The biggest consistent threat to investment returns is human behavioral malfunction. Examples include herd mentality, confirmation bias, overconfidence, and recency bias. Several studies support this assertion, including one from Vanguard, which calculates that investor behavioral coaching could add two percentage points of return per annum. We can harm our portfolio returns a little bit each year and hardly notice it because of the slow erosion (plus, of course, we don’t see or are in denial of our own weaknesses).

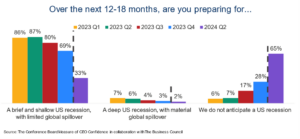

The damage we do see very clearly is a sudden drop in portfolio value. The most significant drops occur when our portfolio is holding too high an allocation of equity up to and through an economic recession. Investors may not have to worry excessively about that for now. According to the Measure CEO Confidence Index, the risk of a recession just past the horizon is low, which supports holding stocks.

The Conference Board describes the index as a barometer of the health of the U.S. economy from the perspective of U.S. chief executives. The index is based on CEOs’ perceptions of current and expected business and industry conditions. The survey includes insights on CEOs’ company plans regarding capital spending, employment, recruiting, and wages.

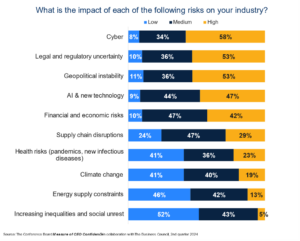

Despite the myriad of challenges, U.S. CEOs are demonstrating remarkable resilience, maintaining a sense of cautious optimism in this complex economic environment. They are navigating through regulatory uncertainty, cybersecurity threats, geopolitical instabilities, and more with a steady hand.

The Measure of CEO Confidence rose to 54 in the second quarter of 2024, up from 53 in the previous quarter, which is the highest it has been for two years. This marks the second consecutive quarter the index has been above 50. A reading above 50 indicates more positive than negative responses.

Most U.S. CEOs no longer anticipate a recession in the coming year.

The Measure of CEO Confidence index is considered a leading indicator, which means that it is a metric that can be used to predict the trajectory of economic growth (as opposed to being used as a trailing or current measure). However, improvement in CEO optimism may be less predictive and, perhaps, more of a self-fulfilling prophecy. CEO’s confidence levels can influence their decisions regarding capital expenditure, expansion plans, and hiring. Improved confidence can lead to increased investment, which can boost economic growth. The index can, in turn, influence investor sentiment and, consequently, stock market performance.

It is important to emphasize the “cautious” qualifier of CEO optimism. Chief executives are not so wildly bullish that their optimism should trigger higher stock prices. Nonetheless, CEOs are confident enough to suggest that the economy remains less of a threat to stock portfolios than investors.

Would lower mortgage rates put more houses on the market?

The Federal Reserve surveys banks roughly quarterly to provide qualitative and forward-looking information about their lending practices and credit standards. The Fed releases the information in the Senior Loan Officer Opinion Survey (SLOOS). The most recent SLOOS revealed some additional cautiously optimistic information: No area of lending standards tightened materially; credit demand for construction increased; and mortgage demand substantially improved despite higher rates from a year ago.

But, to think alternatively, is it bad news that mortgage demand is increasing? More people buying houses could cause home prices to spike, assuming there are more buyers (demand) than homes for sale (supply).

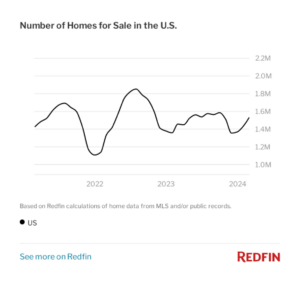

In March 2024, 1.53 million homes and condominiums were listed for sale in the United States, up 5.2 percent from last year. Still, there are not a lot of available homes; the supply is tight.

As of February 2024, the National Association of Realtors estimates there are 1.51 million licensed realtors in the United States. There are roughly as many homes for sale as there are agents to sell them.

Mortgage demand took a dip last year. According to the National Association of Realtors, 4.09 million existing U.S. homes were bought in 2023, an 18.7 percent decrease from 2022, when the average three-year mortgage rate was 5.34 percent.

The number of existing homes sold in 2023 was the lowest since 1995 (there were just over a half million new construction homes purchased in 2023).

The low supply level of homes for sale played a role in the U.S. median sale price of houses increasing to $420,401 today, up 4.8 percent year-over-year and up nearly 20 percent from three years ago.

The conventional theory is that homes are not being put up for sale because homeowners don’t want to swap out their existing mortgage rates for something higher. But is that theory rooted in logical reasoning? Or a hopeful narrative? Or is it just a nudge to the Fed by those trying to jawbone a cheaper monthly payment?

The current average 30-year fixed mortgage rate in the U.S. is above 7 percent, the highest since December 2000. The average 30-year mortgage rate in 2023 was 6.81 percent, up from 5.345 percent in 2022 and 2.96 percent in 2021. From 2020 to 2021, it averaged 3.0 percent. From 2010 to 2019, 30-year fixed mortgage rates averaged 4.1 percent.

The average interest rate across all existing home mortgages is 4.5 percent to five percent. (That is a broad but accurate range. I could not find official data to cite the specific amount, but I found a lot of other data to support that range.) Of all existing home mortgages in the U.S., around 30 to 50 percent are below four percent.

Many homeowners have locked in those low rates, and the theory is that they are resistant to selling their house and having to finance them with new mortgages at nearly twice the current rates.

If there were more homes for sale, prices would decrease theoretically. Would more people put their houses up for sale if they didn’t have to pay a seven percent mortgage rate on their next home and, instead, could keep their current rate?

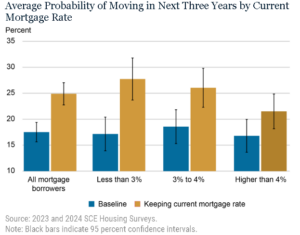

The Federal Reserve Bank of New York addressed the question of whether lower mortgage interest rates would increase the supply of houses for sale (i.e., incentivize homeowners to list their homes for sale to move to another house) in a report posted on its website. The Fed found that:

- Homeowners with existing mortgage rates below three percent increased their odds of moving from 17 to 28 percent.

- Homeowners with mortgage rates between three and four percent increased their odds of moving from 19 percent to 26 percent.

- However, about half of respondents reported that they would not consider moving, and nearly three-quarters said that their odds of moving shifted by less than 10 percentage points.

The Fed’s finding suggests that mortgage rate reductions would spur some increase in relocations. However, most homeowners in their survey do not seem to make moving plans based on mortgage rates. Therefore, home demand relative to housing supply is expected to remain high, as are home prices. This makes homebuilder stocks attractive to investors.

Allen Harris is an owner of Berkshire Money Management in Great Barrington and Dalton, managing more than $700 million of investments. Unless specifically identified as original research or data gathering, some or all of the data cited is attributable to third-party sources. Unless stated otherwise, any mention of specific securities or investments is for illustrative purposes only. Advisor’s clients may or may not hold the securities discussed in their portfolios. Advisor makes no representations that any of the securities discussed have been or will be profitable. Full disclosures here. Direct inquiries to Allen at AHarris@BerkshireMM.com. Adviser is not licensed to provide and does not provide legal, tax, or accounting advice to clients. Advice of qualified counsel or accountant should be sought to address any specific situation requiring assistance from such licensed individuals.