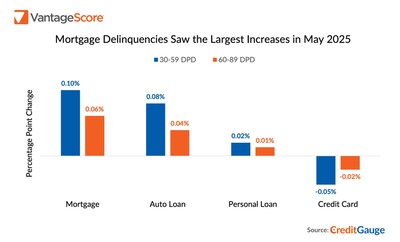

SAN FRANCISCO, June 26, 2025 /PRNewswire/ — May Mortgage loans led an increase in early- and mid-stage delinquencies across all credit categories, according to the new CreditGauge™ published today by VantageScore. Home loans saw the largest year-over-year increase in the 30-59 Days Past Due (DPD) payment category. Mortgage delinquencies rose from 0.92% in the prior month to 1.03% in May, an indication that the housing sector may be demonstrating early signs of borrower financial stress.

“The rise in early and mid-stage delinquencies this month indicates potential financial strain among some consumers,” said Susan Fahy, EVP and Chief Digital Officer at VantageScore. “While consumer behavior generally remains positive, particularly among younger borrowers, mortgages may be an area to watch for increasing credit stress, particularly for traditionally less-risky segments with credit scores above VantageScore 660.”

Watch CreditGauge LIVE for additional key insights from the May 2025 edition of CreditGauge that include:

MORTGAGE LOANS EXPERIENCE A SURPRISE INCREASE IN DELINQUENCIES: Consumers typically prioritize their payment of mortgage obligations compared to other credit payments. However, in May, Home loans saw the largest year-over-year increase in the 30-59 Days Past Due (DPD) payment category. Mortgage delinquencies rose from 0.92% in the prior month to 1.03% in May.

EARLY-STAGE DELINQUENCIES RISE ACROSS MOST CREDIT TIERS: Credit delinquencies in the 30–59 Days Past Due (DPD) category rose year-over-year in May 2025 across VantageScore Nearprime, Prime and Superprime segments. While Subprime late payments declined slightly year over year, somewhat elevated delinquency levels in other VantageScore credit tiers suggest that short-term financial stress is possibly beginning to affect even traditionally lower-risk borrowers.

AVERAGE CREDIT BALANCES REACH NEW HIGHS: The average credit balance rose to $106,000 in May—an increase of $249 (+0.24%) from April—marking the fifth straight month at a five-year high. Year-over-year, balances grew by $1,479 (+1.4%) from May 2024. Mortgage balances showed the largest uptick among product lines, rising 2.8% year-over-year.

CreditGauge is a monthly analysis highlighting the overall health of U.S. consumer credit. To download this month’s full CreditGauge report, visit the VantageScore website.

Follow VantageScore on LinkedIn and YouTube to watch CreditGauge LIVE, a monthly video series featuring our latest insights on consumer credit data and analysis.