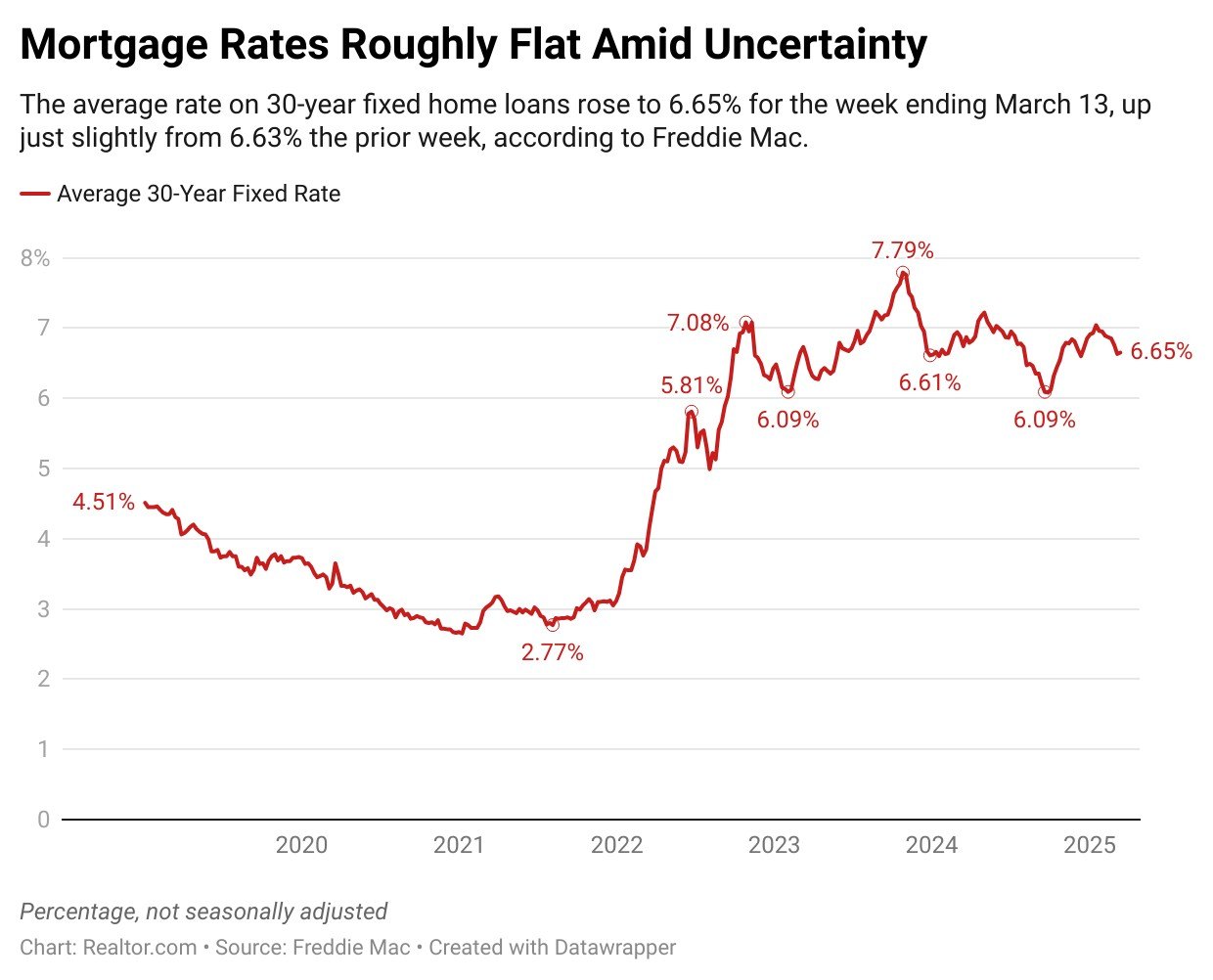

Mortgage rates rose slightly this week, as President Donald Trump‘s tariff agenda drove economic uncertainty and volatility in financial markets.

The average rate on 30-year fixed home loans rose slightly to 6.65% for the week ending March 13, up just slightly from 6.63% the prior week, according to Freddie Mac. Rates averaged 6.74% a year ago.

Article continues below this ad

The uptick this week breaks a seven-week streak of falling rates, which have nevertheless remained in a relatively narrow range after peaking just above 7% in the middle of January.

“Despite volatility in the markets, the 30-year fixed-rate mortgage remained essentially flat from last week,” said Sam Khater, Freddie Mac’s chief economist. “Mortgage rates continue to be relatively low versus the last few months, and homebuyers have responded.”

Khater said purchase applications were up 5% this week compared with a year ago, as modestly lower rates and dramatically improving inventory drew more house hunters into the market at the start of the crucial spring homebuying season.

Article continues below this ad

Uncertainty leaves rates stuck in a tight range

The uptick in mortgage rates follows a week of trade policy drama that has increased economic uncertainty and sparked growing fears of a recession.

Trump last week imposed, and then largely suspended, tariffs on Canada and Mexico, the two largest U.S. trading partners. This week, he announced new 50% tariffs on Canadian steel and 200% tariffs on European wine, both in retaliation for new tariffs on U.S. exports.

A significant sell-off in the stock market on Monday failed to drive bond prices much higher this week, which would have lowered long-term borrowing rates.

Article continues below this ad

Mortgage rates are now caught in the middle of two investor fears: first, that tariffs will drive inflation higher, which would also send lending rates higher, and second, that the economy will tip into recession, which would send rates lower.

Meanwhile, the Federal Reserve is expected to remain on the sidelines at its policy meeting next week, continuing to leave its short-term benchmark rate unchanged.

MORE FROM REALTOR:

Article continues below this ad

“We do not anticipate major or immediate policy changes from the Federal Reserve, which is taking a cautious approach to rate cutting, but slowing inflation gives the central bank more leeway to allow rates to fall,” says Realtor.com® senior economist Joel Berner.

“This is jeopardized, of course, by the ever-changing landscape of trade policy, with the Trump administration frequently announcing, rescinding, and reinstating new tariffs.”

Article continues below this ad

Price reductions rise as sellers try to woo buyers

The Realtor.com economic research team’s weekly housing market update shows that for the week ending March 8, the share of homes with a price reduction increased by 0.8 percentage points compared with a year ago, suggesting more sellers are adjusting prices to attract buyers.

The median list price of homes on the market was also down 0.2% from the same week last year, marking the 41st straight week of listing prices that are falling or flat on an annual basis.

“While the price drop remains moderate, it signals a continuation of the trend toward a more balanced market,” says Realtor.com senior economic research analyst Hannah Jones.

Article continues below this ad

Controlling for the size of home, the median list price per square foot increased by 1.2% annually, suggesting the typical size of homes on the market is shrinking.

Rising inventory gives buyers more options

The number of newly listed homes hitting the market this week rose 8.3% from last year, signaling that sellers are gaining confidence in listing their homes despite persistently high mortgage rates.

The total number of homes actively listed for sale was up 27.8% from a year ago, marking the 70th straight week of rising inventory.

Article continues below this ad

However, this continued rise in active inventory is in part due to less active buyers, and the typical home is spending four days longer on the market than it did last year.