Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

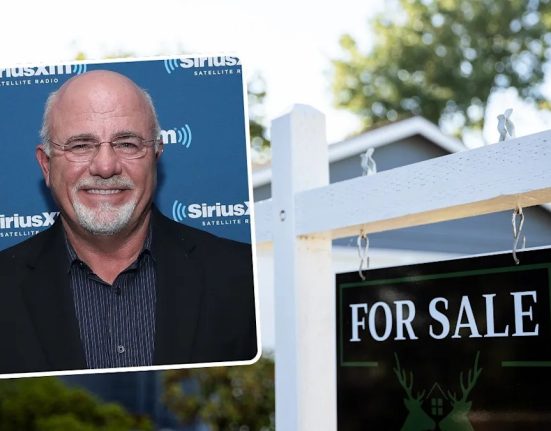

Two financial legends, two completely different paths to homeownership. Dave Ramsey urges you to save up and buy a house outright — no mortgage, no monthly burden. Warren Buffett, on the other hand, calls the 30-year fixed mortgage “the best instrument in the world.” But who’s actually right?

Ramsey has long championed the “no debt” lifestyle — especially when it comes to buying a home. His Ramsey Solutions blog features a guide titled “3 Simple Steps to Pay Cash for Your Home,” advising buyers to eliminate all debt, build a sizable emergency fund, and save up enough to pay 100% in cash before purchasing a property.

Shop Top Mortgage Rates

Don’t Miss:

Ramsey strongly discourages 30-year mortgages. In Mortgage Loan Do’s and Don’ts, he states: “Your home loan should be a conventional, fixed‑rate mortgage with a 15‑year (or less) term. Do not get a 30‑year mortgage!” He notes that a 30-year loan often costs tens of thousands more in interest compared to shorter terms.

When a listener asked if there was ever a case where a 30-year mortgage made more sense than a 15-year, Dave Ramsey didn’t hesitate.

“If you can’t afford a home on a 15-year mortgage,” he said, “it means you can’t afford the house. Period.”

Buffett takes a very different view. During a 2017 CNBC interview, he described the 30-year fixed mortgage as “the best instrument in the world, because if you’re wrong and rates go to 2%… you pay it off.” He called it “a one‑way renegotiation,” explaining that if rates drop, you refinance; if they rise, you’re locked in.

Trending: It’s no wonder Jeff Bezos holds over $250 million in art — this alternative asset has outpaced the S&P 500 since 1995, delivering an average annual return of 11.4%. Here’s how everyday investors are getting started.

Buffett didn’t just praise 30-year mortgages — he used one himself. Back in 1971, he bought a vacation home in Laguna Beach for $150,000. Even though he could’ve paid cash, he only put down around $30,000 and financed the rest through Great Western Savings & Loan. Why? Because he believed he could get a better return by investing the remaining $120,000 instead of locking it all into the house.