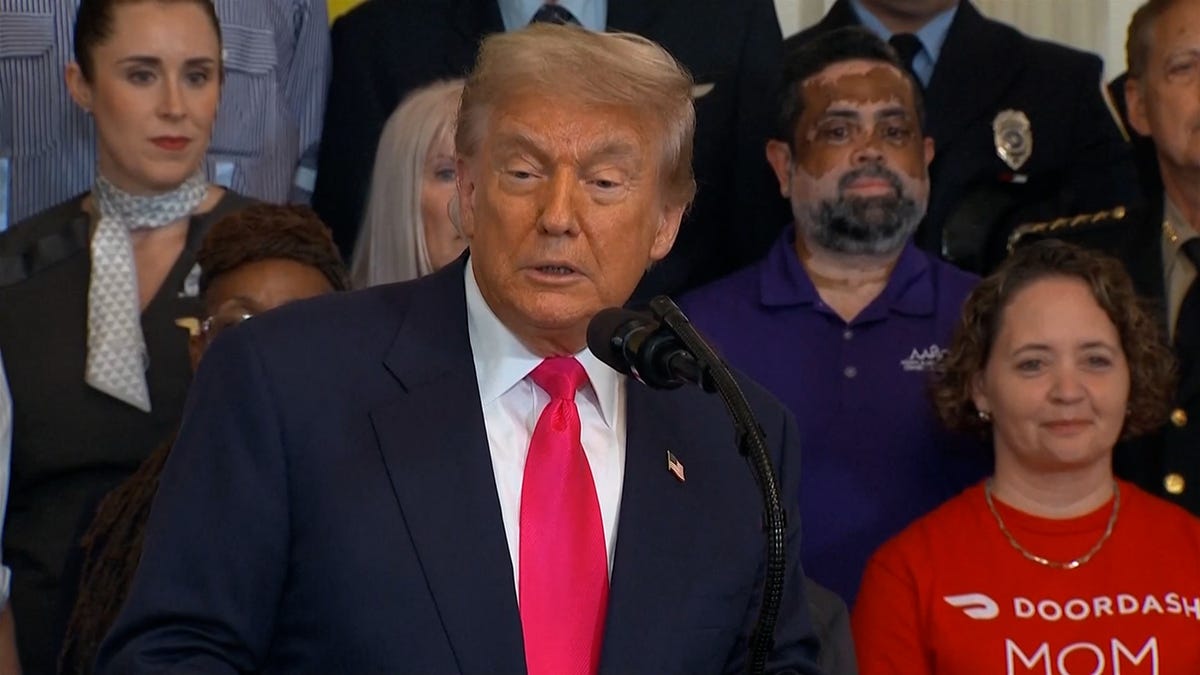

The winners and losers in the ‘big beautiful bill’

These are the potential winners and losers from the tax bill, which President Donald Trump has dubbed the ‘big beautiful bill’.

Congress is closer than it’s been in a long time to massively reforming college financial aid.

On June 10, GOP lawmakers in the U.S. Senate proposed their version of the higher education section of President Trump‘s tax and spending megabill. The 71-page portion of the so-called “One Big Beautiful Bill Act” would set new caps on student loan borrowing while drastically cutting the number of repayment plans.

The final vote on the bill itself hasn’t happened yet, but it’s expected soon, possibly late Monday, as Republicans race to meet their self-imposed July 4 deadline.

The bill passed the House of Representatives in May, but the vote was tight with a final tally of 215-214.

Here is what to know about the Senate’s change to the bill.

What changes did the senate make to the ‘Big, Beautiful Bill’?

The Senate’s version of the legislation is less aggressive than the bill that Republicans in the U.S. House of Representatives introduced in late April, according to USA TODAY.

In April, the U.S. House proposed eliminating subsidized federal loans for undergraduates — which currently allow the government to cover interest while students are in school and during a short grace period after graduation.

That provision didn’t make it into the Senate’s version of the bill. However, both chambers agree on one major change: reducing the number of student loan repayment plans to just two.

Here’s what those plans

Standard repayment plan

The Senate proposes replacing the existing array of income-driven repayment plans with two options for borrowers taking out loans after July 1, 2026.

This plan sets a fixed repayment term based on the total loan amount:

- 10 years for loans of $25,000 or less

- 15 years for $25,001 to $50,000

- 20 years for $50,001 to $100,000

- 25 years for more than $100,000

Repayment assistance plan

This income-driven option ties monthly payments to a borrower’s adjusted gross income. Lower earners would pay less — and could see any remaining balance forgiven after a set number of years, depending on their income and loan amount.

These changes would kill former President Joe Biden‘s Saving on a Valuable Education, or SAVE, program, which former Education Secretary Miguel Cardona repeatedly called the “most affordable repayment plan ever.” SAVE has been stalled in court for months, placing roughly 8 million people in forbearance.

What changes are happening for existing borrowers?

For loans disbursed on or after July 1, 2014, borrowers are required to pay 10% of their discretionary income, with any remaining balance forgiven after 20 years.

It’s the money you have left over after covering basic living costs, according to the government’s formula.

Discretionary income is what’s left after covering basic living expenses, based on a government formula. Specifically, it’s the portion of your income that exceeds 150% of the federal poverty line, which varies by household size and location. Only that amount is used to calculate your loan payments.

Are there changes to deferment and forbearance?

The Senate version of this bill removes economic hardships and unemployment deferments.

Borrowers struggling financially will instead be directed to either the Repayment Assistance Plan or Income-Based Repayment, according to the amendment. There will be discretionary forbearance offered, but it will be capped at nine months for every 24-month period.

What is the deadline for the ‘Big, Beautiful Bill?’

The deadline for the “Big, Beautiful Bill,” is July 4. The Senate is expected to vote on the bill Monday, and then it will go back to the House of Representatives. Once the House votes on the bill, it will head to the president’s desk.