PAYING a mortgage off early might seem like a pipe dream for most people.

It’s typically the largest debt you’ll ever have, taking decades to pay off.

But it is possible to make that dream a reality, even on an average wage.

Monthly mortgage bills are made up of both interest and a repayment towards the underlying debt.

The quicker that you can erode the underlying debt the more you save on interest.

When you make an overpayment on your mortgage it goes straight towards your debt.

Read more on interest rates

The key is making these payments whenever you can afford to.

Even very small amounts of cash can make a big difference over the long term – saving you thousands in interest and mean you become mortgage free sooner.

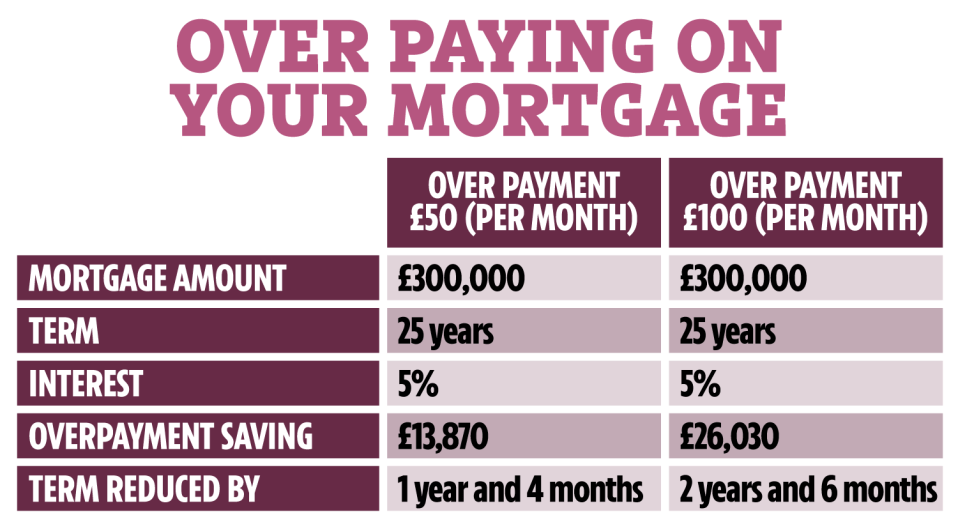

For example, a £50 over payment once a month on a 25-year mortgage would save you more than £13,000 in interest and slash your mortgage term by over a year.

And if you could afford to pay an extra £100, you’d save £26,000 and become mortgage free 2.5 years sooner.

Justin Whitelock, of City Finance Brokers, said: “The key is not to take out your fixed rate for five years and then forget about your mortgage.

“I would always say be realistic and set up your overpayment from the beginning and don’t overstretch yourself.”

You can organise with your mortgage provider to increase your monthly mortgage repayment so that more money is going towards the outstanding loan.

Or if you want to pay money as and when you have extra cash, you can also do that.

A good opportunity to overpay is when you remortgage on to a lower rate.

“Think about keeping that payment the same,” says Justin.

“Everyone can have best intentions about putting the money away every month but for most people they don’t see through that commitment.”

Another option is switching to biweekly payments.

For example, if your monthly mortgage is £1,200 a month, you pay £600 every two weeks.

But because the number of days in a month can change, you end up paying extra over the year.

Lump sum payments are another way of chipping away at the debt, perhaps if you get a bonus from worth or commission.

You can also sign up to a cashback app Sprive which will funnel any money earned through your everyday shopping towards paying off your mortgage.

Downloading the app and linking both your bank and mortgage accounts.

If you were to spend £100 a week at a supermarket, offering a 2.5% cashback, you could have £20 towards a mortgage overpayment at the end of a month.

Watch out for pitfalls

It’s important to note on a fixed-rate mortgage, lenders only usually allow for extra payments of up to 10% of what you owe every year.

For example if your mortgage is £300,000 you can only overpay by £30,000.

If you pay more than this, you’ll get hit with stinging early repayment fees.

How to get the best deal on your mortgage

IF you’re looking for a traditional type of mortgage, getting the best rates depends entirely on what’s available at any given time.

There are several ways to land the best deal.

Usually the larger the deposit you have the lower the rate you can get.

If you’re remortgaging and your loan-to-value ratio (LTV) has changed, you’ll get access to better rates than before.

Your LTV will go down if your outstanding mortgage is lower and/or your home’s value is higher.

A change to your credit score or a better salary could also help you access better rates.

And if you’re nearing the end of a fixed deal soon it’s worth looking for new deals now.

You can lock in current deals sometimes up to six months before your current deal ends.

Leaving a fixed deal early will usually come with an early exit fee, so you want to avoid this extra cost.

But depending on the cost and how much you could save by switching versus sticking, it could be worth paying to leave the deal – but compare the costs first.

To find the best deal use a mortgage comparison tool to see what’s available.

You can also go to a mortgage broker who can compare a much larger range of deals for you.

Some will charge an extra fee but there are plenty who give advice for free and get paid only on commission from the lender.

You’ll also need to factor in fees for the mortgage, though some have no fees at all.

You can add the fee – sometimes more than £1,000 – to the cost of the mortgage, but be aware that means you’ll pay interest on it and so will cost more in the long term.

You can use a mortgage calculator to see how much you could borrow.

Remember you’ll have to pass the lender’s strict eligibility criteria too, which will include affordability checks and looking at your credit file.

You may also need to provide documents such as utility bills, proof of benefits, your last three month’s payslips, passports and bank statements.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories