According to a new survey released Wednesday, millions of Americans approaching retirement age still have student loan debt.

The Federal Reserve Board’s 2022 Survey of Consumer Finances found that 2.2 million Americans over the age of 55 have yet to settle the loans they took out for college. The New School’s Schwartz Center for Economic Policy analysis of the data claims the burden of debt is impacting their retirement plans.

According to the analysis, 43% of borrowers in the 55 and over bracket are classified as middle income. The average debt owed by Americans who make less than $54,600 is approximately $58,000.

The reported offered various solutions to help mitigate the financial impact the loans have on older Americans.

“Three policies would help minimize the negative impacts of student debt on retirement savings: student loan forgiveness, income-based repayments — key components of the Saving on a Valuable Education (SAVE) plan — and preventing garnishment of Social Security benefits to repay student loans,” the analysis said.

The survey comes as the U.S. Department of Education announced earlier in the month that the interest rates on federally backed student loans will increase to 6.53% for the 2024-2025 academic year.

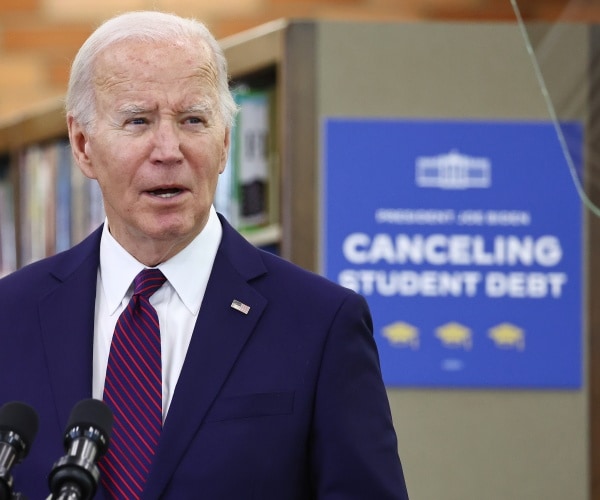

The rise in student loan rates and the financial burden they create has become a nationwide issue with college debt relief being a key component of President Joe Biden’s reelection campaign.

In August of 2022, Biden proposed a massive program to cancel billions in student loan debt, yet that initial attempt was declared unconstitutional by the Supreme Court the following year. Not to be deterred, the Biden Administration announced in April a new plan to “provide debt relief to over 30 million Americans” stating that it would not only benefit borrowers, but the “entire economy” as well.