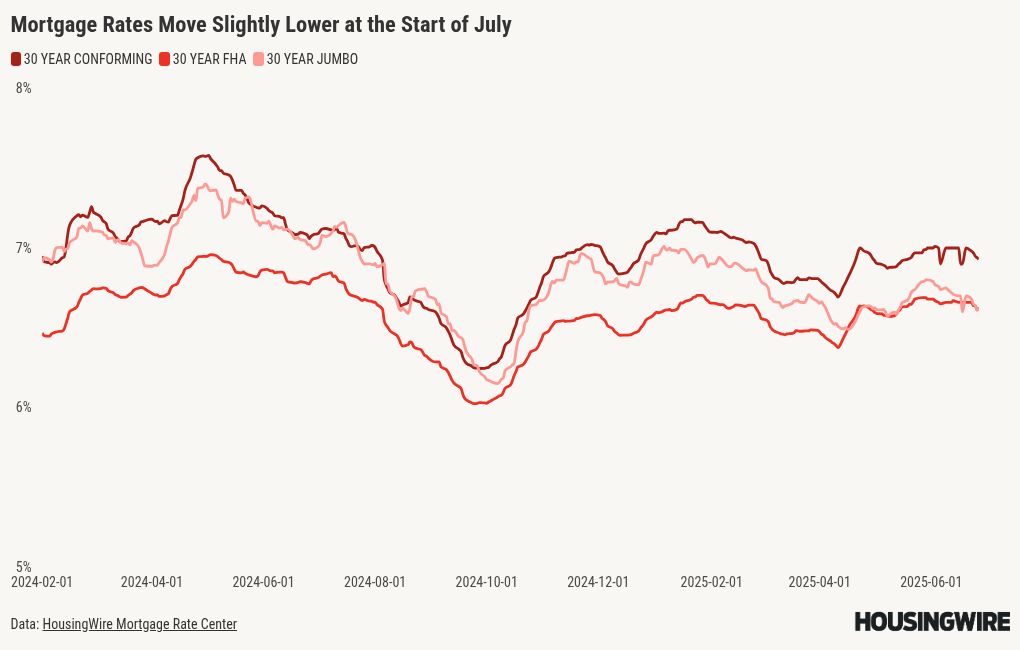

Much of the recent movement in rates can be tied to the Trump administration’s political machinations at the Federal Reserve. The president has continued to point fingers at Fed Chair Jerome Powell for failing to lower rates more quickly, even as inflation nears the Fed’s goal of 2% per year and unemployment remains relatively low at 4.2%.

Is a cut coming in July?

Melissa Cohn, regional vice president for William Raveis Mortgage, pointed out that other Fed governors — including Christopher Waller and vice chair Michelle Bowman — have hinted at a potential rate cut at the end of July.

Cohn said these comments are in line with President Trump’s desired path for rates, and they aren’t surprising given that both are Trump appointees. Waller is reportedly in the running to replace Powell as chair when his term expires next year and could serve as a shadow president as Trump’s patience with Powell has run thin.

Powell has said that benchmark rates haven’t been lowered as policymakers contemplate the potential consequences of Trump’s global tariffs. The president placed a 90-day pause on most tariffs but they’re set to move forward next week.

More uncertainty was introduce on the tariff front in the past week as Trump cancelled trade talks with Canada before resuming them only two days later.

“I think it is possible that Fed Governor Bowman will try to compel the Fed to cut rates,” Cohn said. “Since the tariffs are not yet fully in place, it will be too soon to analyze the full impact of tariffs on inflation.”

She went on to say that a rate cut in July would not necessarily mean lower mortgage rates in the short term as there are many economic variables to consider.

“The bond market has liked Bowman’s and Waller’s comments, and has rallied in the midst of everything going on,” Cohn said. “Oil prices are way down, which helps the inflation outlook. A rate cut could cause the bond market to rally until we get the next piece of economic data or geopolitical unrest.”

The CME Group’s FedWatch tool on Tuesday showed that even as the potential for a cut is rising, only 21% of interest rates traders think one is coming this month. But the increased optimism is showing up further down the road as 93% predict a cut in September — including 19% who think rates will be dialed back by 50 bps.

Where does the housing market stand?

Altos data continues to show that home purchase demand is growing — but as HousingWire Lead Analyst Logan Mohtashami said this week, it’s partially due to the “low bar” set by last year’s market.

“Since we are working from record-low levels, simply having mortgage rates fall this year, combined with new listing data growing year over year, has boosted this (purchase mortgage application) index to show double-digit growth over the last eight weeks,” Mohtashami wrote Saturday.

“The percentage of cash buyers in sales is falling, but mortgage buyers have been applying in a pro-growth manner in 2025.”

Mortgage demand, including applications for refinances and closed-end second liens, rose 1.1% during the week ending June 20, according to the Mortgage Bankers Association (MBA). Analysts have attributed higher application levels to an unusually calm period for interest rates.

“Mortgage demand was flat last week as economic, financial, and geopolitical uncertainty have kept mortgage rates volatile and in the same narrow range of around 6.8 percent,” MBA president and CEO Bob Broeksmit said in a statement.

“While MBA’s new forecast calls for rates to decline only slightly to 6.7 percent by the end of 2025, annual mortgage originations volume is expected to rise 15 percent to just over $2 trillion.”

A recent market analysis from Cotality found that rising inventory and slowing home-price appreciation are helping buyers make inroads. The firm also reiterated that more buyers are turning to financing rather than purchasing in cash.

Cotality Chief Economist Selma Hepp expressed cautious optimism in written commentary.

“While there is some hope mortgage rates may continue easing, there is still an air of pessimism among potential homebuyers,” Hepp said. “Fears that the economy will continue to deteriorate for the next six months are fueling hesitation among many households to make large purchases.

“Still, compared to the high levels of tariff-related anxiety in April, May has seen a rebound in confidence as tariff concerns have faded and equities have recovered. Also, an action from the Fed this summer could be what some are hoping for, though a rate cut may not necessarily bring mortgage rates much lower or boost affordability.”