According to Mortgage News Daily, mortgage rates have dropped to a low of 6.53%, marking a new year-to-date low. With Federal Reserve Chair Jerome Powell under tremendous pressure to lower the Fed funds rate, he finally has the cover to do so with the last jobs report. However, as always, the bond market tends to get ahead of the Fed. In the past, these moves have reversed and rates have headed higher, but for today, we have a fresh new low in 2025.

Housing data with lower rates?

Why is it important to get mortgage rates toward 6%? Well, in the past, the housing data tended to improve when mortgage rates ranged from 6.64% to 6%. So I will take a closer look at the data now to see if this will be the third time since late 2022 that this occurs.

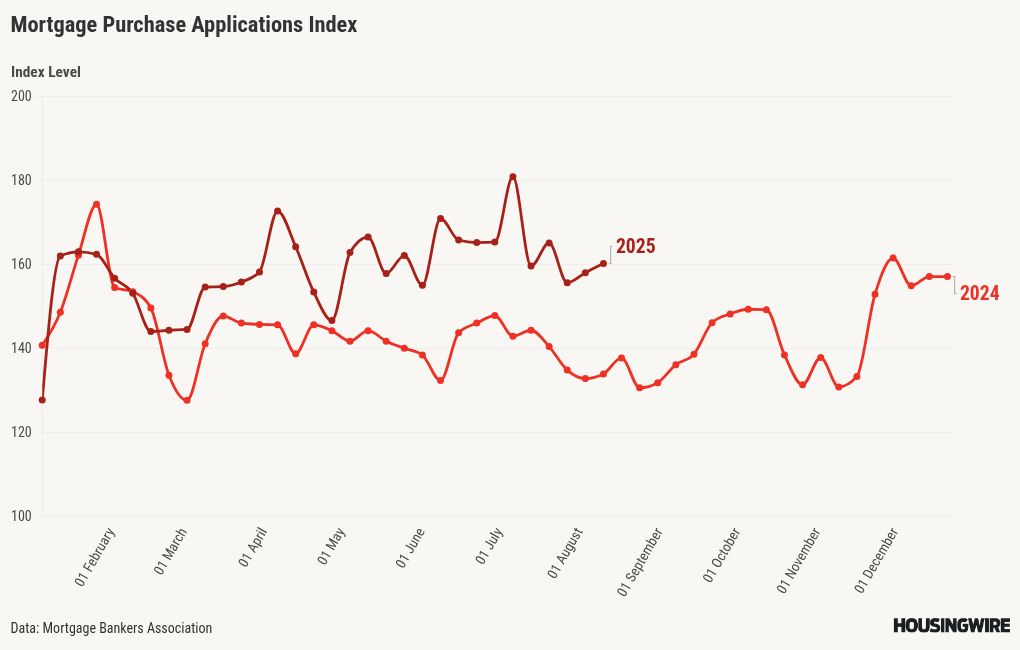

Homebuilder stocks have performed well lately, and the purchase application data for existing home sales indicated a 1% growth week over week and a 17% growth year over year. This is back-to-back weeks of positive weekly and year-over-year data for purchase applications. Purchase application data has also shown 14 straight weeks of double-digit year-over-year growth.

A lot of that growth has had to do with new listings data being higher this year than last, and also extremely low comps. However, in the past, when rates got toward 6%, the week-to-week data tended to improve.

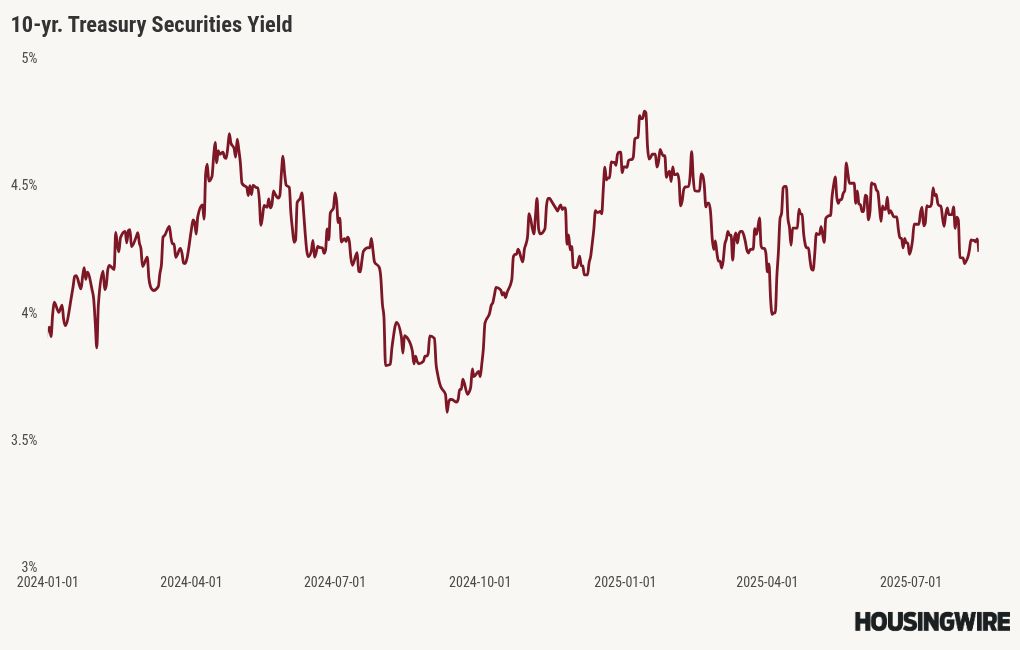

As of now, aside from the Godzilla tariffs, the 10-year yield has not fallen below 4% this year; it currently stands at 4.24%. It will be interesting to observe the bond market’s reaction if labor data deteriorates while the inflation growth rate remains stable. If mortgage spreads continue to improve and the 10-year yield approaches 4% again, as it has in the past few years, we could be looking near 6% this year, thanks to these better mortgage spreads.

Conclusion

Tomorrow, we will receive the PPI inflation report, which will allow us to see if the 10-year yield reacts negatively to it. Today, some Federal Reserve members have taken a slightly hawkish stance, suggesting that a rate cut in the next Fed meeting is uncertain. I doubt their stance on this since the last jobs report was terrible.

However, one thing is sure: over the past few years, whenever there has been an economic growth scare in the data, the 10-year yield tends to decrease, which in turn lowers mortgage rates. The difference now is that mortgage spreads have improved significantly, so even on a week when the 10-year yield rises, as it did last week, mortgage pricing is not heavily affected because spreads are improving alongside higher yields.