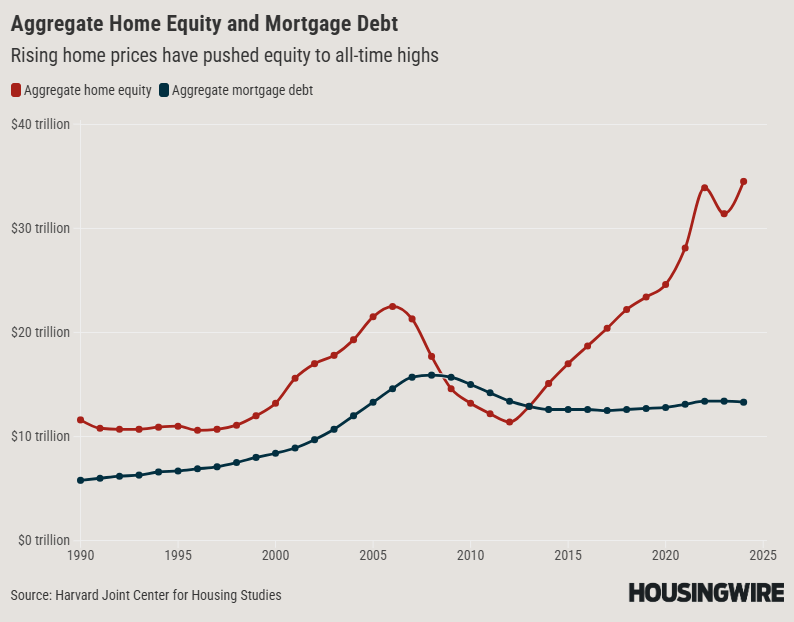

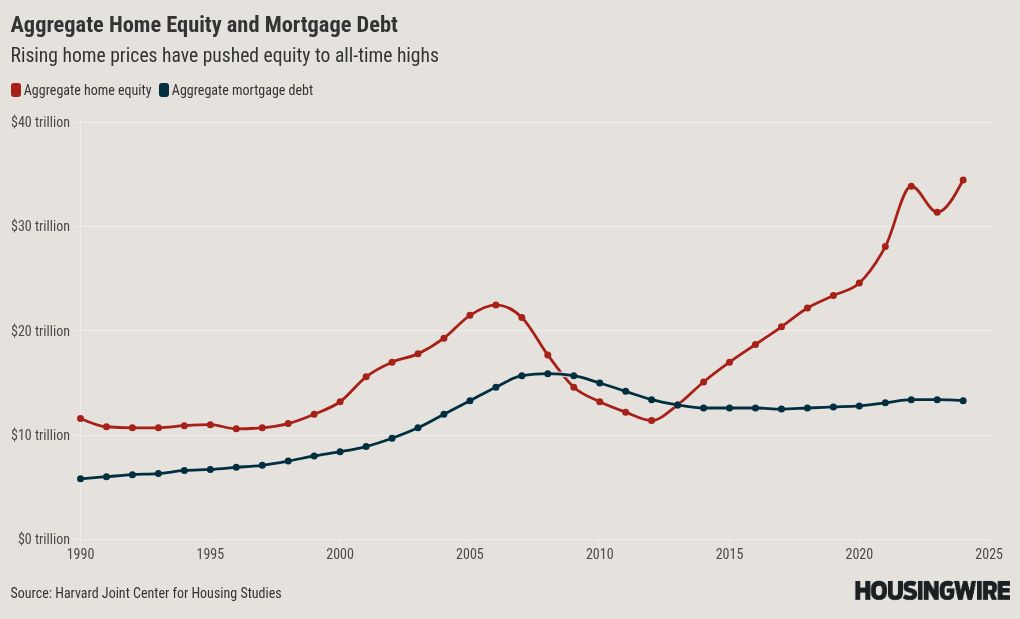

Along with the rise in equity, total mortgage debt has actually fallen by a marginal amount — from $13.4 trillion in 2012 to $13.3 trillion in 2024. This figure has been relatively flat in the post-pandemic period after rock-bottom mortgage rates helped to keep debt down.

This is good news for seniors looking to remodel their homes for aging in place, including those considering a reverse mortgage for such a purpose. It’s more expensive for people to refinance now given that current rates are more than double what some people previously obtained.

Dan McCue, a researcher with JCHS, said that record-high home equity has uneven benefits on the housing market overall.

“The good part is obviously that a lot of households are gaining a lot of wealth,” he said. “But there’s a low incentive to refinance and cash out some of that equity. That’s keeping debt low, but it’s also slowing down markets. It’s a sign that a lot of people are holding on to equity that’s a result of high house price gains and low mortgage rates.”

The performance of the reverse mortgage industry reflects the opportunity provided by record home equity, despite macroeconomic headwinds that are negatively impacting so much in and around the housing market.

Home Equity Conversion Mortgage (HECM) endorsements dropped by only 1% in May to 2,296 loans, while HECM-backed Securities (HMBS) issuance increased slightly by $9 million.

“My hypothesis is that we’re basically at a place where home values have gone up so much that even with interest rates restricting the principal limits these past few months, this is still a compelling option for the core HECM borrower profile,” John Lunde, the president of Reverse Market Insight, previously told HousingWire.