The price of homeownership remains out of reach for many Americans as home prices remain high and mortgage rates continue to hover close to 7%.

The total number of unsold homes, including those under contract, was up 20% compared with the same time last year, according to the Realtor.com® June 2025 Monthly Housing Market Trends report.

According to the economists with the National Association of Realtors®, “A 30-year fixed-rate mortgage of 6% would make the median-priced home affordable for about 5.5 million more households—including 1.6 million renters.”

If a 30-year fixed mortgage rate hit 6%, about 10% of those additional households would likely buy a home over the next 12 or 18 months, according to an NAR survey—that’s about 550,000 households.

“Many of my clients tell me the same thing: They want to buy, but they feel that mortgage rates are holding them back,” Alexei Morgado, real estate agent and founder of Lexawise, tells Realtor.com. “And it’s not just about the number itself. What I hear most often is the fear of making a bad decision, of getting into something they can’t sustain or that will later make them think, ‘I rushed into it.’ That feeling of paying more for the same thing is frustrating, discouraging, and puts them on hold.”

“Buyer activity was similarly constrained a year ago when rates were roughly the same as today,” says Hannah Jones, senior economic research analyst at Realtor.com. “However, buyer demand today appears even more suppressed, as higher rates have become the ‘new normal,’ discouraging casual buyers who previously hoped rates would fall quickly. As a result, for-sale inventory has built up, forcing sellers to be more flexible on price to attract buyer attention.”

“Rates could dip to that projected homebuying sweet spot of 6% by 2026,” NAR forecasters say in the report. That would drive home sales up by 14%. It identified key metros that would benefit from a mortgage rate drop. Atlanta, Dallas, Minneapolis, Cleveland, and Kansas City, MO-KS, would be among the top markets seeing the largest uptick in home sales if rates were to drop to 6%.

Here’s how the numbers stack up in those metros for June:

Atlanta, GA

- Median list price: $421,000

- Median days on the market: 51

Cleveland, OH

- Median list price: $277,000

- Median days on the market: 37

Dallas, TX

- Median list price: $440,000

- Median days on the market: 50

Kansas City, MO-KS

- Median list price: $409,475

- Median days on the market: 45

Minneapolis, MN

- Median list price: $447,900

- Median days on the market: 37

Waiting game

NAR economists say buyers who are waiting for lower mortgage rates might be missing out. Housing inventories have been rising across the country, which is giving buyers more options and more bargaining power.

Though the pace of home prices have slowed, they’re still rising, and NAR predicts that on a national basis, list prices will rise about 1% this year before “accelerating to a projected 4% increase in 2026.”

“Through real estate, more Americans are gaining financial security,” said NAR Chief Economist Lawrence Yun. “Real estate net worth is on solid ground, based on the low delinquency rate and even lower foreclosure rate conditions.”

For example, NAR found in Phoenix, homeowners gained an average of $320,860 in equity over 10 years of ownership—wealth that nonhomeowners are missing out on.

But whether it’s the right time to buy will depend on one’s situation.

“I always tell people that the important thing is to enter the market with a strategy that feels realistic,” says Morgado. “See what you can afford without compromising your peace of mind.”

Rate watch

Mortgage rates have been on the rise for two consecutive weeks. The average rate on a 30-year fixed home loan stands at 6.75% for the week ending July 17, according to Freddie Mac. That’s up from 6.72% the week before.

The rate rise has had an effect on people applying for a mortgage, as home loan demand fell by 10% for the week ending July 11, according to the Mortgage Bankers Association. MBA economists say this was driven by concerns over the impact of tariffs on the economy.

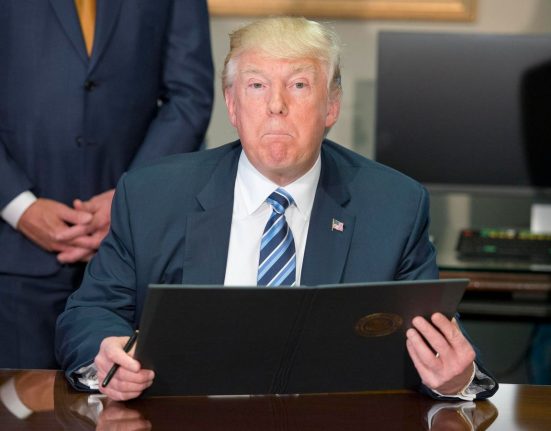

That uncertainty over President Donald Trump’s tariffs has homebuilders scaling back on projects, as supplies have become more costly and buyers aren’t jumping on breaking ground as quickly as in the past.

In addition, inflation inched up—the consumer price index rose by 2.7%, according to new data from the Bureau of Labor Statistics.