Mortgage rates fell to a 10-month low on Thursday, extending last week’s decline and offering further relief to homebuyers—but remained in the high 6% range after a mixed inflation report.

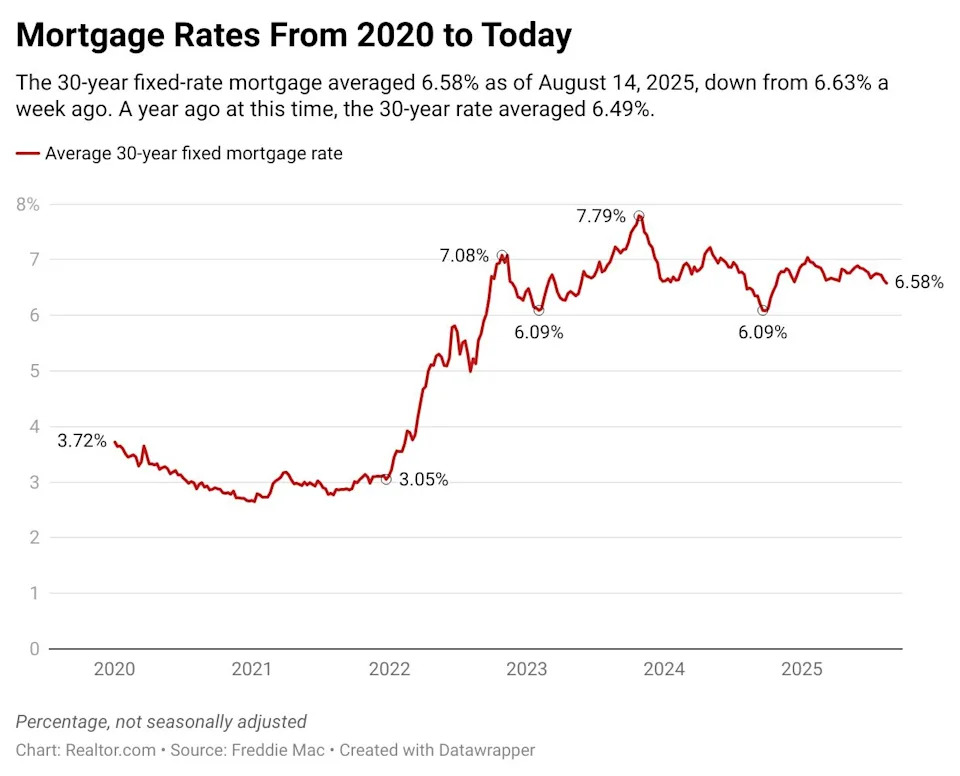

The average rate on 30-year fixed home loans was 6.58% for the week ending Aug. 14, down from 6.63% the previous week, according to Freddie Mac. Rates averaged 6.49% during the same period in 2024.

“Mortgage rates fell to their lowest level since October,” says Sam Khater, Freddie Mac’s chief economist. “Purchase application activity is improving as borrowers take advantage of the decline in mortgage rates.”

The previous week, the mortgage rate dropped to its lowest level since April, following the release of a weak jobs report that bolstered predictions that the Federal Reserve would cut its benchmark interest rate at its next policymaking meeting in September.

This week, the latest data from the Bureau of Labor Statistics showed that the July consumer price index (CPI) saw an annual increase of 2.7%, same as in June, while core inflation, which excludes volatile energy and food prices, accelerated to 3.1%, up from 2.9% the month before—and the highest since February.

“Had inflation come in under expectations, steady prices at the same time that job growth is stalling would be a doubly clear message that interest rates ought to come down,” says Realtor.com® Senior Economist Joel Berner. “Instead, the call to action for the Fed is a bit less loud and clear.”

As a result, the bond market has steadied, with the 10-year Treasury yield holding above 4.2% for the past week. Since mortgage rates typically follow the yield’s trajectory, Berner says “they do not have much room to come down.”

Homebuyers who have been hanging out on the sidelines because of the high financing costs will no doubt receive a dose of encouragement with the year’s biggest decline in the 30-year rate—but, according to Berner, it may take a bit longer to lure more buyers back to the market.

So far, the summer selling season has been lethargic, both for existing homes and new builds, but Berner says there is yet hope.

“As we saw at the end of last year, buyers are responsive to rates coming down and further downward progress could lead to a similar late-year buying surge in 2025,” he shares.

The Fed’s policy decisions in September could have a major impact on the housing market. Following Tuesday’s CPI report, financial markets increased their prediction for a quarter-point rate cut on Sept. 17 from 85% to 94%.

But Berner reminds that this Fed, under Chair Jerome Powell, has proven to be cautious when it comes to cutting rates, so he believes it will take more positive news on the inflation front to inspire the central bank to take action.

How mortgage rates are calculated

Mortgage rates are determined by a delicate calculus that factors in the state of the economy and an individual’s financial health. They are most closely linked to the 10-year Treasury bond yield, which reflects broader market trends, like economic growth and inflation expectations. Lenders reference this benchmark before adding their own margin to cover operational costs, risks, and profit.

When the economy flashes warning signs of rising inflation, Treasury yields typically increase, prompting mortgage rates to go up. Conversely, signs of falling inflation or weakness in the labor market usually send Treasury yields lower, causing mortgage rates fall.

The mortgage rates you’re offered by a lender, however, go beyond these benchmarks and take some of your personal factors into account.

Your lender will closely scrutinize your financial health—including your credit score, loan amount, property type, size of down payment, and loan term—to determine your risk. Those with stronger financial profiles are deemed as lower risk and typically receive lower rates, while borrowers perceived as higher risk get higher rates.

How your credit score affects your mortgage

Your credit score plays a role when you apply for a mortgage. A credit score will determine whether you qualify for a mortgage and the interest rate you’ll receive. The higher the credit score, the lower the interest rate you’ll qualify for.

The credit score you need will vary depending on the type of loan. A score of 620 is a “fair” rating. However, people applying for a Federal Housing Administration loan might be able to get approved with a credit score of 500, which is considered a low score.

Homebuyers with credit scores of 740 or higher are typically considered to be in very good standing and can usually qualify for better rates.

Different types of mortgage loan programs have their own minimum credit score requirements. Some lenders have stricter criteria when evaluating whether to approve a loan. They want to make sure you’re able to pay back the loan.