Rate cut on the horizon?

The federal funds rate hasn’t budged since December, when the Federal Reserve made the last of three consecutive cuts. But with the labor market cooling and inflation staying below 3% despite President Donald Trump’s tariffs taking effect, market observers are becoming increasingly bullish on a September cut.

On Tuesday, the CME Group’s FedWatch tool showed that 85% of interest rate traders expect a 25-bps pullback next month. And 45% are anticipating benchmark rates to fall to a range of 3.75% to 4% by the end of October — the equivalent of a 50-bps cut or a pair of 25-bps cuts.

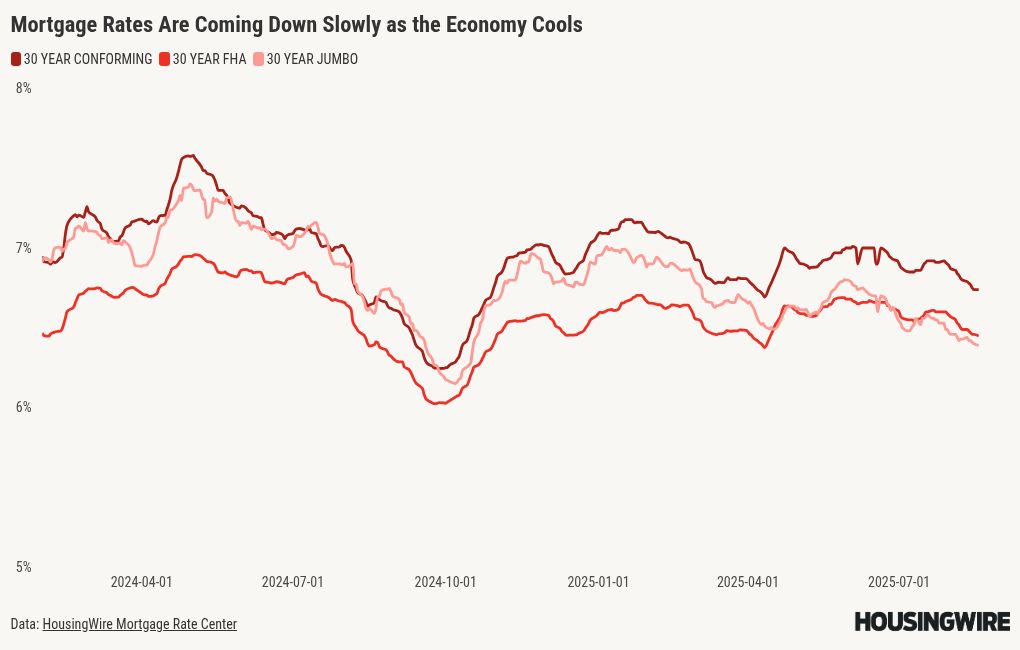

“Rates are falling as a September rate cut by the Fed appears more likely,” Bright MLS Chief Economist Lisa Sturtevant said last week. “While some buyers on the margins will be getting into the market as rates dip, affordability continues to be a major constraint for other would-be buyers. Mortgage rates are just about 10 basis points lower than they were a year ago, but the median home price nationally hit a new record high in June.”

Melissa Cohn, regional vice president at William Raveis Mortgage, is also maintaining a neutral outlook. Although rates have reached a low point for 2025, Cohn said that mortgage rates are not “plunging” as some reports have suggested.

“They’re definitely lower, but I don’t consider that to be plunging,” she said. “When rates start to drop, they’re not going to go down in a straight line.”

More data on jobs and inflation will be released before the Fed’s next meeting and will ultimately determine the course of mortgage rates regardless of the wider policy rate, she added. “If we continue to see weaker data, no matter what the Fed does, bond yields will continue to drop and mortgage rates will drop,” Cohn said.

Impacts to new construction

Despite the recent gradual declines in rates, HousingWire Lead Analyst Logan Mohtashami told CNBC’s “Squawk Box” on Tuesday morning that “mortgage rates are too high to get things moving again” in the construction industry. The costs to acquire land and build more homes are deterring homebuilders and keeping new-home sales in check.

“Single-family permits have been going lower and lower for some time now. The big publicly traded builders can still buy down rates to get below 6% to move product, but the smaller builders are at a disadvantage here,” Mohtashami said. “Multifamily construction has already had a very big crash in starts, so they’re working from a very, very low level.”

In a note to investors last week, analysts at Keefe, Bruyette & Woods (KBW) noted that homebuilder stocks have recently outperformed the S&P 500 as a whole. This is “driven by the improving rate outlook with 30-year mortgage rates down 20 bps from July and hopes for further declines,” they wrote.

But they also advocated for investors to “maintain caution” as the market for new homes is weak and isn’t expected to turn positive in the immediate future. New-home sales were down 3.8% year over year in the second quarter, with sales in May alone dropping 7.6%.

“That said, we believe new home sales may have bottomed at an annualized 623k in May and will show Y/Y declines through October 2025, resulting in an 8-month correction in line with history. We expect moderation in monthly declines with improvements in coming months,” the KBW analysts wrote.

Mohtashami continues to argue that 6% rates should unlock some of the supply constraints that have hampered first-time buyers, move-up buyers and those looking to downsize over the past two years. He told CNBC that the 5 million annual sales expected in 2025 across the existing-home and new-home segments are about 1 million short of historic norms.

“If you look at the history of housing economics going back decades, there’s always been periods of time where home sales crash, they stabilize, wages grow, household formation grows, rates go lower, demand picks up,” he said. “We just basically rinse and wash and do it all over again.

“We had a similar situation in the 1980s when affordability was worse there. … You probably need mortgage rates just to get down to 6% and hold it with duration.”