Home sales could fall to a new three-decade low in 2025 as elevated mortgage rates continue to crimp affordability, according to new projections from the Realtor.com® economic research team.

The Realtor.com Housing Forecast Midyear Update released on Wednesday provides revised projections for trends in mortgage rates, home sales, and home prices in 2025, updating the initial annual forecast released in December.

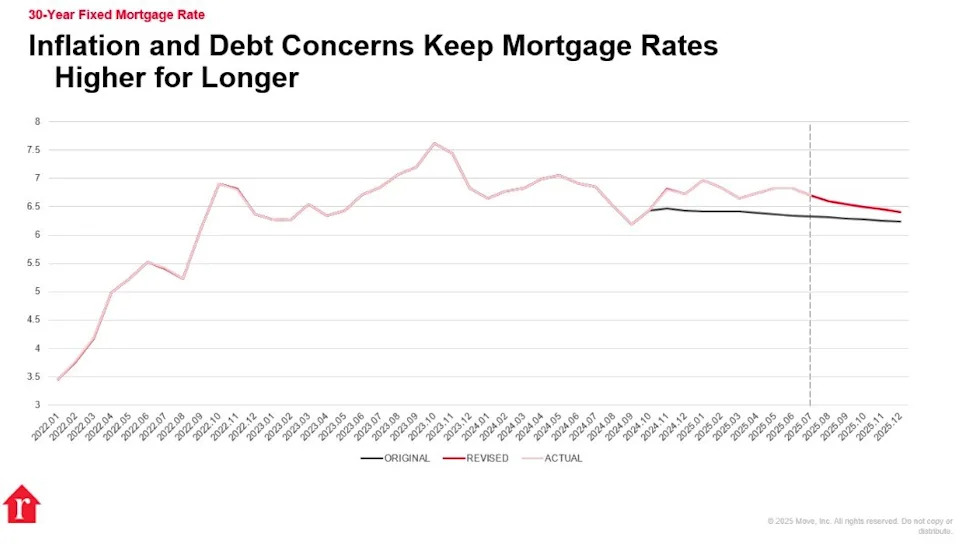

The revised forecast predicts 30-year mortgage rates will remain higher than originally projected, averaging 6.7% across 2025 and ending the year at around 6.4%. That’s up from the initial forecast of a 6.3% full-year average, and 6.2% at year-end.

Sales volume for existing homes, previously projected to grow slightly this year compared with 2024, is now expected to fall 1.5% annually, to just 4 million transactions.

That would mark the slowest year for existing-home sales since 1995, when they registered 3.8 million. Home sales were also at their lowest since 1995 in both 2023 and 2024, according to the National Association of Realtors®.

“Even with more homes on the market, buyer response has remained muted compared to what we’d expect from similar supply shifts in the past,” says Danielle Hale, chief economist of Realtor.com.

“In regions like the South and West, inventory gains have been more substantial, but affordability constraints continue to weigh on demand. Meanwhile, the Northeast and Midwest remain tighter markets with relatively steadier buyer activity.”

Despite the ongoing slump in sales, Realtor.com economists do not foresee an imminent national correction in home prices, but rather project home prices will grow 2.5% through 2025. That’s slightly lower than the 3.7% growth they expected at the start of the year.

Rather than dropping their asking prices, many home sellers now appear to have opted to wait out the market. Realtor.com recently reported that delistings surged 47% in May compared with a year earlier, suggesting that sellers increasingly prefer to wait rather than negotiate.

In many respects, the forecast suggests that this year’s housing market will look similar to last year’s, with affordability concerns weighing heavily on sales volume and national home prices growing at a sluggish pace.

A chart shows how mortgage rates have remained higher in 2025 than Realtor.com economists initially forecast in December.

One major difference, however, is a significant increase in inventory in 2025, particularly in the South and West. After years of tight supply, the number of active listings nationwide topped 1 million in May for the first time since late 2019.

But the anticipated bump in home sales that some expected to see alongside higher inventory has not materialized, with elevated mortgage rates and record-high home prices keeping many prospective buyers sidelined.

Mortgage rates, which have remained above 6.6% since the beginning of the year, most recently averaged 6.75% for the week ending July 17, according to Freddie Mac.

New construction and homeownership rate seen declining

After a slow spring for new housing construction, the latest forecast also delivers a sharp downward revision to residential construction projections for 2025.

Realtor.com economists now project that single-family housing starts will fall 3.7% from last year, to just 980,000.

That’s far below the 13.8% annual gain they had projected at the start of the year, an unwelcome revision in a market that still has millions fewer homes than are needed to meet expected demand from new household formation.

As a result of the shortage, the typical age of first-time homebuyers has surged to a record high of 38, with many young people remaining renters or living with family far longer than they used to.

That trend is expected to continue, with the forecast projecting the homeownership rate will drop to 65.2% this year, down from 65.6% in 2024 and 65.9% in 2023.

In a bright spot of news for renters, rent growth is expected to remain soft in 2025, with median asking rents down 0.1% in 2025, after falling 0.2% last year.