More than 4 in 5 U.S. homeowners with outstanding mortgages are fortunate to have locked in a rate below 6%—and they are in no rush to sell or even refinance in the current climate of uncertainty.

One of those owners is Annabelle Frazier, Ph.D., an assistant professor at the University of Southern Mississippi School of Criminal Justice.

At the height of the COVID-19 pandemic, Frazier and her husband were living in Methuen, MA, when they decided they’d had enough of working 12-hour days just to cover their ballooning housing costs, she tells Realtor.com®.

At the time, the couple had just finished restoring their nearly century-old Craftsman-style home, which Frazier bought in 2017 for $240,000.

Looking to relocate to a place with a lower cost of living, Frazier swiftly sold her renovated home for $450,000—more than $50,000 over asking—and moved 1,400 miles to Ellisville, MS, a town of just 4,000 inhabitants outside the state capital of Jackson.

In Ellisville, Frazier was able to buy a 2,800-square-foot, three-bedroom, two-bathroom home on a large plot of land featuring a two-bedroom guesthouse, all for the relatively low price of $150,000—a major upgrade from her cramped 1,400-square-foot Mathuen home.

Annabelle Frazier is seen doing renovations on her new home in Ellisville, MS.

The only caveat was that the sprawling new property was “uninhabitable,” Frazier says. So she and her husband took out a $50,000 mortgage at a 5% rate to make their new home livable.

“Now, I’d like to do an addition, and I won’t so long as the rates are bad,” she says.

Because of today’s elevated mortgage rates, Frazier also has been forced to put her dream of buying a vacation home on the Mississippi coast on hold.

“We want a second property, but that’s got to wait for the rates, which I don’t think are coming down anytime soon,” says Frazier.

She adds: “My bigger hope at this point is that the real estate market will crash again.”

The “lock-in effect” persists

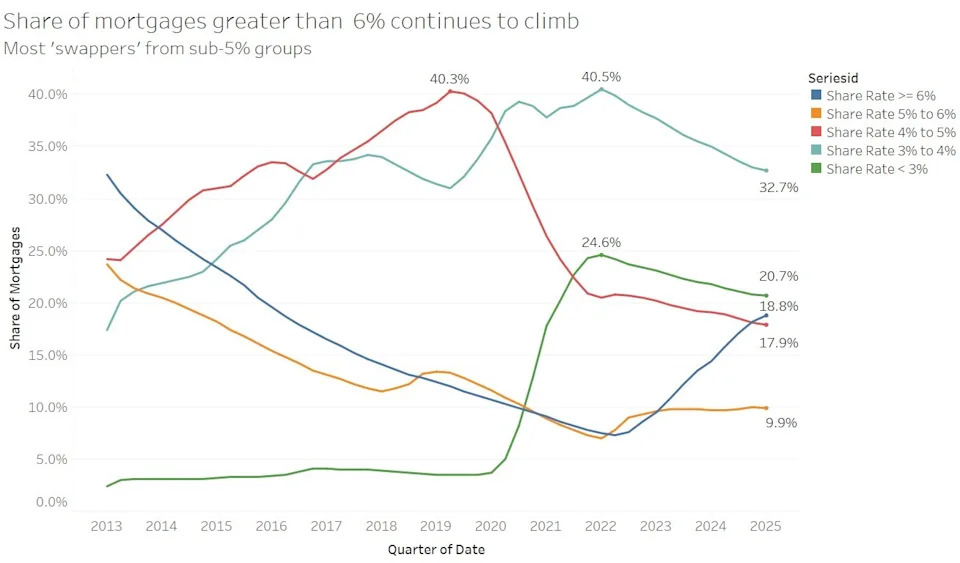

Although rates have retreated from recent above-7% peaks, they remain stuck in the high 6% range, offering little incentive to would-be sellers to list their properties, only to then risk financing their next home at a much higher rate.

Realtor.com Senior Economic Research Analyst Hannah Jones says that this impasse has stalled the post-pandemic recovery of the national home inventory.

“Housing supply has improved over the past year but remains below pre-pandemic levels,” says Jones. “Scarce inventory has kept upward pressure on home prices, especially in affordable areas where homes continue to sell at a quick clip and buyers face considerable competition.”

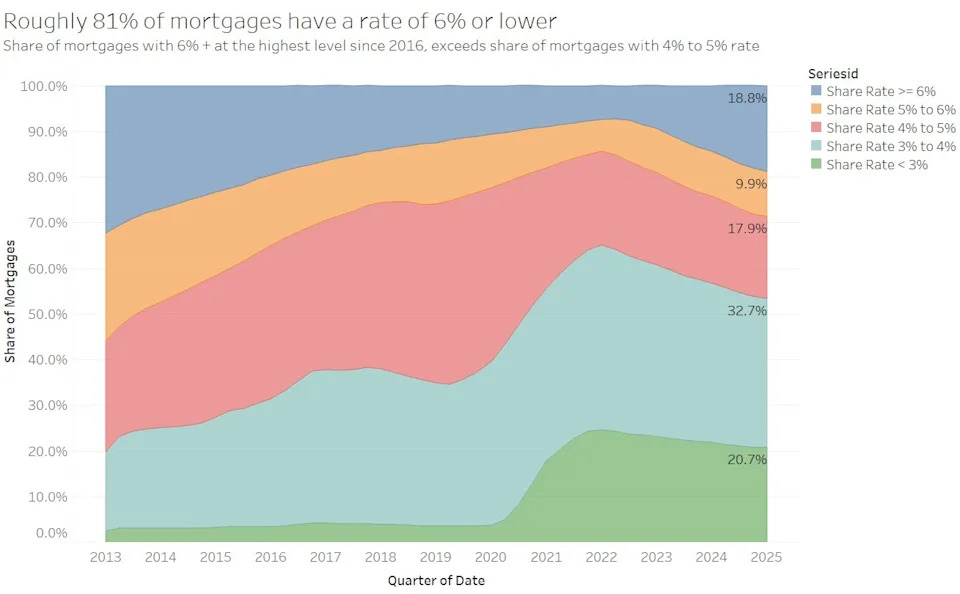

In the first quarter of 2025, 20.7% of outstanding mortgages had an interest rate below 3%, according to the latest report from Realtor.com.

The Freddie Mac fixed rate on a 30-year loan dipped below 3% in July 2020 and more or less stayed below that threshold through September 2021.

Strikingly, this was the only period in the data’s 50-year history where rates dropped below this benchmark, pointing to the extraordinary nature of these circumstances.

Just under a third of outstanding mortgages (32.7%) have an interest rate between 3% and 4%; 17.9% have a rate between 4% and 5%; 9.9% have a rate between 5% and 6%; and 18.8% have a rate of 6% or greater.

The combined share of outstanding mortgages with a rate of 4% now stands at more than half, and almost three-quarters of home loans have a rate of 5% or lower.

Notably, the number of mortgages nationally edged down in the first quarter of 2025, marking the first quarterly decline since 2018.

Realtor.com Senior Economist Jake Krimmel says there are two main factors behind this shift.

“Demand is down due to high mortgage rates and more people are starting to own their home outright,” he says.

Looking at the year ahead, economists expect the share off mortgages below 6% to edge down to 75% by the end of 2025.

“Put differently, we expect the share of mortgage holders with a rate of 6% or higher to increase as home shoppers purchase a home in the current 6%-plus rate environment,” says Jones.

The percentage of homeowners carrying a mortgage with a rate of 6% or higher ticked up between the first quarter of 2024 and the first quarter of 2025 as people continued purchasing homes despite the mounting financing costs.

Even in today’s housing market weighed down by elevated prices and interest rates, homebuying associated with major life events, such as marriage, birth, and divorce, keeps the inventory moving.

Although the “lock-in effect” remains a feature of the market, a recent survey revealed that 40% of prospective buyers said they would be able to purchase a house if mortgage rates were to dip below 6%.

A further third of respondents said they would venture into the market if rates dropped below 5%.

Frazier, the university professor from Mississippi, is one of those homeowners biding their time and waiting to see where the rates go.

“If we went to under 5%, I’m definitely refinancing for an addition and buying that vacation property on the coast,” she tells Realtor.com.

For the week ending Aug. 14, the 30-year fixed mortgage rate fell to a 10-month low of 6.58%, coming on the heels of a mixed inflation report.

“Easing inflation and mortgage rates will be key drivers of seller activity, which will relieve some of the price pressure and competition in today’s under-supplied market,” says Jones.

In July, inflation held steady, with overall prices increasing 2.7% year over year—the same annual growth rate seen in June. The pressure is mounting on the Federal Reserve to cut rates, with financial markets upping their prediction of a quarter-point reduction next month to 94%.

Builders step in to boost inventory

With a large share of existing homes “locked in” for now, due to elevated rates, new construction has stepped in to fill the inventory gap, especially in the South.

Eager to meet today’s buyers where they are, savvy builders have adjusted to the market by offering smaller, more affordable homes. As a result, newly built homes saw the lowest premium (the percentage difference between new and existing home prices) in the data’s history, at just 7.8%.

Looking at price per square foot, new-construction homes were cheaper than existing properties in the second quarter of 2025.