their tax bills jump at least 2% more on average.

“While successful appeals by businesses have further shifted the tax burden onto homeowners, that burden has not been shared equally,” the report said.

About 64% of businesses filed appeals between 2021 and 2023 compared to 27% of homeowners, and nearly half of businesses filed one annually while most homeowners only appealed once, according to the report.

However, households in lower income areas that appealed saw an average of 7.3% increases to their bills compared to 5.2% in higher-income neighborhoods. Areas with median incomes, between $75,000 and $99,999, saw the largest increase at 8%.

“Low-income homeowners experienced significant shifts in the property tax burden due to appeals,” Christian Belanger, spokesperson for Cook County Assessor Fritz Kaegi wrote in a statement Friday. “This was because big businesses received outsized reductions from the Cook County Board of Review.”

Board of Review Commissioner George Cardenas denied that claim, saying the issue was with inaccurate initial assessments that were fixed when property owners appealed. Those property owners tended to be business owners or wealthy white homeowners.

Still, filing an appeal is the key to lower tax bills until the system sees some reforms, according to Cardenas, who said his agency is the “only friend of the taxpayer.” Bloated tax-increment financing ( TIF) districts and inaccurate initial assessments are the problem, Cardenas said, , suggesting that one solution lies in government spending cutbacks to reduce tax levies.

“It isn’t the Board of Review, it’s the system,” Cardenas said Saturday. “It’s the perfect storm… People should be appealing more.”

Kaegi’s office says it has already started sharing more information with the Board of Review — including vacancy and business cost records — and is hoping for the same in return, while also making bids to get access to a federal appraisals database that Belanger said could make initial assessments more accurate.

Board of Review Commissioner Samantha Steele said generally there’s more data available for residential buildings because sales are more comparable and frequent, meaning residential assessments are generally more accurate and require less appeals. That could explain why fewer homeowners are appealing.

“We now share data that allows us to make better decisions, and that wasn’t happening before,” Cardenas said.

Legislative solutions, however, are where the agencies find the most common ground.

A “circuit breaker” law laid out in one bill currently proposed in the Illinois Senate would grant up to $5,000 in property tax relief for residents in properties valued below $350,000 and making less than the state median adjusted gross income. A similar bill is in the Illinois House, but neither has made significant progress since being introduced earlier this year.

“The system is stacked against the homeowner,” Cardenas said. “Circuit breakers are a solution.”