In a split decision, the Federal Reserve on Wednesday left its key policy rate unchanged yet again, hours after President Donald Trump called on Fed Chair Jerome Powell to cut rates and boost the housing market.

As was widely expected, Fed policymakers left the central bank’s overnight rate unchanged at a range of 4.25% to 4.5%, where it has remained since December. But for the first time in 30 years, two voting members of the Federal Open Market Committee dissented from the majority.

Fed Govs. Michelle Bowman and Christopher Waller instead voted for a quarter-point rate cut, marking the first time since 1993 that more than one FOMC member has diverged from the consensus.

The split decision comes at a time of remarkable political polarization over Fed rate policy, with Trump and his allies insisting for months that inflation is fully under control and demanding lower rates.

On Wednesday morning, Trump had written on his Truth Social site that Powell “MUST NOW LOWER THE RATE.”

He added, “No Inflation! Let people buy, and refinance, their homes!”

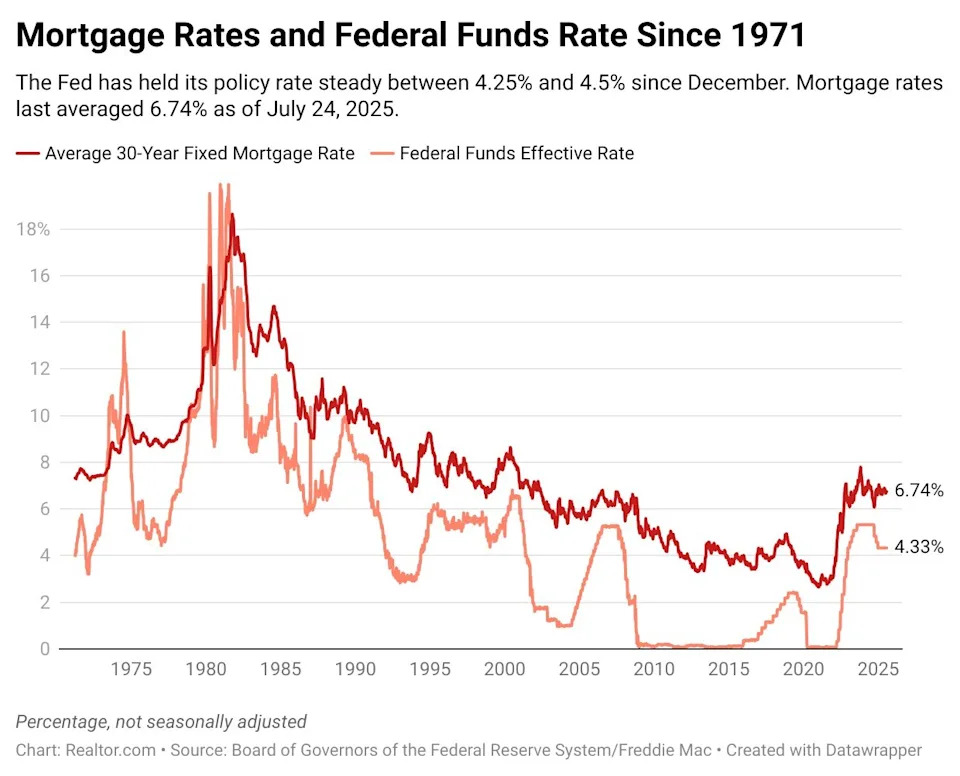

Mortgage rates have remained stuck above 6.6% since the beginning of the year, contributing to historically bad affordability conditions for homebuyers and severely depressed home sales activity.

Still, it’s unclear whether a Fed rate cut would offer significant relief to mortgage borrowers. The Fed doesn’t set mortgage rates, which instead track long-term bond yields. Bond markets would have to view a central bank rate cut as credible and justified to move the needle for mortgage rates.

The Realtor.com® economic research team estimates that mortgage rates will remain in the upper 6% range for most of the year, but ease slightly to around 6.4% by the end of 2025.

“Fed rate cuts, which are expected later this year, in a steadier policy environment should help mortgage rates fall, relieving some of the strain on homebuyers,” says Realtor.com Chief Economist Danielle Hale.

In public comments, Powell has said that the Fed remains concerned about the impact of Trump’s trade policy on both inflation and the labor market, and plans to take a cautious approach before lowering rates.

“Higher tariffs have begun to show through more clearly to prices of some goods, but their overall effects on economic activity and inflation remain to be seen,” Powell said at a press conference on Wednesday.

Major economic reports released earlier this month showed rising inflation and a still-strong labor market, indicators that made a rate cut at this Fed meeting seem extremely unlikely.

Annual inflation as measured by the consumer price index jumped to 2.7% in June, while the unemployment rate dropped slightly, to 4.1%, as the economy added 147,000 jobs last month, beating analyst expectations.

The Fed has a dual mandate to achieve 2% inflation and maximum employment, using higher interest rates to control prices and lower rates to spur more job creation.

“We see our current policy stance as appropriate to guard against inflation risks. We’re also attentive to risks on the employment side of our mandate,” Powell said on Wednesday. “In coming months, we will receive a good amount of data that will help inform our assessment of the balance of risks and the appropriate setting of the federal funds rate.”

Financial markets estimate a roughly 60% chance that the Fed will cut its policy rate by a quarter-point at the next FOMC meeting in September, although Powell stressed in his remarks that no decision has been made about future rate moves.

Instead, he said that policymakers would carefully review the economic data that comes out between now and September as they assess their next move.

Powell: ‘We don’t set mortgage rates’

Although elevated mortgage rates have been a key focus for homebuyers, and a cudgel for Fed critics who demand lower rates, Powell clarified the Fed’s role when asked about pain in the housing market.

“We don’t set mortgage rates at the Fed,” he said. “We set an overnight rate, and the rates that go into mortgages are longer-term rates, like Treasury rates. … It’s not that we don’t have any effect. We do have an effect, but we’re not a main effect.”

Fed policy affects mortgage rates indirectly through the bond market, although the main impact is through expectations about future Fed moves.

That’s why mortgage rates increased by nearly a full percentage point last fall, even as the Fed cut its policy rate by the same amount—bond traders were revising their expectations about the speed and duration of future cuts.

Powell went on to say that Fed policymakers recognize significant problems in the housing market, but said that the central bank is simply not positioned to solve those problems.

“There are things that are going on in the housing sector, and one of those is just kind of a long-term housing shortage that we have. We haven’t built enough housing. This is not something the Fed can help with, but then that’ll be the case even after things normalize,” he said.

“So I think the best thing that we can do for housing is to have 2% inflation and maximum employment, and that’s what we can contribute to housing,” Powell added.

Bill Pulte, the Trump-appointed chairman of Fannie Mae and Freddie Mac who has furiously criticized Powell over rates, disputed this claim in a social media broadside.

“Jerome Powell, again, lies to the American people. This time saying that the Fed has nothing to do with Housing,” Pulte wrote on X. “The Fed has EVERYTHING to do with Housing.”