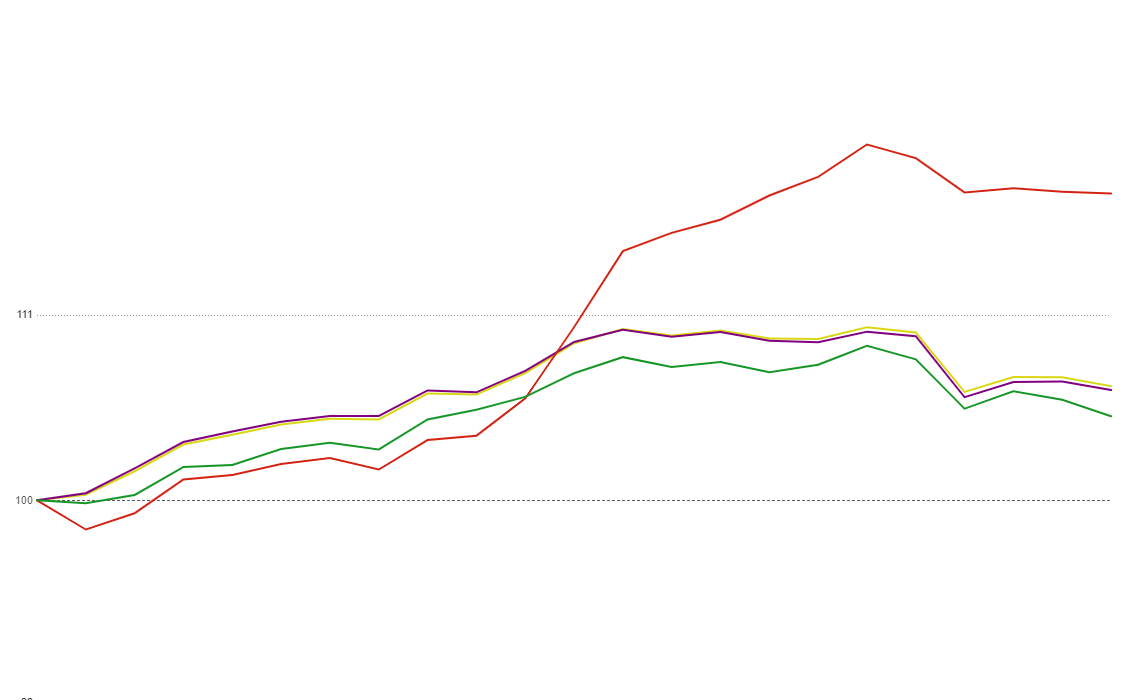

SAN DIEGO, CA – June 10, 2024 – Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today an increase of 6.78% in mortgage lock volume compared to the previous month. To gain comprehensive insights into the market dynamics, industry professionals and enthusiasts are invited to download the complete report.

As mortgage lock volume edges upward during the buying season, the mortgage industry continues to monitor economic indicators that will factor into the Federal Reserve’s decision on how long to hold rates.

Early May economic indicators present a mixed bag, which could give the Federal Reserve reason to hold rates longer. While April’s Consumer Price Index (CPI) aligned with predictions, the May Nonfarm Payroll report far exceeded forecasts with an additional 272,000 jobs.

The combination of the May Nonfarm Payroll and upcoming CPI report could suggest that the Federal Reserve will hold rates longer as they seek more consistent economic indicators pointing toward their goal of two percent inflation.

Andrew Rhodes, Senior Director and Head of Trading at MCT, stated, “The next couple of months will be key from a data standpoint as the Federal Reserve looks for a trend of inflation heading towards the goal of two percent. Considering the Nonfarm Payroll number that just came out, setting a trend is going to take more time. We’re looking ahead to the May CPI print to see how the Fed is going to interpret both data points. Even with CPI coming in around expectation, the jobs number could likely push the Fed to further delay their rate cuts.”