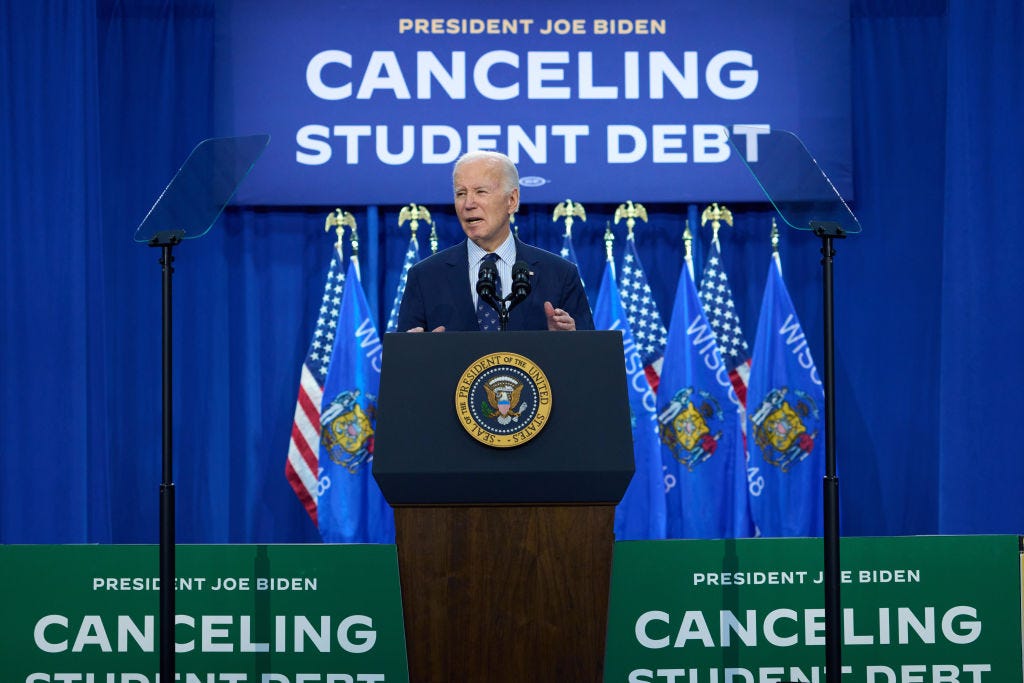

Daniel Steinle/Bloomberg via Getty Images

Key takeaways

-

- On Sunday, the US Court of Appeals voted to allow the Department of Education to proceed with lowering payments for SAVE borrowers from 10% to 5% of their discretionary income.

- This decision comes after two judges ruled against key components of the Biden administration’s SAVE plan last week.

- New forgiveness efforts under SAVE are still temporarily on hold. This roadblock doesn’t affect borrowers who already received loan cancellation or impact other existing forgiveness and income-based repayment programs.

For millions of borrowers, the road to student loan forgiveness has been lined with speed bumps. But a new win in the appeals court has reinstated part of the Biden administration’s Saving on a Valuable Education plan.

On Sunday night, the US Court of Appeals for the 10th Circuit ruled to allow (PDF) part of the SAVE repayment plan to proceed as planned after being temporarily halted last week. As part of a second rollout of the SAVE plan, which first went live in 2023, borrowers’ payments were set to be adjusted from 10% of their discretionary income to 5% for undergraduate loans, essentially halving monthly payments for millions.

This news comes after federal judges in Kansas and Missouri filed injunctions against key parts of the SAVE plan last week in response to Republican-led lawsuits filed earlier this year. The Missouri judge ruled against parts of the White House’s debt relief plan but allowed the Department of Education to lower payments and limit interest accrual. The Kansas judge ruled against much of the White House’s newest student loan forgiveness plan proposals, including rolling out new components of SAVE, such as lowering monthly payments.

Student loan forgiveness under SAVE still remains on hold, a decision that has a significant impact to borrowers, said Elaine Rubin, an expert on higher education finance and policy, and director of corporate communications for Edvisors.

Here’s what you need to know about SAVE, what’s next for student loan forgiveness and which debt relief programs are on hold.

What is SAVE and why is it on hold?

The SAVE repayment plan was launched last summer after a payment pause of more than three years, which began during the pandemic. Since then, more than 8 million borrowers have received some type of relief through SAVE, according to the Department of Education’s May 21 press release.

This income-driven repayment plan offers borrowers a handful of benefits, such as lowering monthly payments to a percentage of their discretionary income (slashing payments to $0 for more than 4.6 million) and offering debt relief benefits, such as forgiveness after 10 to 25 years.

Components of SAVE are currently on hold in response to two injunctions filed by Kansas and Missouri state judges in June. So far, one key SAVE component placed on hold has been approved to move forward. This decision will allow the Department of Education to reduce monthly payments for borrowers with undergraduate student loans from 10% to 5% of their discretionary income, effectively cutting their payments in half.

Why are SAVE payments paused?

The Department of Education placed 3 million borrowers enrolled in SAVE into temporary forbearance for the month of July in order to lower their payments from 10% to 5% of their discretionary income. Even with the temporary legal hiccup, the payment pause proceeded, pending a decision from the appeals court.

Now that the Department of Education is free to proceed with reducing payments for SAVE borrowers, expect the processing pause to remain in effect until August, though it could be extended.

Does this decision impact other student loan forgiveness programs?

Neither ruling affects people applying for debt relief through the Public Service Loan Forgiveness program or other income-driven repayment plans, said Mark Kantrowitz, a financial aid expert and CNET Money Expert Review Board member. It also doesn’t change the Department of Education’s one-time income-driven repayment count to maximize debt relief, which is happening right now, he added.

So, if you have a type of federal loan that wasn’t eligible for forgiveness in the past, consolidating before June 30 still gives you your best shot at receiving debt relief sooner.

This decision also doesn’t impact the Fresh Start program, which offers borrowers a way to get their student loans out of default. The deadline to apply is Sept. 30, 2024.

What should borrowers do next?

Right now the path forward for SAVE and future forgiveness through the program is unclear. If you applied for SAVE and are expecting forgiveness, be prepared for either of these outcomes: The plan could go forward as expected, or it could get quashed, said Lawrence Sprung, author of Financial Planning Made Personal.

“Start putting a budget together for both scenarios and make sure the payments will fit into your budget,” Sprung said. It’s better to have a plan to pay off your balance. You can use student loan payment calculators on the StudentAid.gov site to explore different payment plan options.

Rubin added that borrowers should continue to repay their student loans as required, but those in the SAVE plan need to be vigilant. “If all forgiveness is blocked under the SAVE Plan, it may be wise for borrowers to consider other income-driven repayment plans. But currently, we are still waiting guidance.”

Where does that leave borrowers? Kantrowitz encourages them to try not to worry too much until we receive a final verdict from the courts. The SAVE repayment plan has a sound statutory and regulatory basis, he said. “This is just the start of the legal process. The court rulings are preliminary and may be overturned on appeal.”

How long borrowers will have to wait for clarity also remains to be seen. But experts expect we’ll be waiting for several months.

“There is a good chance this will be left to the next administration unless this is completed in the courts well in advance of Election Day,” Sprung added.

Recommended Articles

Source link