RBI Cuts Repo Rate By 25 Bps: Interest rates on home, personal, vehicle loans and deposit rates are set to come down in the coming days with the Reserve Bank of India’s (RBI) six-member Monetary Policy Committee’s (MPC) decision to cut the repo rate – the key policy rate – by 25 basis points (bps) to 6 per cent in its policy review on April 9. The rate setting panel also changed the monetary policy stance from neutral to accommodative – signaling further reductions in the repo rate.

The MPC has also decided to slash the GDP growth to 6.5 per cent in 2025-26 from 6.7 per cent projected earlier. Retail inflation is expected to be 4 per cent in 2025-26, MPC said.

The six-member MPC took the decision amid heightened uncertainty in the global market following the recent announcement of reciprocals tariffs by US President Donald Trump. The rate cut has come in the wake of fears that higher tariff rates may lead to inflation, increase in trade tensions and a lower growth in the world economy. “Global economic outlook is fast changing. FY26 has started on an anxious note and some global trade frictions are coming true,” RBI Governor Sanjay Malhotra said.

Rate cut follows dip in inflation

The RBI’s Monetary Policy Committee delivered a 25 basis points cut in the repo rate for the second consecutive time in the policy following the decline in inflation. In the February monetary policy, the MPC, for the first time in nearly five years, had reduced the repo rate by 25 bps to 6.25 per cent. The decision was taken amid easing inflation and concerns over slowing growth.

The repo rate is the rate at which the RBI lends money to banks to meet their short-term funding needs.

January-February inflation is tracking an average of 3.9 per cent, below the RBI’s quarterly projection for January-March 2025. The RBI has projected consumer price-based inflation (CPI) at 4.8 per cent for the fourth quarter of the fiscal 2025.

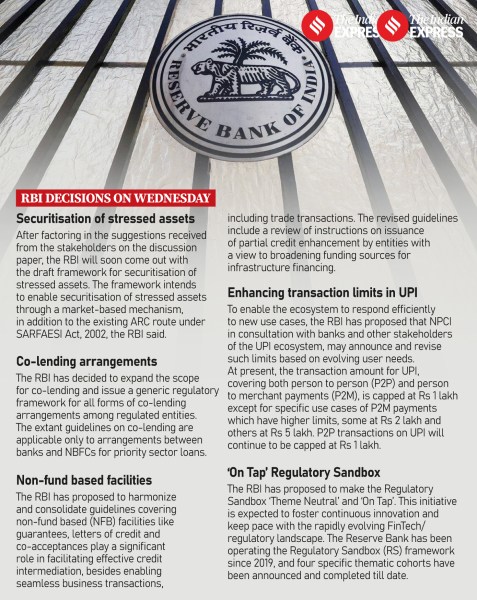

Decisions taken by RBI on Wednesday. (Graphic by Abhishek Mitra)

Decisions taken by RBI on Wednesday. (Graphic by Abhishek Mitra)

How would a repo rate cut impact interest rates?

Story continues below this ad

With the cut in the repo rate by 25 bps to 6 per cent, all external benchmark lending rates (EBLR) linked to it will come down by the same margin. It would be a relief for borrowers as their equated monthly instalments (EMIs) on home and personal loans will decline by 25 bps.

In response to the 25 bps cut in the policy repo rate during the February policy, banks have reduced their repo-linked external benchmark-based lending rates by a similar magnitude.

Lenders may also reduce interest rates on loans that are linked to the marginal cost of fund-based lending rate (MCLR), where the full transmission of a 250 bps hike in the repo rate between May 2022 and February 2023 has not happened. The one-year MCLR of banks rose by 178 bps during May 2022 to January 2025.

Deposit rates will also come down following the 25 basis point cut each in Repo rate in the last two policy reviews.

© The Indian Express Pvt Ltd