If you’re into high-yielding investments, then you probably know about mortgage REITs. But you should also know about preferred shares, baby bonds, and BDCs. We cover all of these investments, as well as equity REITs, inside The REIT Forum. These alternatives tend to perform much better than mortgage REIT common shares over long periods. That doesn’t mean every one of them will be a winner, but on average, they come out ahead.

There will still be BDCs like Prospect Capital (PSEC). We cut coverage of PSEC some time ago because we were focusing on ideas for dividend investors. We are rarely hunting for ideas for shorting, though sometimes we find them. Consequently, PSEC was a poor fit for our service.

BDCs

Most BDCs have done very well over the last few years. They’ve been enjoying the higher interest rates as they pushed their income higher. It would push up their cost of funds as well, but they have less leverage, so it was still positive for their income. I think the biggest surprise for many investors coming out of 2021 was the economic stability. Despite surging interest rates, the credit investments held up surprisingly well. Since the BDCs were still getting paid on their underlying investments, even as the interest rates increased, earnings and share prices went up.

Preferred Shares

Preferred shares have been mixed. The ones with fixed-rate dividends generally did much worse. That’s not surprising given the magnitude of the change in interest rates relative to 2021. On the other hand, the fixed-to-floating shares generally did very well. Even the ones that were not floating yet were respectable. Investors were able to get a reasonable yield while having far less price volatility.

Investors may find it ironic that so many of the attractive preferred shares come from mortgage REITs. While the common shares have been bleeding book value in more quarters than not, the preferred shares have been much more stable. The dividends are a bit lower, but the total returns are much better.

Total Returns Matter

Some investors don’t care about the change in the value of their shares. Those investors don’t seem to care about the value of their accounts, either. They choose to believe everything is fine until the dividend cut is announced. Well, the price usually moves in advance. Then they get “stuck” holding some trash.

Baby Bonds

Perhaps the most impressive thing is the performance of the baby bonds, though. While Treasuries had a pretty rough time, we’ve seen baby bonds doing fairly well. Higher interest rates put some pressure on prices, but most of the ones we cover trade above $24.00, and a surprising portion trade over $25.00. That’s pretty solid given that the maturity value is $25.00. For baby bonds, it’s typical to have a $25.00 maturity value.

The worst performer among the baby bonds we cover has been from Ready Capital — RCD (RCD). The baby bond trades around $22.87 today, which implies a yield to maturity of just under 12%. As negative as that sounds, shares already went ex-dividend twice, resulting in over $1.10 of dividends. Consequently, investors who paid $25.00 would still only be down about $1.00 adjusted for dividends. Not great, but it sure beats PSEC. When the worst performer is only down about 4% adjusted for dividends, that’s not a disaster.

Expectations

Q2 2025 is not expected to be a great quarter for the mortgage REITs on total economic return (change in book value plus the dividends).

The Nice Thing

The one nice thing about the mortgage REITs is that there is a fairly wide spread between the yield on assets and the cost of funds.

Looking at prices and yields in the bond market right now, we can see that the three-year Treasury yields 3.896% and the five-year Treasury yields 3.985%. We could think of those as rates for hedging borrowing costs for a mortgage REIT. It certainly isn’t a perfect estimate, but it’s a good rough estimate. So how much would a mortgage REIT earn on newly invested capital? Well, we can approximate that using the yield on fixed-rate agency MBS. Rather than trying to predict the actual rate of prepayments, we can simply estimate the coupon rate where a pool of fixed-rate MBS would be trading at par value. It’s actually not too hard if you have access to the pricing data. We do, so I’ll share it.

- The fixed-rate agency MBS pools with a 5.5% coupon rate are trading at $99.09 for $100 of face value.

- The fixed-rate agency MBS pools with a 6.0% coupon rate are trading at $101.13 for $100 of face value.

Well, those are both about $1 away from trading at face value. Therefore, the pool that would trade at face value would have about a 5.75% coupon rate. Quick and dirty math. We made it easy.

Well, 5.75% is quite a bit higher than 3.985%, so that’s a pretty attractive spread. The risk in this scenario is that rates could move significantly in either direction. If they fall substantially, the homeowner refinances, but the mortgage REIT is left with that hedging rate. If rates go up substantially, prepayments plunge. Consequently, the mortgage REIT is stuck holding that MBS (or selling it at a loss) even after its hedge runs out.

If you have a mortgage, hopefully, you were able to lock in a much lower rate. My mortgage is locked in at 2.125%. I could pay it off quite easily. It’s less than my cash allocation. But why would I pay it off at 2.125% when even my cash allocation earns about 4% in short-term Treasury ETFs? That would be a terrible choice for me.

That’s the risk of owning fixed-rate MBS. When rates rise substantially, the homeowner becomes far less likely to pay off their mortgage. When rates fall, they refinance. Just like I refinanced into that 2.125% deal.

Long-Term Performance

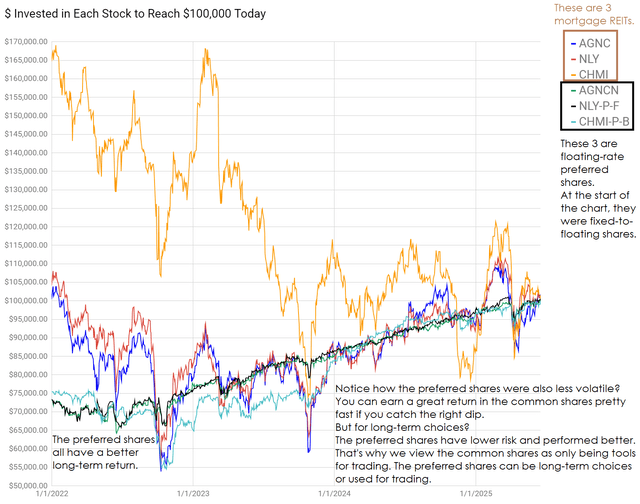

This multi-year chart demonstrates why investors would be interested in preferred shares:

The REIT Forum

Going back to the start of 2022, we can see that the preferred shares outperformed despite having much lower volatility. We’re using preferred shares from the same mortgage REITs we charted for the common shares.

Shares of Cherry Hill Mortgage Series B (CHMI-B) were much more volatile than those from AGNG AGNCN or Annaly (NLY-F). However, they were still less volatile than any of the common shares. You can’t rely on the historical change in price to tell you exactly what’s going to happen in the future. However, you can get a feel for the volatility of different investments if you’re charting them over several years.

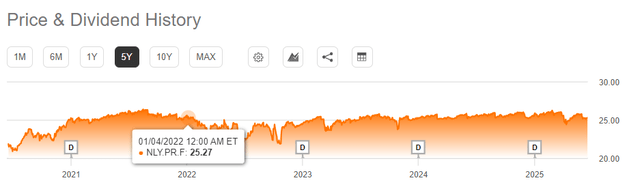

It’s not like the preferred shares needed a bunch of appreciation to put together those returns. At the start of that chart, shares of NLY-F were a bit over $25, as shown here:

Seeking Alpha

How much are those shares today? $25.18.

There was some volatility, particularly in 2022, but it was extremely stable compared to the common shares. Meanwhile, shares produced a healthy amount of income for investors.

Opportunities

I’m finding a decent amount of opportunity presently with the preferred shares and baby bonds. I’m quite happy allocating some capital there. I shrank that part of my portfolio as we kept capturing gains on the positions, but there are enough opportunities there for us to start new positions.

Ideas Always Welcome

We got some great suggestions for charts in the comments of our prior article. I’m still going over possibilities for how we might add some of those charts. So long as I can get past the uploading, I can provide quite a few charts. In many cases, readers are asking for images (or tables) using data we either already have or can acquire quickly. So feel free to check out what we already have and make suggestions in the comments here.

Charts

You can see all the charts here.

It’s just one extra click, and it saves me a ton of time in uploading the article.

All The Stocks

The charts compare the following companies and their preferred shares or baby bonds:

- BDCs: (CSWC), (BXSL), (TSLX), (OCSL), (GAIN), (TPVG), (FSK), (MAIN), (ARCC), (GBDC), (OBDC), (SLRC)

- Commercial mREITs: (GPMT), (FBRT), (BXMT)

- Residential Hybrid mREITs: (MITT), (CIM), (RC), (MFA), (EFC), (NYMT)

- Residential Agency mREITs: (NLY), (AGNC), (CHMI), (DX), (TWO), (ARR), (ORC)

- Residential Originator and Servicer mREITs: (RITM), (PMT)

Build a foundation for steady income with REITs

As demand for key real estate sectors increases and supply fails to keep pace, 2025 presents a prime opportunity to invest in REITs, Preferreds, and BDCs.

The REIT Forum offers a proven, transparent approach with actionable insights. Led by Colorado Wealth Management Fund (aka Michael VanLoon) and an expert team, subscribers receive precise trade alerts, portfolio tracking, and exclusive articles. Strategies from The REIT Forum have consistently outperformed sector indexes for nearly a decade.

Start your risk-free two-week trial today and capitalize on the power of real estate returns.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.