Best Personal Loan Rates Of 2025

Compare the Best Personal Loan Rates

The above personal loan rates and details are accurate as of March 3, 2025. While we update this information regularly, the annual percentage rates (APRs) and loan details may have changed since the page was last updated. Keep in mind, some lenders make specific rates and terms available only for certain loan purposes. Be sure to confirm available APR ranges and loan details, based on your desired loan purpose, with your lender before applying.

Tips for Comparing Personal Loan Rates

In general, annual percentage rates (APRs) vary by lender and depend on several factors, including the applicant’s creditworthiness. However, there are several things you can do to access the lowest rate possible when applying for a personal loan. Consider these factors when comparing personal loan rates:

Credit score and eligibility requirements.

Average borrower rates.

Loan amounts and repayment terms.

Additional costs.

-Colin Beresford, Deputy Editor Personal & Business Loans

What Is a Personal Loan?

A personal loan is a type of financing that lets borrowers access cash for a wide range of personal uses, including home improvements, auto repairs and unanticipated expenses. Loan amounts and repayment terms vary by lender, but the best personal loans typically range from $1,000 to $100,000 with some starting as low as $250. In general, loan repayment terms extend from one to seven years.

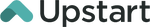

Current Personal Loan Interest Rates

Personal Loan Rates Over Time

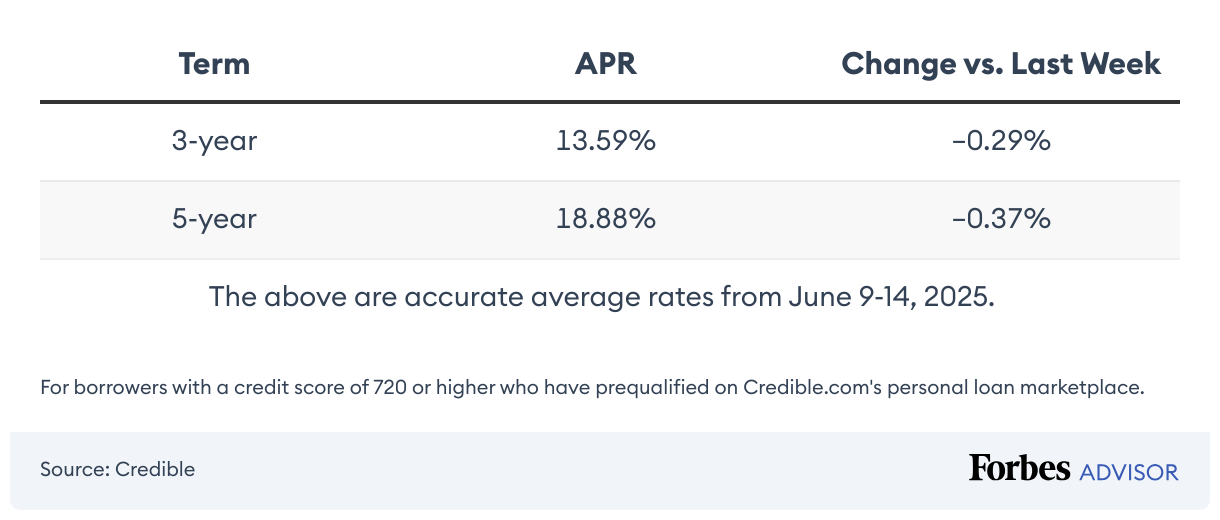

Average Personal Loan Interest Rates By Credit Score

Interest rates vary by lender, borrower qualifications and loan characteristics. However, interest rates are best predicted by a borrower’s credit score.

Personal Loan Rates for Excellent Credit

Personal Loan Rates for Good Credit

Personal Loan Rates for Fair Credit

Personal Loan Rates for Bad Credit

How Lenders Determine Personal Loan Rates

Lenders determine personal loan rates based on several factors, but the applicant’s credit score and overall credit profile are the most important. Many traditional and online lenders also look at the prospective borrower’s income and current outstanding debts to determine their debt-to-income ratio (DTI).

DTI is the ratio of a borrower’s monthly income to their monthly debt service and is used to evaluate an applicant’s ability to make on-time payments. The higher the DTI, the riskier the borrower—and the higher the interest rate they’ll likely receive.

When determining personal loan rates, some online and alternative lenders also look at a prospective borrower’s occupation and education to evaluate earning potential. Likewise, lenders may evaluate the risk posed by a borrower based on where they live.

Pro Tip

It’s always a good idea to prequalify for several loans before choosing one. Many lenders let you prequalify without a hard credit inquiry so you can check and compare rates. However, if you accept a loan offer, the full application process typically includes a hard credit check that may impact your score. Hard inquiries typically stay on your credit report for up to two years.

How To Get the Lowest Personal Loan Rates

The most competitive personal loan rates are typically reserved for the most creditworthy borrowers. However, other factors can impact rates, and it’s possible to get lower rates without a stellar credit profile. Follow these tips to get the best personal loan rates:

- Understand your credit report. Before prequalifying or applying for a personal loan, request a copy of your credit report from one of the three main credit bureaus—Equifax, Experian and TransUnion. You can get free weekly credit reports from AnnualCreditReport.com. Knowing your credit score can help you prequalify for a loan offer before committing to a hard credit inquiry.

- Calculate the best loan amount and term. Personal loan APRs are generally higher for larger loans and more extended repayment terms. That said, shorter repayment terms mean larger monthly payments. Use a personal loan calculator to determine how much monthly payment you can afford, and then opt for the shortest possible loan term.

- Apply with a co-signer or co-borrower. If you won’t qualify for a competitive APR based on your credit, consider applying with a co-borrower or co-signer who has a higher credit score. This approach can lead to higher approval odds and lower personal loan rates.

- Choose a secured loan. A secured personal loan is collateralized by a valuable asset, such as real estate. If a borrower defaults on a secured loan, the lender can seize the collateral. Because secured loans are less risky to lenders, they may be a better fit for borrowers who can’t qualify for a personal loan or a competitive APR.

- Take advantage of rate discounts. Many lenders offer rate discounts to borrowers who sign up for automatic payments during the loan application process. When comparing lenders, choose an option that offers autopay discounts or other savings opportunities.

- Opt for a fee-free lender. To remain competitive, some lenders moved to a fee-free structure that charges no origination, late payment, prepayment or other additional fees. Choosing a fee-free lender can reduce the overall cost of a loan, thereby reducing the APR.

Pros and Cons of Personal Loans

Before taking out a personal loan to consolidate debt or finance your next purchase, it’s a good idea to run through the pros and cons. Below are the advantages and disadvantages of personal loans you should be aware of.

Pros of Personal Loans

- Flexible loan amounts

- Unsecured loans typically require no collateral or down payment

- Fixed installment payments

- Can qualify for low interest rates

- Loan funding may happen in a week or less

- Funds can be used to pay for almost any type of legal personal expense

Cons of Personal Loans

- Loans may have origination fees

- Collateral may be required if you don’t have good credit

- Borrowers with less-than-perfect credit may qualify for higher interest rates

- Loans can damage your credit history if you don’t make on-time payments

- Late payment fees or prepayment penalties may increase the cost of the loan

Where To Get a Personal Loan

Various lenders offer personal loans and some may be better suited for you and your financial needs. Before accepting a loan, consider

How To Get a Personal Loan

Although the process can vary by lender, you’ll generally take these steps in order to get a personal loan:

- Check your credit. Before starting your search for lenders, check your credit score for free through your credit card issuer or another service. This will help you narrow down which lenders will be willing to work with you.

- Improve your credit. If your credit score is lower than 610, take steps to improve your credit score such as lowering your credit usage or paying off debts. This can help you qualify for a loan and, in some cases, a lower interest rate.

- Shop around for lenders. Determine how much money you need to borrow and which lenders whose qualification requirements you meet. Many lenders will let you pre-qualify before submitting a formal application, which allows you to see the rates you could qualify for without impacting your credit score.

- Submit an application. Once you find the lender that works best for you, submit an application. Depending on the lender, this can take hours or days.

Recap: Best Personal Loan Interest Rates of 2025

Methodology

We reviewed 31 popular lenders based on 16 data points in the categories of loan details, loan costs, eligibility and accessibility, customer experience and the application process. We chose the best lenders based on the weighting assigned to each category:

- Loan costs. 35%

- Loan details. 20%

- Eligibility and accessibility. 20%

- Customer experience. 15%

- Application process. 10%

Within each major category, we also considered several characteristics, including available loan amounts, repayment terms, APR ranges and applicable fees. We also looked at minimum credit score requirements, whether each lender accepts co-signers or joint applications and the geographic availability of the lender. Finally, we evaluated each provider’s customer support tools, borrower perks and features that simplify the borrowing process—like prequalification options and mobile apps.

Where appropriate, we awarded partial points depending on how well a lender met each criterion.

To learn more about how Forbes Advisor rates lenders, and our editorial process, check out our Personal Loans Rating & Review Methodology.

Frequently Asked Questions (FAQs)

How much can you borrow with a personal loan?

How large of a personal loan you can borrow depends on what the lender offers and your own creditworthiness. It’s possible to find lenders offering a wide range of loan amounts from a few hundred dollars up to $100,000.

When you apply with a lender, they’ll consider several different factors to figure out how much to approve you for. This could include your credit score, monthly income, other debt obligations and overall credit history.

How much will a personal loan cost?

The cost of a personal loan depends on the lender, type of loan and the borrower’s creditworthiness. Interest typically accrues on personal loans at a rate from 4% to 36%, with the lowest rates accessible to high-credit borrowers. In addition to interest, some lenders also charge origination fees between 1% and 8% of the total loan amount. Borrowers also may be subject to late payments fees and/or prepayment penalties, which can increase the total cost of the personal loan.

How does a personal loan affect your credit score?

A personal loan can have both a negative and positive impact on your credit score. To qualify for most personal loans, you’ll have to undergo a hard credit inquiry, which can temporarily impact your credit score. Once you begin repayment, most lenders will report your payment history to the credit bureaus. On-time payments can help improve your credit, while late payments can drop your credit score.

What’s the difference between APR and interest rate?

The main difference between APR versus interest rate is that the interest rate is the actual cost to borrow money. In contrast, a loan’s annual percentage rate includes the interest rate plus additional costs like finance charges as the annual cost over the life of the loan.

Can I negotiate personal loan rates with lenders?

In some cases, you may be able to negotiate with lenders to get a lower interest rate on your personal loan. Call and ask the lender if you can lower your interest rate, and if that doesn’t work, refinancing your loan may be the best option for securing a lower interest rate.

Can I get a personal loan with bad credit?

It is possible to get a personal loan with bad credit, but it is generally more difficult to qualify—especially for competitive rates. Less creditworthy applicants also face lower borrowing limits and higher interest rates than more qualified applicants. However, some lenders specialize in personal loans for borrowers with bad credit, instead basing lending decisions on alternative credit data.

What is a good interest rate on a personal loan?

Personal loan rates range from around 7% to 36%, with the average hovering around 12-15% for a 3-year loan. A good interest rate on a personal loan is one that is lower than the national average. However, borrowers with excellent credit scores may qualify for even lower rates.